Philips Lighting Unit IPO Could Raise More Than $950 Million -- Update

16 Maio 2016 - 8:32AM

Dow Jones News

By Ian Walker

Koninklijke Philips NV set the pricing for the initial public

offering of its lighting unit on Monday, saying the spinoff could

raise between EUR694 million and EUR844 million ($784.8 million to

$954.5 million) for the company.

The Dutch electronics group said it wanted to sell shares in the

unit at between EUR18.50 and EUR22.50, implying a market

capitalization of EUR2.78 billion to EUR3.38 billion.

The final offer price is expected to be announced May 26, with

unconditional trading in the shares on Euronext Amsterdam set to

start May 31.

Philips is selling 37.5 million Philips Lighting shares, or 25%

of the business, in the float to both institutional and retail

investors. It has also offered the underwriters the opportunity to

buy an extra 3.75% of the business. If these shares are taken up,

the company will raise up to EUR970 million, depending on the final

issue price.

Philips confirmed earlier this month that it would float the

lighting business, which dates back nearly 125 years, as part of

plans to trim the operation and devote more time to its more

profitable and faster-growing health-care business, which competes

with Siemens AG and General Electric Co.

Philips Chief Executive Frans van Houten said that as separately

listed companies, Royal Philips and Philips Lighting will be better

equipped to focus on innovation, entrepreneurship and long-term

growth. Lighting Chief Executive Eric Rondolat said the new company

will be committed to further expanding its global position in the

general lighting market, driving the transition to LED and

connected lighting systems and services.

The lighting business reported sales of EUR7.4 billion last

year, making it one of the world's biggest lighting manufacturers.

The unit comprises a declining traditional lamps operation as well

as a fast-growing division called Lumileds, which makes lighting

with energy-efficient light-emitting diodes, or LEDS.

Philips has previously explored a sale of its lighting business,

but struggled to find a buyer. A deal to sell the Lumileds

operation was agreed at the end of last year, but was terminated in

January when U.S. regulators blocked the agreement on national

security grounds. Philips said last month it hopes to close a new

deal for Lumileds before the end of the year.

For the first quarter of 2016 the lighting division saw

comparable sales decline by 2% as strong growth in LED sales was

offset by a drop in sales of conventional lamps. Philips said the

unit is expected to return to growth in the course of the year as

growing demand for energy-efficient lighting is expected to boost

LED sales.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

May 16, 2016 07:17 ET (11:17 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

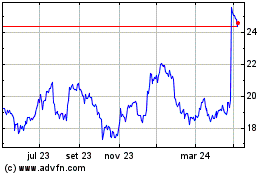

Koninklijke Philips NV (EU:PHIA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

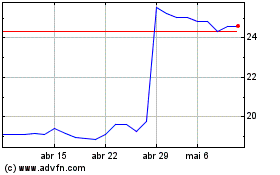

Koninklijke Philips NV (EU:PHIA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024