Financials Down With Treasury Rates Despite Strong Earnings - Financials Roundup

17 Janeiro 2017 - 8:04PM

Dow Jones News

Banks, lenders and other financial companies fell sharply --

despite another round of strong earnings -- as interest rates slid.

Recent comments from President-elect Donald Trump about trade and

the dollar have caused traders to back off predictions of what the

president elect's economic policy will look like. As a consequence,

the run-up in Treasury yields -- and stocks -- has stalled. One

brokerage said the postelection rally could resume later in the

year, however. "The bullish sweet spot of Presidential Cycle Year 1

is March-July, which has an average gain of 7.86% (average

March-August rally of 11.15% for a first term President)," said

analysts at Bank of America Merill Lynch Global Research. "This

fits with the potential for a 10% melt-up in stocks and commodities

in the first half of 2017" after "wobbles" in January and February.

Morgan Stanley posted its best fourth-quarter results since the

financial crisis, helped by increased activity on its trading desks

and for its army of financial advisers. But shares of the bank and

other strong earners fell in a reaction that Carter Worth, chief

market technician for research firm Cornerstone Macro called

"classic...buy the rumor, sell the news" trading.

-Rob Curran, rob.curran@dowjones.com

(END) Dow Jones Newswires

January 17, 2017 16:49 ET (21:49 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

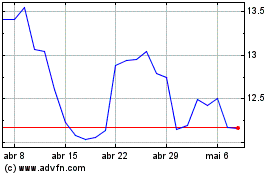

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

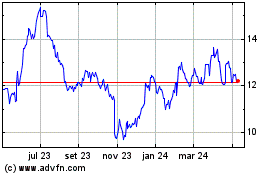

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024