Corebridge Financial Partners with Market Synergy Group to Launch Power Select Advisory for Registered Investment Advisors

22 Março 2023 - 11:00AM

Business Wire

New Fixed Index Annuity Offers Growth

Potential, Downside Protection and Lifetime Income

Corebridge Financial today announced the expansion of its

partnership with Market Synergy Group (MSG), one of the nation’s

largest networks of independent marketing organizations, to include

the launch of Power Select AdvisorySM, a fixed index annuity

created for registered investment advisors (RIAs).

“We are excited to build on our long-standing partnership with

Market Synergy Group and help their clients save more for

retirement while protecting their portfolios in volatile markets,”

said Eric Taylor, RICP®, Senior Vice President, Independent Annuity

Distribution at Corebridge Financial. “Power Select Advisory

combines growth, protection and lifetime income benefits in an

advisory solution that’s specifically designed to help meet the

needs of registered investment advisors and their clients.”

Power Select Advisory is the newest addition to The Power Series

of Index Annuities®, Corebridge’s family of fixed index annuities,

and is available exclusively through MSG. In a first for an

advisory index annuity, Power Select Advisory offers growth

potential through indices created and managed by Dimensional Fund

Advisors and AllianceBernstein (AB), two leading asset management

firms known for their research experience and expertise. The

Dimensional US Foundations Index draws on prize-winning academic

and empirical research to pursue growth with targeted volatility,

and the AB All Market Index® combines global market exposure with a

dynamic momentum strategy to help stabilize returns.

The new Power Select Advisory includes protected lifetime income

options that can add certainty and flexibility throughout

retirement. These include two optional guaranteed living benefit

(GLB) riders—Lifetime Income Plus Flex®, which guarantees a 9%

income credit every year until lifetime income begins, and Lifetime

Income Plus Multiplier Flex®, which provides income credits that

double the interest earned in the annuity while saving for

retirement and that match the interest earned after starting

lifetime income.

“Market Synergy Group is committed to providing financial

professionals with innovative product solutions, and our strong

partnership with Corebridge Financial has been instrumental in

helping us deliver on that goal,” said Lance Sparks, President,

Market Synergy Group. “In today’s market environment, it’s critical

to have retirement solutions like Power Select Advisory that

combine upside growth potential with downside principal protection,

while ensuring that clients won’t outlive their income. We are

thrilled to feature this new advisory solution exclusively to our

RIA partners.”

Power Select Advisory is issued by American General Life

Insurance Company (AGL), a subsidiary of Corebridge Financial, Inc.

Guarantees are backed by the claims-paying ability of AGL.

# # #

Index annuities are not a direct investment in the stock market.

They are long-term insurance products with guarantees backed by the

claims-paying ability of the issuing insurance company. They

provide the potential for interest to be credited based in part on

the performance of the specified index, without the risk of loss of

premium due to market downturns or fluctuations. Index annuities

may not be suitable or appropriate for all individuals.

Withdrawals may be subject to federal and/or state income taxes.

An additional 10% federal tax may apply if individuals make

withdrawals or surrender their annuity before age 59½. Individuals

should consult their tax advisor regarding their specific

situation.

This material is general in nature, was developed for

educational use only, and is not intended to provide financial,

legal, fiduciary, accounting or tax advice, nor is it intended to

make any recommendations. Applicable laws and regulations are

complex and subject to change. Please consult with your financial

professional regarding your situation. For legal, accounting or tax

advice consult the appropriate professional.

All contract and benefit guarantees including any fixed account

crediting rates or annuity rates are backed by the claims-paying

ability of the issuing insurance company. They are not backed by

the broker/dealer from which this annuity is purchased. Rates are

subject to change prior to contract issue.

The Power Series of Index Annuities are issued by American

General Life Insurance Company (AGL), Houston, Texas. Contract

Numbers: AG-800 (12/12) and AG-801 (12/12). AGL is a member company

of Corebridge Financial, Inc. The underwriting risks, financial and

contractual obligations, and support functions associated with the

annuities issued by AGL are its responsibility. Guarantees are

backed by the claims-paying ability of the issuing insurance

company. AGL does not solicit, issue or deliver policies in the

state of New York. Annuities and riders may vary by state and are

not available in all states. This material is not intended for use

in the states of Idaho and New York.

Not FDIC or NCUA/NCUSIF

Insured

May Lose Value • No Bank or

Credit Union Guarantee

Not a Deposit • Not Insured by

any Federal Government Agency

About Corebridge Financial

Corebridge Financial (NYSE: CRBG) makes it possible for more

people to take action in their financial lives. With more than $355

billion in assets under management and administration as of

December 31, 2022, Corebridge is one of the largest providers of

retirement solutions and insurance products in the United States.

We proudly partner with financial professionals and institutions to

help individuals plan, save for and achieve secure financial

futures. For more information, visit corebridgefinancial.com and

follow us on LinkedIn, YouTube, Facebook and Twitter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230321005721/en/

Josh Smith (Investors):

investorrelations@corebridgefinancial.com Matt Burkhard (Media):

media.contact@corebridgefinancial.com

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

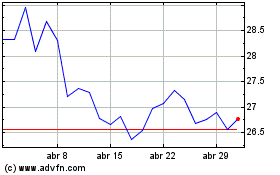

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024