Corebridge Financial Announces Effectiveness of Form S-4 Registration Statement and Launch of Exchange Offer

26 Abril 2023 - 5:16PM

Business Wire

Exchange Offer for up to $1.0 billion of its

3.500% Senior Notes due 2025, up to $1.25 billion of its 3.650%

Senior Notes due 2027, up to $1.0 billion of its 3.850% Senior

Notes due 2029, up to $1.5 billion of its 3.900% Senior Notes due

2032, up to $500 million of its 4.350% Senior Notes due 2042, up to

$1.25 billion of its 4.400% Senior Notes due 2052 and up to $1.0

billion of its 6.875% Fixed-to-Fixed Reset Rate Junior Subordinated

Notes due 2052

Corebridge Financial, Inc. (the “Company”) announced today that

effective at 10:00 a.m. EDT on April 26, 2023, the U.S. Securities

and Exchange Commission declared effective its previously filed

Registration Statement on Form S-4 for the exchange of up to $1.0

billion aggregate principal amount of its outstanding 3.500% Senior

Notes due 2025 (the “Old 3.500% Senior Notes”), up to $1.25 billion

aggregate principal amount of its outstanding 3.650% Senior Notes

due 2027 (the “Old 3.650% Senior Notes”), up to $1.0 billion

aggregate principal amount of its outstanding 3.850% Senior Notes

due 2029 (the “Old 3.850% Senior Notes”), up to $1.5 billion

aggregate principal amount of its outstanding 3.900% Senior Notes

due 2032 (the “Old 3.900% Senior Notes”), up to $500 million

aggregate principal amount of its outstanding 4.350% Senior Notes

due 2042 (the “Old 4.350% Senior Notes”), up to $1.25 billion

aggregate principal amount of its outstanding 4.400% Senior Notes

due 2052 (the “Old 4.400% Senior Notes” and, together with the Old

3.500% Senior Notes, Old 3.650% Senior Notes, Old 3.850% Senior

Notes, Old 3.900% Senior Notes and Old 4.350% Senior Notes, the

“Old Senior Notes”) and up to $1.0 billion aggregate principal

amount of its outstanding 6.875% Fixed-to-Fixed Reset Rate Junior

Subordinated Notes due 2052 (the “Old Hybrid Notes” and, together

with the Old Senior Notes, the “Old Notes”), for a like principal

amount of its 3.500% Senior Notes due 2025 (the “New 3.500% Senior

Notes”), 3.650% Senior Notes due 2027 (the “New 3.650% Senior

Notes”), 3.850% Senior Notes due 2029 (the “New 3.850% Senior

Notes”), 3.900% Senior Notes due 2032 (the “New 3.900% Senior

Notes”), 4.350% Senior Notes due 2042 (the “New 4.350% Senior

Notes”), 4.400% Senior Notes due 2052 (the “New 4.400% Senior

Notes” and, together with the New 3.500% Senior Notes, New 3.650%

Senior Notes, New 3.850% Senior Notes, New 3.900% Senior Notes and

New 4.350% Senior Notes, the “New Senior Notes”) and 6.875%

Fixed-to-Fixed Reset Rate Junior Subordinated Notes due 2052 (the

“New Hybrid Notes” and, together with the New Senior Notes, the

“New Notes”), respectively, which have been registered under the

Securities Act of 1933, as amended.

Accordingly, the Company announced that, effective April 26,

2023, it has launched its offer to exchange its Old Notes for its

New Notes. This offer will expire at 5:00 p.m. EDT on May 24, 2023,

unless otherwise extended.

This press release is not an offer to exchange the New Notes for

the Old Notes, nor is it the solicitation of an offer to exchange,

which the Company is making only through the exchange offer

prospectus, dated April 26, 2023, together with the related letter

of transmittal. There will not be any offer or sale of the New

Notes in any state in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such state.

Copies of the exchange offer prospectus and related documents

may be obtained from The Bank of New York Mellon, the exchange

agent for the exchange offer, at the following address:

The Bank of New York Mellon c/o BNY Mellon Corporate Trust

Operations – Reorganization Unit 2001 Bryan Street, 10th Floor

Dallas, Texas 75201 Attn: Joseph Felicia Email:

CT_REORG_UNIT_INQUIRIES@bnymellon.com Facsimile: (732) 667-9408

About Corebridge Financial

Corebridge Financial, Inc. (NYSE: CRBG) makes it possible for

more people to take action in their financial lives. With more than

$355 billion in assets under management and administration as of

December 31, 2022, Corebridge Financial is one of the largest

providers of retirement solutions and insurance products in the

United States. We proudly partner with financial professionals and

institutions to help individuals plan, save for and achieve secure

financial futures. For more information, visit

corebridgefinancial.com and follow us on LinkedIn, YouTube,

Facebook and Twitter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230426005623/en/

Josh Smith (Investors):

investorrelations@corebridgefinancial.com Matt Burkhard (Media):

media.contact@corebridgefinancial.com

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

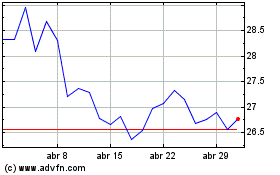

Corebridge Financial (NYSE:CRBG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024