Europe-China Deals Receive More Scrutiny From Key U.S. Panel

25 Janeiro 2016 - 6:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 1/25/16)

By Shayndi Raice

LONDON -- The U.S. government body that screens corporate

takeovers for security concerns is scrutinizing an increasing

number of high-profile deals in which neither party is

American.

The group, known as the Committee on Foreign Investment in the

U.S., or CFIUS, has long examined deals in which foreign companies,

especially Chinese ones, try to purchase U.S. assets. But a recent

surge in Asian takeovers of European companies that own businesses

in the U.S. has put the panel in the delicate position of trying to

police overseas deals.

On Friday, Philips NV said it was terminating its $2.8 billion

deal to sell its lighting-components and automotive-lighting

business to Go Scale Capital, an investment fund led by Chinese

venture-capital firm GSR Ventures.

That deal -- with neither of the principal actors being American

-- wouldn't be considered a likely target for CFIUS to inspect for

potential impacts on U.S. national security. But the Philips

business that is on the block, called Lumileds, has a large

portfolio of U.S. patents for light-emitting diodes, or LED, and a

sizable presence in the U.S. through manufacturing and

research-and-development facilities in San Jose, Calif. That,

apparently, was enough to attract the attention of CFIUS, which

blocked the deal.

CFIUS's increasingly proactive approach toward deals that don't

directly involve U.S. parties is causing angst among some European

executives, deal makers and lawyers.

CFIUS sometimes exerts its power "in a way that observers kind

of scratch their heads and say, 'Really?' " said Robert Profusek,

the global chair of mergers and acquisitions at the law firm Jones

Day. By their logic, he added, "almost anything is a CFIUS

deal."

CFIUS doesn't itself have the power to reject transactions. If

it spots potential problems, it can recommend that the companies

modify the terms of their deal, for example, by shedding U.S.

assets, or it can recommend that the U.S. president nix the

transaction. A presidential veto has only happened twice; more

often, as was the case with Philips, the companies abandon

transactions that CFIUS frowns upon.

Besides the scuttled Philips deal, last year's $16.6 billion

merger between the Finnish wireless-equipment company Nokia Corp.

and French firm Alcatel-Lucent SA underwent CFIUS scrutiny.

Alcatel-Lucent had a joint-venture with China's Shanghai Bell. The

deal ultimately went forward, though it is unclear if the parties

had to make concessions to ensure CFIUS's backing. The details

around CFIUS's scrutiny remain secret.

Experts on the government-review process believe a sale of Swiss

pesticides giant Syngenta AG could also get caught in a CFIUS

review if a deal proceeds with China National Chemical Corp. or

ChemChina, because of Syngenta's U.S. holdings. Syngenta declined

to comment.

The increased oversight comes as regulatory and

national-security scrutiny of deals globally has become more

common, increasing what companies need to do to get deals across

the finish line.

After General Electric Co. went after France's Alstom Group in

2014, for example, the French government expanded the scope of its

national-security reviews of foreign acquisitions to include a

broader range of industries. No deals have yet been killed, but

several have been scrutinized, said one CFIUS lawyer.

"National-security reviews are expanding around the world and

the national-security issues are broader as the supply chain

globalizes," said Ivan Schlager, a CFIUS attorney with the law firm

Skadden, Arps, Slate, Meagher & Flom LLP.

CFIUS's mandate hasn't changed. What has changed is the nature

of deals that are being struck, as globalization means U.S. assets

could end up in the hands of a wider array of companies.

(END) Dow Jones Newswires

January 25, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

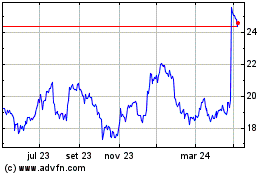

Koninklijke Philips NV (EU:PHIA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

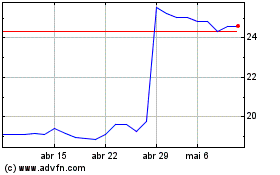

Koninklijke Philips NV (EU:PHIA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024