Ford Fights Back Against Trump Debate Claims

27 Setembro 2016 - 12:50PM

Dow Jones News

Ford Motor Co. went on the defensive following the latest

attacks from Donald Trump aimed at the auto maker's big-dollar

Mexico investments and production plans.

Employees of the Dearborn, Mich., company, including

high-ranking engineers, took to social media platforms—including

Facebook and Twitter—with statistics that defend the company's

reputation as an American company during and after Monday's

presidential debate. A graphic that some employees sent out claims

Ford invested $12 billion in U.S. plants and "created nearly"

28,000 jobs in the past five years. Others circulated stories

written by Detroit media outlets highlighting Ford's contributions

to the U.S. manufacturing sector.

Mr. Trump has for most of his campaign used Ford's Mexico

investment as a key pillar in his attacks of the North American

Free Trade Agreement and as a way to highlight the decline of the

U.S. manufacturing base. While Ford has been touting its plan to

invest $1.6 billion in new Mexican production capacity, it has only

recently taken Mr. Trump on directly. Its recent response included

a round of television interviews and other media engagements

conducted by Chief Executive Mark Fields.

"We shared the facts about Ford's U.S. jobs and investment," a

Ford spokeswoman said.

The Republican nominee once again singled out Ford on Monday,

mentioning the company in opening comments he made during his

debate with Democratic nominee Hillary Clinton. He noted Ford's

decision to take small car production from Michigan and move it out

of the country reflects a broader move to Mexico and lower cost

countries by U.S. manufacturers.

The United Auto Workers union, representing tens of thousands of

Ford's U.S. hourly workers, has long criticized Ford and other U.S.

auto companies for moving jobs outside of the U.S. The union has

opposed Nafta and argued that auto makers need to look for other

ways to cut costs other than offshoring jobs.

Last week, UAW President Dennis Williams said he agreed with Mr.

Trump's proposal to hit companies like Ford with a 35% tariff on

cars built in Mexico, but questioned whether a president would

actually have authority. Mr. Williams also said it is unclear what

impact tariffs would have on the U.S. economy.

Mr. Williams said Ford's decision is "frustrating" because the

union signed a contract with Ford last year "that can make them

money."

Ford employees and executives have recently pointed out the

company will back-fill small car production in Michigan with

higher-profit SUVs and pickup trucks. But the company has been slow

to outline specific product plans as it continues to negotiate with

union officials, and state and local officials on tax breaks and

labor terms.

The company said it is currently hiring 488 professionals.

Still, Ford is following a broader industry rush to Mexico in

recent years. Several auto makers, including General Motors Co.,

Volkswagen AG and Toyota Motor Co., have set aside billions of

dollars to upgrade or build new factories.

In the U.S., auto makers have generally upgraded or expanded

facilities in recent years, but they have been reluctant to build

new facilities.

Ford and the Detroit auto makers have been key topics in

presidential elections dating back to 2008, when GM and Chrysler

were running out of money and requesting bailouts from Washington.

In 2012, auto maker bankruptcies and recoveries were highlighted as

successes for the Obama administration.

Ford didn't file for bankruptcy protection, but instead relied

on debt raised during former Chief Executive Alan Mulally's tenure

and certain government loans to keep it afloat.

The Ford Focus, one of the cars moving from Michigan to Mexico,

already contains less than 50% U.S. materials content, according to

the 2016 National Highway Traffic Safety Administration's American

automobile labeling act reports.

Christina Rogers contributed to this article

Write to John D. Stoll at john.stoll@wsj.com

(END) Dow Jones Newswires

September 27, 2016 11:35 ET (15:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

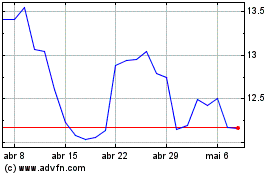

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

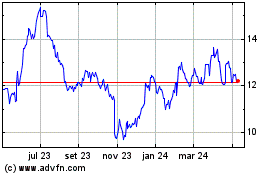

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024