AIG to Sell Validus Re to RenaissanceRe

22 Maio 2023 - 5:31PM

Business Wire

- Divestiture of AIG’s Treaty Reinsurance Business Continues

Progress on AIG’s Portfolio Repositioning, Reduces Volatility in

Underwriting Results, Accelerates Focus on Insurance Business,

Increases Liquidity and Unlocks Significant Capital

- Transaction Includes Validus Re, AlphaCat and the Talbot Treaty

Reinsurance Business; Transaction Excludes Talbot Underwriting

Ltd., Western World and Crop Risk Services

- RenaissanceRe to Pay $2.985 Billion on the Closing Date,

Consisting of $2.735 Billion in Cash and $250 Million in

RenaissanceRe Common Shares; AIG to Receive all Capital in Excess

of $2.1 Billion of Shareholders’ Equity of Validus Re and Achieve

Future Capital Synergies of Approximately $400 Million from the

Recapture of Reserves as a Result of Transferring the Validus Re

Balance Sheet to RenaissanceRe, which together, as of December 31,

2022, was over $1.5 Billion; Total Transaction Value to AIG is

Expected to Exceed $4.5 Billion

- AIG Entitled to Receive Additional Cash Consideration Over Time

Through Value Sharing of Reserve Redundancies that may Emerge, as

well as Net Income Generated from the Business Through the

Closing

- Following the Closing, AIG Expects to Make Significant

Investments in RenaissanceRe’s DaVinci Reinsurance and Fontana Re

Managed Funds, Strengthening Partnership between Companies

American International Group (NYSE: AIG) today announced that it

has entered into a definitive agreement to sell Validus Re,

including AlphaCat and the Talbot Treaty reinsurance business, to

RenaissanceRe Holdings Ltd. (NYSE: RNR) (“RenaissanceRe”) for

$2.985 billion, consisting of $2.735 billion in cash and $250

million in RenaissanceRe common shares. In addition, AIG will

receive all capital in excess of $2.1 billion of shareholders’

equity of Validus Re and achieve future capital synergies of

approximately $400 million from the recapture of reserves as a

result of transferring the Validus Re balance sheet to

RenaissanceRe, which together, as of December 31, 2022, was over

$1.5 billion. The total estimated transaction value is expected to

exceed $4.5 billion.

AIG will retain Talbot Underwriting and Western World, which

were purchased as part of its 2018 acquisition of Validus Holdings

Ltd. and which currently represent approximately $1.6 billion of

AIG’s total gross premiums written. On May 2, 2023, AIG announced

that it reached an agreement to sell Crop Risk Services, also

purchased as part of the 2018 acquisition of Validus Holdings Ltd.

in 2018, to American Financial Group, Inc. for $240 million; this

transaction is expected to close in the third quarter of 2023.

The sale of Validus Re is expected to close in the fourth

quarter of 2023, subject to regulatory approvals and other

customary closing conditions. Following the closing, AIG expects to

make significant investments in RenaissanceRe’s DaVinci Reinsurance

and Fontana Re managed funds through AIG’s Investment

portfolio.

Peter Zaffino, Chairman and Chief Executive Officer of AIG,

commented: “Today’s announcement represents another key milestone

for AIG and is strategically significant for both AIG and Validus

Re. For AIG, it further simplifies our business model and reduces

volatility in our portfolio, while generating significant cash

liquidity and capital efficiencies that enable us to accelerate our

capital management strategy.

“We have spent the last several years transforming Validus Re by

re-underwriting the portfolio and driving operating leverage

leading to improved outcomes. As part of RenaissanceRe, Validus Re

will benefit from global scale that will allow the business to

continue to grow, expand its capabilities and drive value for

clients and other stakeholders.

“At the same time, our investment in RenaissanceRe’s common

shares demonstrates our commitment to the strong relationship we

have with RenaissanceRe and, coupled with our investment in DaVinci

Reinsurance and Fontana Re, will allow us to continue to

participate in the growth of the reinsurance market with less risk

and capital requirements. I have enormous respect for Kevin and

RenaissanceRe and look forward to continuing our longstanding and

successful partnership.”

Evercore Group L.L.C. and J.P. Morgan Securities LLC acted as

financial advisors, and Wachtell, Lipton, Rosen & Katz and

Debevoise & Plimpton LLP acted as legal counsel for AIG.

About AIG

American International Group, Inc. (AIG) is a leading global

insurance organization. AIG member companies offer insurance

solutions that help businesses and individuals in approximately 70

countries and jurisdictions protect their assets and manage risks.

AIG common stock is listed on the New York Stock Exchange.

Additional information about AIG can be found at www.aig.com |

YouTube: www.youtube.com/aig | Twitter: @AIGinsurance

www.twitter.com/AIGinsurance | LinkedIn:

www.linkedin.com/company/aig. These references with additional

information about AIG have been provided as a convenience, and the

information contained on such websites is not incorporated by

reference into this press release.

AIG is the marketing name for the worldwide property-casualty,

life and retirement, and general insurance operations of American

International Group, Inc. For additional information, please visit

our website at www.aig.com. All products and services are written

or provided by subsidiaries or affiliates of American International

Group, Inc. Products or services may not be available in all

countries and jurisdictions, and coverage is subject to

underwriting requirements and actual policy language. Non-insurance

products and services may be provided by independent third parties.

Certain property-casualty coverages may be provided by a surplus

lines insurer. Surplus lines insurers do not generally participate

in state guaranty funds, and insureds are therefore not protected

by such funds.

Forward Looking

Statements

Certain statements in this press release and any related oral

statements constitute forward-looking statements. These statements

are not historical facts but instead represent only the relevant

party’s belief regarding future events, many of which, by their

nature, are inherently uncertain and outside the relevant party’s

control. It is possible that the transactions will not be completed

within the expected timeframes or at all, or that the transactions

will take a materially different form from those contemplated by

these statements. Each party referenced in this press release only

assumes responsibility for its statements and does not affirm or

otherwise adopt the statements of any other party.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230522005650/en/

Quentin McMillan (Investors): quentin.mcmillan@aig.com Dana

Ripley (Media): dana.ripley@aig.com

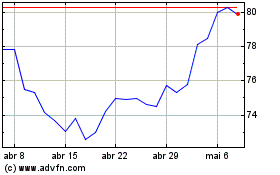

American (NYSE:AIG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

American (NYSE:AIG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024