Coty Says Profit Rises, Gives Details on P&G Beauty Merger

05 Novembro 2015 - 12:00PM

Dow Jones News

Coty Inc. reported Thursday its first-quarter profit soared,

helped by a one-off tax benefit, and provided more details on the

financing and organizational structure for its merger with Procter

& Gamble Co.'s beauty brands.

The beauty-products maker said it has transferred 10 out of 12

fragrance licenses, putting it on track to close the deal in the

second half of 2016.

Coty said its business will be reorganized around three

divisions: luxury, consumer beauty and professional beauty. It will

also launch a growth and digital department focused on top-line

growth.

The New York company announced in September that it would buy

P&G's beauty brands for $13 billion, adding items such as

Clairol hair dyes and CoverGirl makeup to its portfolio.

Coty Interim Chief Executive Bart Becht acknowledged

first-quarter results were mixed. He said strong profit showed

success in Coty's global efficiency program, launched last year and

designed to save at least $200 million annually.

"On the other hand, revenue growth wasn't where we would like it

to be," he said in prepared remarks, pointing to declining

fragrance revenue that has suffered from a large number of

unsustainable historical launches.

"We will be working hard to clean up past portfolio practices,"

Becht said.

For the quarter ended in September, Coty reported a profit of

$125.7 million, or 34 cents a share, up from $10.6 million, or 3

cents a share, a year earlier. Adjusted earnings were 59 cents a

share compared with 28 cents a share the year before.

Revenue dipped 5.9% to $1.11 billion.

Analysts polled by Thomson Reuters had forecast earnings of 30

cents a share on $1.13 billion in revenue. Gross margin rose to

60.1% from 59.2%.

The latest quarter included a tax benefit of $67.1 million,

compared with $5 million in the year-earlier quarter.

This week, Coty announced its acquisition of beauty and personal

care business Hypermarcas . The move is expected to increase Coty's

exposure to higher growth emerging markets over time, especially

Brazil, and is the latest in a string of acquisitions that include

nail-polish company OPI Products, skin-care-products brand

Philosophy and digital marketing platform Beamly.

Shares, which closed Wednesday at $29.95, were inactive

premarket.

Write to Anne Steele at Anne.Steele@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 08:45 ET (13:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

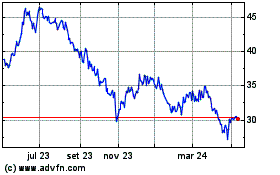

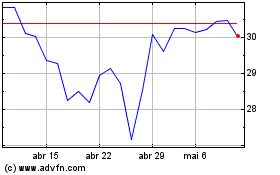

HYPERA ON (BOV:HYPE3)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

HYPERA ON (BOV:HYPE3)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024