Airlines Boost Buybacks on Confidence in Demand

21 Janeiro 2016 - 4:40PM

Dow Jones News

Two big U.S. airlines on Thursday boosted their share buyback

programs and said demand remained solid, though fares continue to

fall because of fierce domestic competition and currency

headwinds.

United Continental Holdings Inc. and Southwest Airlines Co. both

reported record fourth-quarter profits bolstered by falling fuel

prices. The carriers also plan to add larger aircraft to lower

their costs and tackle the twin challenges of fast-growing discount

rivals and pricier new labor deals.

Oscar Munoz, United's chief executive, said he was committed to

returning more capital to shareholders as he made a surprise

appearance on the airline's quarterly earnings call. Mr. Munoz had

a heart transplant on Jan. 6 and said he expected to return to work

before the end of the first quarter.

Investors have hammered U.S. airline stocks this year, concerned

that slowing global economic growth will dent demand and accelerate

a yearlong slide in average fares, prompting executives to boost

their buybacks.

United, the third-largest U.S. airline by traffic, said it plans

to repurchase $750 million in shares during the first quarter,

having bought back $1.2 billion during 2015. Southwest said it

would buy back an additional $500 million starting in the

quarter.

The moves reflect executives' confidence in overall demand,

though pockets of weakness remain, notably in routes to Latin

America and among corporate customers tied to the energy

sector.

United said energy-related business dropped 40% in the fourth

quarter from a year earlier, and is moving capacity from its big

Houston hub to Denver and San Francisco, its main base for flights

to Asia. The airline said demand on its services to China, where's

it's the market leader, remained robust.

The airline said it was ordering 40 Boeing Co. 737-700 jets to

replace smaller regional planes. United evaluated jets from Airbus

Group SE, Bombardier Inc. and Embraer SA, though the company

expects to review bids from all four manufacturers for a follow-on

order.

Mr. Munoz has sought to repair some of United's fractious labor

relations, and its pilots are due to announce on Friday whether

they have accepted a proposed contract, with mechanics also

reviewing a planned new pact. United said, if accepted, the two

plans would raise unit costs by 2.5% this year compared with 2015.

The airline has yet to secure a new deal with its flight

attendants, who staged protests on Thursday about the lack of

progress.

United reported a fourth-quarter profit of $823 million compared

with $28 million a year earlier, with per-share earnings rising to

$2.24 from 7 cents, just shy of analysts' expectations. Revenue

fell 3% to $9.04 billion.

The airline said its closely watched average passenger revenue

is expected to fall six percentage points to 8% in the first

quarter, and it has trimmed planned capacity additions to help

bolster fares.

Southwest, a bellwether for the domestic market, said it

expected its average passenger revenue to stabilize in the quarter.

The airline said it was converting 25 of its Boeing orders to the

larger 737-800 model.

The airline reported a profit of $536 million for the fourth

quarter compared with $190 million a year earlier, with per-share

earnings rising to 82 cents from 28 cents. Revenue climbed 7.5% to

$4.98 billion.

United shares, which have slid about 20% this year, were

recently up 1.1% at $45.63 after reversing an early decline.

Southwest's stock was up 2.2% at $40.16.

Anne Steele contributed to this article.

(END) Dow Jones Newswires

January 21, 2016 13:25 ET (18:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

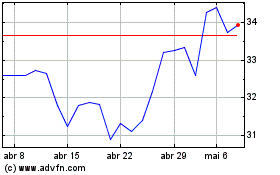

EMBRAER ON (BOV:EMBR3)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

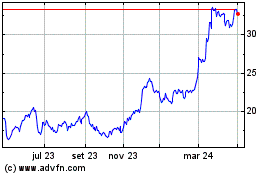

EMBRAER ON (BOV:EMBR3)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024