Chinese companies have launched a record wave of foreign

acquisitions in the first few weeks of 2016 as they seek inroads

into overseas markets amid China's slowing economy and falling

currency.

China National Chemical Corp., known as ChemChina, on Wednesday

said it would pay $43 billion to buy Swiss pesticide maker Syngenta

AG in a deal that, if approved by Syngenta shareholders and

regulators, would be the largest foreign takeover by a Chinese

company.

Including the ChemChina deal, the combined value of China's

outbound mergers and acquisitions has reached about $68 billion so

far this year, the strongest volume ever for this period and

already more than half of 2015's record annual tally, according to

deal tracker Dealogic.

Other Chinese companies, such as Haier Group and China Cinda

Asset Management Co., have also been ramping up their foreign-asset

purchases in recent years as China looks to bolster its

capabilities in industries including agribusiness, real estate and

energy.

The flurry of deals is providing a jolt of attention to the

world's second-largest economy after the U.S. as it suffers from

its weakest growth in 25 years and its volatile stock market panics

investors globally.

Companies such as ChemChina that are run by China's

government—or state-owned enterprises—are among those buying. A

push by President Xi Jinping to boost overseas trade through the

"One Belt, One Road" initiative aims to open up new markets from

Central Asia to Europe for Chinese companies that previously

focused at home.

The policy, invoking the spirit of the old Silk Road trading

route between East and West, means government cash may be available

to help finance state-owned enterprises, or SOEs, wanting to buy

foreign assets.

But Chinese companies' purchase of foreign assets may come under

scrutiny at home, as the deals come at a tricky time for the

economy.

Beijing is stepping up efforts to halt a flood of money leaving

the country in response to the slowdown and a currency that has

fallen 5.5% against the U.S. dollar since August. China's latest

efforts involve curbing the ability of foreign companies in China

to repatriate earnings and banning yuan-based funds for overseas

investments, people with direct knowledge of the matter have

said.

The Chinese government's concern over capital outflows—which may

have been as high as $1 trillion last year, by some estimates—may

mean that regulators in Beijing look more closely at certain

acquisitions of foreign assets, analysts said. But the government

will still likely support foreign deals that are seen as a

cornerstone of Chinese companies' overseas expansion, they

said.

"It's the nature of the assets that determines Beijing's

support," said Derek Scissors, resident scholar at the American

Enterprise Institute, a Washington-based think tank.

Chinese acquisitions of key Western technologies are likely to

face stiff scrutiny overseas.

In the U.S., a federal agency that screens corporate takeovers

for security concerns recently nixed a deal by a Chinese investment

fund to buy the lighting business of Royal Philips NV. The business

had manufacturing, research and development facilities in the

U.S.

The agency, the Committee on Foreign Investment in the U.S., is

likely to look closely at the ChemChina-Syngenta deal because most

of Syngenta's seed business is in the U.S.

Overall, "we see the deals getting bigger and bigger," said

Patrick Yip, mergers and acquisitions leader for Deloitte China,

referring to Chinese companies' acquisitions of foreign companies.

"I am working on a number of them. Chinese companies want brand

power and high technology."

David Brown, transaction services leader for

PricewaterhouseCoopers China and Hong Kong, predicts around 50%

growth for outbound Chinese mergers and acquisitions every year,

for the next several years.

There is "huge pent-up demand," said Mr. Brown, as Chinese

companies gain confidence to pursue global deals.

The depreciation of the yuan—and the expectation that it will

continue falling—means that Chinese companies are looking to buy

now before the price of foreign assets gets more expensive, said

Rocky Lee, a Beijing- and Hong Kong-based partner at law firm

Cadwalader.

China's yuan, after strengthening by more than 30% over the past

decade, has fallen 8% against the U.S. dollar since the beginning

of 2014 as policy makers seek to make their currency more

market-driven and grapple with a deepening economic slowdown.

Some analysts believe the yuan could fall up to 10% more by the

end of this year amid fears that the Chinese economy is slowing

faster than expected and as the government's moves to contain

market forces send capital flooding out of China.

Chinese state-owned enterprises, for one, are receiving strong

backing for strategic foreign acquisitions from the central

government.

"A lot of the [state-owned enterprises] are fairly cash-rich,"

says Ben Cavender, a Shanghai-based principal at China Market

Research Group. "One of the issues they're running into is they're

out of room to grow in their home market."

ChemChina, when it agreed to buy Italian premium tire maker

Pirelli & C. SpA for roughly $7.7 billion last year, had

secured funding from an overseas investment vehicle championed by

China's president.

Under the deal, Silk Road Fund Co.—an investment vehicle

controlled by China's State Administration of Foreign Exchange and

other state-owned entities—took a 25% stake in the ChemChina

subsidiary set up to acquire Pirelli's shares.

The government is likely to continue providing financial support

for SOEs to buy foreign assets in areas such as technology, energy

and infrastructure, said Mr. Lee of Cadwalader.

Brian Spegele and Anjani Trivedi contributed to this

article.

Write to Kathy Chu at kathy.chu@wsj.com and Julie Steinberg at

julie.steinberg@wsj.com

(END) Dow Jones Newswires

February 03, 2016 14:15 ET (19:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

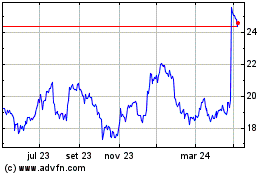

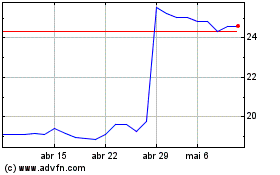

Koninklijke Philips NV (EU:PHIA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Koninklijke Philips NV (EU:PHIA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024