CaixaBank First-Quarter Net Profit Declines -- Update

28 Abril 2016 - 4:40AM

Dow Jones News

By Jeannette Neumann

MADRID-- CaixaBank SA on Thursday reported a 27% decline in

first-quarter net profit to EUR273 million ($308.7 million)

compared with the same period a year earlier, on weaker lending

income and fees as Spanish banks battle negative interest rates and

other headwinds to profitability.

Analysts had anticipated CaixaBank, Spain's third-biggest bank

by market value, would report net profit of EUR287 million in the

first quarter, according to a poll by data provider FactSet.

The bank, led by Executive Chairman Isidro Fainé, said net

interest income was EUR1.02 billion, in line with analysts'

expectations and a 10.4% decline from the first quarter of 2015.

Fees were also down.

Net interest income, a key driver of revenue for retail banks

such as Caixabank, is the difference between what lenders pay

clients for deposits and charge for loans. Caixabank and other

Spanish lenders have removed interest-rate floors on mortgage

contracts, which has also chipped away at the profitability of

loans.

CaixaBank has set it sights on neighboring Portugal in an

expansion bid. Earlier this month, CaixaBank said it was once again

going to try to take over Portuguese lender Banco BPI SA. A

previous attempt had failed as some shareholders balked at the

offering price. CaixaBank already owns 44.1% of BPI and wants full

control to be able to guide the bank in boosting profitability.

CaixaBank and other lenders in Spain are facing gale-force

headwinds in their bid to boost profitability. Negative interest

rates, lackluster demand for home mortgages and muted returns on

business loans have sent lenders scrambling to cut costs. CaixaBank

recently said it had reached early retirement agreements with up to

484 employees to trim salary expenses.

But executives have said the bank's branch network--he most

extensive in Spain--is off limits for any major trims. CaixaBank

has charted a dual course--maintaining that many clients still rely

on bricks-and-mortar banking--while also investing in digital

banking applications to cater to younger clients.

CaixaBank is bucking the trend by staunchly defending its branch

network in the tide of shifting customer habits. Banco Santander

SA, for instance, has said it plans to close 450 smaller bank

branches this year in Spain.

Spain has more branches per person than any other country in the

EU except Cyprus, according to European Central Bank data through

2014, the latest figures available. Even after a 26% decline in

branches between 2010 and 2014, Spain had around three times as

many bank branches as the U.K.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

April 28, 2016 03:25 ET (07:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

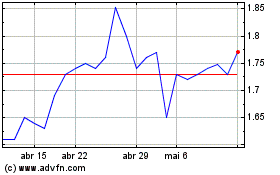

Caixabank (PK) (USOTC:CAIXY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Caixabank (PK) (USOTC:CAIXY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024