- Net sales decreased 12.9% year-over-year to $676.7 million

- Net income was $35.0 million compared to $46.9 million in the

prior year quarter

- Adjusted EBITDA* increased 0.9% year-over-year to $81.5

million

- Operating cash flow was $62.1 million with free cash flow* of

$59.2 million

- Raises 2023 financial outlook

- Announces new $50 million share repurchase program

MasterBrand, Inc. (NYSE: MBC, the “Company”, or “MasterBrand”),

the largest residential cabinet manufacturer in North America,

today announced first quarter 2023 financial results.

“We delivered stronger than expected sales in the first quarter,

as we benefited from more resilient demand across our customers

servicing the new construction end market. This top-line

performance, along with the flexibility of our manufacturing

network and further progress on our three strategic initiatives

helped us expand our adjusted EBITDA margin year-over-year, despite

overall softer end market demand,” said Dave Banyard, President and

Chief Executive Officer.

“Our strong free cash flow generation in this environment has

given management and our Board of Directors confidence in our

ability to begin returning value directly to shareholders.

Accordingly, I am pleased to announce that our Board of Directors

has approved a new share repurchase program allowing the Company to

purchase up to $50 million of its outstanding common shares.”

First Quarter 2023

Net sales were $676.7 million, compared to $777.1 million in the

first quarter of 2022, a decrease of 12.9%. Gross profit was $204.6

million, compared to $211.0 million in the comparable period of the

prior year. Gross profit margin expanded 300 basis points to 30.2%,

compared to 27.2% in the first quarter of 2022.

Net income was $35.0 million, compared to $46.9 million in the

first quarter of 2022, primarily due to higher interest expense of

$17.4 million, related to bank debt issued in December 2022 at the

time of our separation from Fortune Brands Home and Security.

Diluted net income per share was $0.27, compared to pro forma

diluted net income per share of $0.37 in the comparable period of

the prior year.

Adjusted EBITDA* was $81.5 million, compared to $80.8 million in

the first quarter of 2022. Adjusted EBITDA* margin expanded 160

basis points to 12.0%, compared to 10.4% in the comparable period

of the prior year.

Balance Sheet and Cash

Flow

As of March 26, 2023, the Company had $116.3 million in cash and

$300 million of availability under its revolving credit facility.

Net debt* was $823.3 million and net debt to adjusted EBITDA* was

2.0x.

Operating cash flow was $62.1 million, compared to $(2.9)

million in the first quarter of last year. Free cash flow* was

$59.2 million, compared to $(13.9) million in the same period of

the prior year.

2023 Financial Outlook

For full year 2023, the Company expects:

- Net sales year-over-year decline of mid teens, based on market

declines of low teens

- Adjusted EBITDA* in the range of $315 million to $345 million,

with related adjusted EBITDA* margins of roughly 11.5 to 12.5

percent

The Company is increasing the midpoint of full-year adjusted

EBITDA* outlook by $10 million following stronger than expected

performance in the first quarter of 2023. Net sales outlook remains

unchanged for the full year as the Company continues to expect

softer end markets in 2023.

“We delivered stronger than anticipated financial performance in

the first quarter of 2023,” said Andi Simon, Executive Vice

President and Chief Financial Officer. “While the macroeconomic

environment remains dynamic, we feel confident in our ability to

consistently execute and deliver solid margin performance in any

market condition. Coupled with the benefits from prior actions

taken in 2022, we are raising our full-year adjusted EBITDA outlook

for 2023. We believe we will be able to deliver this strong

near-term performance while still investing in the business for

long-term growth.”

Share Repurchase Program

Masterbrand’s Board of Directors approved a new share repurchase

program with authorization to purchase up to $50 million of shares

of the Company’s common stock. Purchases may be made at

management’s discretion from time to time through the open market

or privately negotiated transactions, in accordance with applicable

securities laws and other restrictions. The newly announced share

repurchase authorization does not obligate the Company to purchase

any dollar amount or number of shares of common stock. This

authorization is in effect until April 23, 2025, and may be

suspended or discontinued at any time.

Conference Call Details

The Company will hold a live conference call and webcast at 4:30

p.m. ET today, May 9, 2023, to discuss the financial results and

business outlook. Telephone access to the live call will be

available at (877) 407-4019 (U.S.) or by dialing (201) 689-8337

(international). The live audio webcast can be accessed on the

“Investors” section of the MasterBrand website

www.masterbrand.com.

A telephone replay will be available approximately one hour

following completion of the call through May 23, 2023. To access

the replay, please dial 877-660-6853 (U.S.) or 201-612-7415

(international). The replay passcode is 13737805. An archived

webcast of the conference call will also be available on the

"Investors" page of the company's website.

Non-GAAP Financial

Measures

To supplement the financial information presented in accordance

with Generally Accepted Accounting Principles in the United States

(“GAAP”) in this earnings release, certain non-GAAP financial

measures as defined under SEC rules have been included. It is our

intent to provide non-GAAP financial information to enhance

understanding of our financial information as prepared in

accordance with GAAP. Non-GAAP financial measures should be

considered in addition to, not as a substitute for, other financial

measures prepared in accordance with GAAP. Our methods of

determining these non-GAAP financial measures may differ from the

methods used by other companies for these or similar non-GAAP

financial measures. Accordingly, these non-GAAP financial measures

may not be comparable to measures used by other companies.

We use EBITDA, adjusted EBITDA, adjusted EBITDA margin,

incremental or decremental adjusted EBITDA margin, adjusted diluted

earnings per share, free cash flow, and net debt, which are all

non-GAAP financial measures. EBITDA is defined as earnings before

interest, taxes, depreciation and amortization. We evaluate the

performance of our business based on income before income taxes,

but also look to EBITDA as a performance evaluation measure because

interest expense is related to corporate functions, as opposed to

operations. For that reason, we believe EBITDA is a useful metric

to investors in evaluating our operating results. Adjusted EBITDA

is calculated by removing the impact of non-operational results and

special items from EBITDA. Adjusted EBITDA margin is calculated as

adjusted EBITDA divided by net sales. Incremental or decremental

adjusted EBITDA margin is calculated as the period-over-period

dollar change in adjusted EBITDA divided by the period-over-period

dollar change in net sales. Adjusted diluted earnings per share is

a measure of our diluted earnings per share excluding

non-operational results and special items. These non-GAAP measures

are useful to investors as they are representative of our core

operations and are used in the management of our business,

including decisions concerning the allocation of resources and

assessment of performance.

Free cash flow is defined as cash flow from operations less

capital expenditures. We believe that free cash flow is a useful

measure to investors because it is a meaningful indicator of cash

generated from operating activities available for the execution of

our business strategy, and is used in the management of our

business, including decisions concerning the allocation of

resources and assessment of performance. Net debt is defined as

total balance sheet debt less cash and cash equivalents. We believe

this measure is useful to investors as it provides a measure to

compare debt less cash and cash equivalents across periods on a

consistent basis.

As required by SEC rules, see the financial statement section of

this earnings release for detailed reconciliations of these

non-GAAP financial measures to the most directly comparable GAAP

measure. We have not provided a reconciliation of our fiscal 2023

adjusted EBITDA guidance because at this time we cannot reasonably

predict or quantify many of the adjustments that will ultimately

constitute the primary differences between our fiscal 2023 adjusted

EBITDA on the one hand and our fiscal 2023 EBITDA and GAAP net

income on the other. Accordingly, a reconciliation of such measure

is not available without unreasonable effort.

About MasterBrand:

MasterBrand, Inc. (NYSE: MBC) is the largest manufacturer of

residential cabinets in North America and offers a comprehensive

portfolio of leading residential cabinetry products for the

kitchen, bathroom and other parts of the home. MasterBrand products

are available in a wide variety of designs, finishes and styles and

span the most attractive categories of the cabinets market: stock,

semi-custom and premium cabinetry. These products are delivered

through an industry-leading distribution network of over 4,500

dealers, major retailers and builders. MasterBrand employs over

13,600 associates across more than 20 manufacturing facilities and

offices. Additional information can be found at

www.masterbrand.com.

Forward Looking Statements:

This Press Release contains “forward-looking statements”

regarding business strategies, market potential, future financial

performance, and other matters. Statements preceded by, followed by

or that otherwise include the word “believes,” “expects,”

“anticipates,” “intends,” “projects,” “estimates,” “plans,” “may

increase,” “may fluctuate,” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” “may,” and

“could,” are generally forward-looking in nature and not historical

facts. Where, in any forward-looking statement, we express an

expectation or belief as to future results or events, such

expectation or belief is based on the current plans and

expectations of our management. Although we believe that these

statements are based on reasonable assumptions, they are subject to

numerous factors, risks and uncertainties that could cause actual

outcomes and results to be materially different from those

indicated in such statements. These factors include those listed

under “Risk Factors” in our Form 10-K and other filings with the

SEC.

The forward-looking statements included in this document are

made as of the date of this Press Release and, except pursuant to

any obligations to disclose material information under the federal

securities laws, we undertake no obligation to update, amend or

clarify any forward-looking statements to reflect events, new

information or circumstances occurring after the date of this Press

Release.

Some of the important factors that could cause our actual

results to differ materially from those projected in any such

forward-looking statements include:

- Our ability to develop and expand our business;

- Our anticipated financial resources and capital spending;

- Our ability to manage costs;

- The impact of our dependence on third parties with respect to

sourcing our raw materials;

- Our ability to accurately price our products;

- Our anticipated future revenues and expectations of operational

performance;

- The effects of competition and consolidation of competitors in

our industry;

- Costs of complying with evolving regulatory requirements and

the effect of actual or alleged violations of environmental

laws;

- The effect of climate change and unpredictable seasonal and

weather factors;

- Failure to realize the anticipated benefits of the separation

from Fortune Brands;

- Conditions in the housing market in the United States and

Canada;

- The expected strength of our existing customers and

consumers;

- Worldwide economic, geopolitical and business conditions and

risks associated with doing business on a global basis;

- Unfavorable or unexpected effects of the distribution and

separation from Fortune Brands;

- The effects of the COVID-19 pandemic or another public health

crisis or other unexpected event; and

- Other statements contained in this Press Release regarding

items that are not historical facts or that involve

predictions.

*See "Non-GAAP Financial Measures" and the corresponding

financial tables at the end of this press release for definitions

and reconciliations of non-GAAP measures.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

13 Weeks Ended

(U.S. Dollars presented in millions,

except per share amounts)

March 26, 2023

March 27, 2022

NET SALES

$

676.7

$

777.1

Cost of products sold

472.1

566.1

GROSS PROFIT

204.6

211.0

Gross Profit Margin

30.2

%

27.2

%

Selling, general and administrative

expenses

135.3

145.1

Amortization of intangible assets

4.0

4.4

Restructuring adjustments

(0.4

)

—

OPERATING INCOME

65.7

61.5

Related party interest income, net

—

(1.1

)

Interest expense

17.4

—

Other expense, net

0.4

0.9

INCOME BEFORE TAXES

47.9

61.7

Income tax expense

12.9

14.8

NET INCOME

$

35.0

$

46.9

Average Number of Shares of Common Stock

Outstanding

Basic

128.2

128.0

Diluted

129.5

128.0

Earnings Per Common Share

Basic

$

0.27

$

0.37

Diluted

$

0.27

$

0.37

SUPPLEMENTAL

INFORMATION

(Unaudited)

13 Weeks Ended

March 26,

March 27,

(In millions, except per share amounts and

percentages)

2023

2022

1. Reconciliation

of Net Income to EBITDA to ADJUSTED EBITDA

Net income (GAAP)

$

35.0

$

46.9

Related party interest income, net

—

(1.1

)

Interest expense

17.4

—

Income tax expense

12.9

14.8

Depreciation expense

11.3

10.8

Amortization expense

4.0

4.4

EBITDA (Non-GAAP Measure)

$

80.6

$

75.8

[1] Net cost savings as standalone

company

—

5.0

[2] Separation costs

1.6

—

[3] Restructuring adjustments

(0.4

)

—

[4] Restructuring-related adjustments

(0.3

)

—

Adjusted EBITDA (Non-GAAP

Measure)

$

81.5

$

80.8

2. Reconciliation

of Net Income to Adjusted Net Income

Net Income (GAAP)

$

35.0

$

46.9

[1] Net cost savings as standalone

company

—

5.0

[2] Separation costs

1.6

—

[3] Restructuring adjustments

(0.4

)

—

[4] Restructuring-related adjustments

(0.3

)

—

[5] Income tax impact of adjustments

(0.2

)

(1.2

)

Adjusted Net Income (Non-GAAP

Measure)

$

35.7

$

50.7

3. Earnings per

Share Summary

Diluted EPS (GAAP)

$

0.27

$

0.37

Impact of adjustments

$

0.01

$

0.03

Adjusted Diluted EPS (Non-GAAP

Measure)

$

0.28

$

0.40

Weighted average diluted shares

outstanding

129.5

128.0

4. Profit

Margins

Net Sales

$

676.7

$

777.1

Gross Profit

$

204.6

$

211.0

Gross Profit Margin %

30.2

%

27.2

%

Adjusted EBITDA Margin %

12.0

%

10.4

%

TICK LEGEND:

[1] Prior to the separation

from Fortune Brands in Q4 2022, our historical consolidated

financial statements included expense allocations for certain

corporate functions performed on our behalf by Fortune Brands,

including information technology, finance, executive, human

resources, supply chain, internal audit and legal services. As a

standalone public company, we expect that the costs we incur on a

standalone basis for such expenses previously allocated to us by

Fortune Brands and new costs relating to our public company

reporting and compliance obligations will be less than the expense

allocations from Fortune Brands within our historical financial

statements.

The costs of MasterBrand we plan to incur are based on our

expected organizational structure and expected cost structure as a

standalone company. In order to determine the impact of the

synergies and dissynergies, MasterBrand prepared a detailed

assessment of personnel costs based on the estimated resources and

associated costs required as a baseline to stand up MasterBrand as

a standalone company.

In addition to personnel costs, estimated nonpersonnel third

party support costs in each function were considered, which

included business support functions and corporate overhead charges

previously shared with Fortune Brands. Estimated non personnel

third party support costs were determined by estimating third party

spend in each function, and include the costs associated with

outside services supporting information technology, finance,

executive, human resources, supply chain, internal audit and legal

services. This process was used by all functions resulting in

expected net cost savings when compared to the corporate

allocations from Fortune Brands included in the historical

financial statements.

[2] Separation costs

represent one-time costs incurred directly by MasterBrand related

to the separation from Fortune Brands.

[3] Restructuring

adjustments are recoveries of previously recorded restructuring

charges during the thirteen week period ended March 26, 2023,

mainly due to changes in estimate of accruals recorded in prior

periods. The restructuring charges recorded in prior periods

consist mainly of workforce reduction costs.

[4] Restructuring-related

adjustments are recoveries of previously recorded

restructuring-related charges during the thirteen week period ended

March 26, 2023, mainly due to changes in estimate of accruals

recorded in prior periods. Restructuring-related charges are

directly related to restructuring initiatives that cannot be

reported as restructuring under GAAP. Such costs may include losses

on disposal of inventories, trade receivables allowances from

exiting product lines, accelerated depreciation expense, write off

of displays from exiting a customer relationship and the losses on

the sale of closed facilities.

[5] In order to calculate

Adjusted Net Income, each of the items described in Items [1] - [4]

above were tax effected based upon the effective tax rates for the

respective periods. The effective tax rate was calculated by

dividing income tax expense by income before taxes for the

respective periods.

13 Weeks Ended

March 26,

March 27,

2023

2022

Income taxes (a)

$

12.9

$

14.8

Income before taxes (b)

47.9

61.7

Effective income tax rate (a)/(b)

26.9

%

24.0

%

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

March 26,

March 27,

(In millions)

2023

2022

ASSETS

Current assets

Cash and cash equivalents

$

116.3

$

138.9

Accounts receivable, net

278.3

324.5

Inventories

349.6

337.5

Other current assets

66.4

69.6

TOTAL CURRENT ASSETS

810.6

870.5

Property, plant and equipment, net

344.0

339.5

Operating lease right-of-use assets,

net

62.8

58.2

Goodwill

923.8

927.0

Other intangible assets, net

345.3

412.2

Related party receivable

—

444.6

Other assets

21.6

33.7

TOTAL ASSETS

$

2,508.1

$

3,085.7

LIABILITIES AND EQUITY

Current liabilities

Accounts payable

202.8

218.1

Current portion of long-term debt

22.2

—

Current operating lease liabilities

14.4

13.3

Other current liabilities

149.4

126.1

TOTAL CURRENT LIABILITIES

388.8

357.5

Long-term debt

917.4

—

Deferred income taxes

84.4

86.8

Pension and other postretirement plan

liabilities

12.2

9.5

Operating lease liabilities

50.6

47.1

Related party payable

—

15.5

Other non-current liabilities

8.3

29.3

TOTAL LIABILITIES

1,461.7

545.7

Stockholders' equity

1,046.4

2,540.0

TOTAL EQUITY

1,046.4

2,540.0

TOTAL LIABILITIES AND EQUITY

$

2,508.1

$

3,085.7

Reconciliation of Net Debt

Current portion of long-term debt

$

22.2

Long-term debt

917.4

LESS: Cash and cash equivalents

(116.3

)

Net Debt

$

823.3

Adjusted EBITDA for FY2022

411.4

LESS: Adjusted EBITDA for Q1 2022

(80.8

)

PLUS: Adjusted EBITDA for Q1 2023

81.5

Adjusted EBITDA (52 Weeks)

$

412.1

Net Debt to Adjusted EBITDA

2.0

x

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

13 Weeks Ended

March 26,

March 27,

(In millions)

2023

2022

OPERATING ACTIVITIES

Net income

$

35.0

$

46.9

Non-cash expense (income):

Depreciation

11.3

10.8

Amortization of intangibles

4.0

4.4

Restructuring adjustments, net of cash

payments

(10.4

)

(0.6

)

Amortization of finance fees

0.5

—

Stock-based compensation

4.9

2.7

Changes in operating assets and

liabilities:

Accounts receivable

14.1

(18.3

)

Inventories

23.3

(32.8

)

Other current assets

(2.0

)

(8.6

)

Accounts payable

(16.9

)

14.9

Accrued expenses and other current

liabilities

(14.6

)

(17.5

)

Other items

12.9

(4.8

)

NET CASH PROVIDED BY (USED IN)

OPERATING ACTIVITIES

62.1

(2.9

)

INVESTING ACTIVITIES

Capital expenditures

(2.9

)

(11.0

)

Proceeds from the disposition of

assets

0.2

—

NET CASH USED IN INVESTING

ACTIVITIES

(2.7

)

(11.0

)

FINANCING ACTIVITIES

Issuance of long-term and short-term

debt

40.0

—

Reductions of long-term and short-term

debt

(79.6

)

—

Related party borrowings

—

727.7

Related party repayments

—

(744.8

)

Net contributions from Fortune Brands

—

28.3

Payments of employee taxes withheld from

share-based awards

(2.8

)

—

Repayment of finance lease facilities

(0.3

)

(0.2

)

NET CASH (USED IN) PROVIDED BY

FINANCING ACTIVITIES

(42.7

)

11.0

Effect of foreign exchange rate changes on

cash and cash equivalents

(1.5

)

0.4

NET INCREASE (DECREASE) IN CASH AND

CASH EQUIVALENTS

$

15.2

$

(2.5

)

Cash and cash equivalents at beginning of

period

$

101.1

$

141.4

Cash and cash equivalents at end of

period

$

116.3

$

138.9

Reconciliation of Free Cash

Flow

Net cash provided by (used in) operating

activities

$

62.1

$

(2.9

)

Less: Capital expenditures

(2.9

)

(11.0

)

Free cash flow

$

59.2

$

(13.9

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230509006035/en/

Investor Relations: Investorrelations@masterbrand.com Media

Contact: Media@masterbrand.com

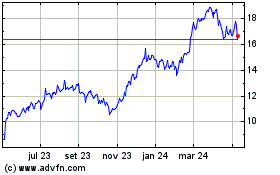

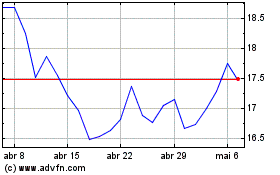

Masterbrand (NYSE:MBC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Masterbrand (NYSE:MBC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024