ESSEN, Germany—ThyssenKrupp AG's painful restructuring from

German steel dinosaur to a world-leading industrial manufacturer is

finally starting to pay off.

Since taking the helm nearly five years ago, Chief Executive

Heinrich Hiesinger has labored to reshape what was then a staid

steel giant—one that has armed German troops for over 150

years.

ThyssenKrupp hired Mr. Hiesinger in 2011 from Siemens AG, where

he had spent nearly two decades, and tasked him with cleaning

house. The company was plagued by corruption scandals, internal

divisions and inefficiency. It was hemorrhaging cash amid a global

steel slump and suffering especially from its ill-timed expansion

of steel operations in the Americas.

"The picture at the beginning was not a very nice one," Mr.

Hiesinger said in a recent interview.

The 55-year-old engineer has since cut ThyssenKrupp's steel

production to less than 30% of sales and transformed the company

into a more diversified capital goods company. Its elevator and

escalator business is a world leader.

He has sought synergies across business areas by centralizing

controls and operating as an integrated group, rather than

disparate enterprises, as in the past.

He also has striven to reform a corporate culture that

discouraged whistleblowing about corruption and mismanagement. When

Mr. Hiesinger took over, the company was plagued by accusations

that some executives had paid bribes for contracts.

"How could it happen that our company was maneuvering itself in

such a difficult situation and nobody raised a hand or corrected it

beforehand?" Mr. Hiesinger said. "We wanted to build an

organization where hierarchy is strongly reduced, so that truth has

a chance to move up from bottom to top."

Last autumn, ThyssenKrupp posted its first annual net profit in

four years and its first dividend in three years, figures that

analysts expect to rise when the company reports its results for

fiscal-year 2015 on Thursday.

Mr. Heisinger's first success was staunching the company's cash

drain, said Christian Obst, director of equity research for steel

and metals at Baader Bank AG. "The biggest challenge going forward

is to increase free cash flow," which Mr. Obst said is "not very

satisfying so far."

Analysts widely expect the company's free cash flow to have

broken even during the fiscal year that ended Sept. 30. This is

important for a company that borrows heavily and would like to

raise its dividend payments, while increasing investments in its

capital goods businesses, said Ingo Speich, a senior portfolio

manager at Union Investment, a ThyssenKrupp investor.

Mr. Hiesinger said that when he took the reins, ThyssenKrupp was

a "low-performance company." Now, he said, it is a

"medium-performance" operation, adding: "We are definitely not

completed in our transformation."

At the center of that transformation is the company's investment

in its elevator business, which now runs even with world leader

United Technologies Corp.' Otis Elevator Company unit on its home

turf in the U.S.

"This is a business where we demonstrated now for already four

years in a row that we have the capability to really improve it,"

Mr. Hiesinger said.

Also vital to the turnaround was selling ThyssenKrupp's

Alabama-based steel-rolling and coating plant last year to a

consortium of ArcelorMittal SA and Nippon Steel & Sumitomo

Metal Corp. for $1.55 billion.

The sale improved ThyssenKrupp's balance sheet and let Mr.

Heisinger shift investment to higher-margin and more stable capital

goods businesses, said Seth Rosenfeld, an analyst at Jefferies

International Ltd.

Aside from elevators, ThyssenKrupp's capital goods businesses

include a unit that supplies the auto industry with parts such as

electrical-steering systems and engine components. Another unit

builds complex systems including production facilities for

industrial customers and advanced submarines.

Some investors, including Union, have urged ThyssenKrupp to sell

its marine business. Mr. Speich said that the unit was profitable

but in a risky sector, so selling it would only improve the

company's overall multiple.

Mr. Hiesinger said he still wants to sell the last part of

ThyssenKrupp's U.S. steel operations, a plant in Brazil, when

market conditions improve.

Unloading the company's storied European steel business, on

which ThyssenKrupp was built, would be tougher.

"We don't deny there is a structural weakness in the European

steel market," Mr. Hiesinger said. "But to be honest," he added,

"it's unlikely that you can sell" the company's European steel

unit. He noted that the division's earning grew over the past year

and it was "cash contributing."

Despite Mr. Heisinger's efforts, ThyssenKrupp's stock price is

little changed from one year ago and shareholders' patience is

uncertain.

Swedish activist investor Cevian Capital Partners owns a 16%

stake and since January has held one of the 20 seats on

ThyssenKrupp's supervisory board. The Swedish investment fund is

one of the few activist investors to sit on the board of a German

company and analysts have long speculated the firm would like to

engineer a breakup of ThyssenKrupp.

Such a move could set up a clash on the supervisory board with

representatives of the Krupp family foundation, which holds 23% and

two supervisory board seats. The foundation, which lost one board

seat and veto power in 2013 after sitting out a capital increase,

still abides by its charter to keep the company's structure

intact.

Cevian and the foundation declined to comment. Cevian in the

past has voiced public support for Mr. Hiesinger and his

strategy.

Write to Christopher Alessi at christopher.alessi@wsj.com

Access Investor Kit for "Siemens AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE0007236101

Access Investor Kit for "ThyssenKrupp AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE0007500001

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 17, 2015 12:05 ET (17:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

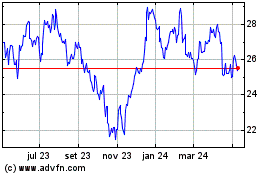

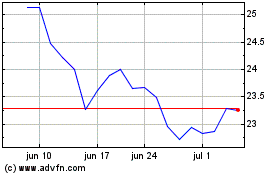

Arcelor Mittal (NYSE:MT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Arcelor Mittal (NYSE:MT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024