ADR Shares End Higher; JinkoSolar, Petrobras Trade Actively

30 Setembro 2015 - 8:04PM

Dow Jones News

By Maria Armental

International stocks trading in New York closed higher on

Wednesday.

The BNY Mellon index of American depositary receipts rose 2.3%

to 124.77. The European index improved 2.1% to 126.02, the Asian

index rose 2.4% to 129.55, the Latin American index rose 2.9% to

155.98 and the emerging-markets index improved 2.8% to 206.46.

JinkoSolar Holding Co. Ltd. (JKS) and Petroleo Brasileiro SA (PBR,

PETR3.BR, PETR4.BR) were was among the companies with ADRs that

traded actively.

AirMedia Group Inc. (AMCN) on Wednesday said it reached a deal

with a group of its executives to take the company private with an

offer that values the firm around $360 million, following a raft of

management offers earlier this year to take Chinese companies off

the U.S. market. The management-led buyout group already owns about

35% of the company's shares. ADRs rose nearly 7.8% to 5.37.

JinkoSolar said it reached a nearly $5.1 million settlement of a

2011 lawsuit with class-action status representing purchasers of

the Chinese solar-products company's American depositary shares

between their U.S. stock market debut in May 2010 and September

2011. ADRs surged nearly 14% to $21.94.

Novartis AG's (NVS, NOVN.VX) Sandoz Inc. unit agreed to a

nonexclusive license to sell a generic version of the United

Therapeutics Corp.'s hypertension drug Remodulin by June 2018

ending a long-running dispute between the two companies. Sandoz

could be permitted to enter the market sooner under certain

circumstances, United Therapeutics said in a news release. The

license would exclude other United Therapeutics products, as well

as technology related to an implantable version of Remodulin that

United Therapeutics is developing with medical-device maker

Medtronic PLC (MDT) and a pre-filled semi-disposable pump system

being developed with DEKA Research & Development Corp. ADRs

rose 2.7% to $91.92.

ADRs of Petrobras rose nearly 12% to $4.35 a day after Brazil's

state-run oil company said it was raising gasoline prices by 6% and

diesel prices by 4% at its refineries. Any change to prices at the

pump is unclear, as they are set by gas-station owners. Petrobras

imports gasoline and diesel fuel to meet domestic demand. The

weakening of the Brazilian currency, the real, against the dollar

has made those imports more expensive.

Write to Maria Armental at maria.armental@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 30, 2015 18:49 ET (22:49 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

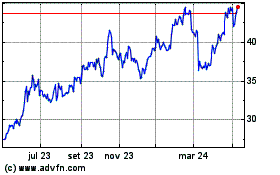

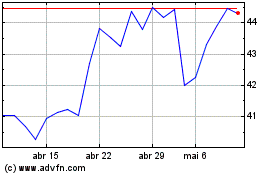

PETROBRAS ON (BOV:PETR3)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

PETROBRAS ON (BOV:PETR3)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024