ADRs End Mostly Higher; BT Trades Actively

24 Janeiro 2017 - 8:52PM

Dow Jones News

International stocks trading in New York closed up on

Tuesday.

The BNY Mellon index of American depositary receipts improved

0.28% to 130.89; the European index edged up 0.17% to 122.63; the

Asian index increased 0.52% to 149.24; the Latin American index

edged up 0.05% to 224.77; and the emerging markets index rose 0.82%

to 263.89.

BT Group PLC (BT, BT.A.LN) was among the companies with ADRs

that traded actively.

Alibaba Group Holding Ltd. (BABA) on Tuesday raised revenue

projections for the year and said it would step up investments to

expand its digital media and cloud businesses following strong

third-quarter results. Alibaba runs China's most popular e-commerce

websites Taobao and Tmall. ADRs rose 3% to $101.43.

One of Britain's oldest and best-known companies BT Group,

parent company of British Telecommunications, on Tuesday said it

had grossly underestimated the severity of an accounting scandal at

its Italian business. BT said it would take a GBP530 million ($661

million) write-down, more than three times its previous estimate,

for yearslong "improper" accounting practices and transactions in

Italy. In addition, it cut financial projections, citing a

deteriorating outlook for business from the British public sector

and international corporations. ADRs, which set a 52-week-low on

Tuesday, closed at $19.38, down 21% for the day.

HDFC Bank (HDB, 500180.BY), India's second-largest private

lender, reported quarterly profit rose 15% while gross bad loans

were at 1.05% of total advances, compared with 1.02% in the

previous quarter. ADRs rose 4% to $66.64.

Rio Tinto PLC (RIO, RIO.LN), capitalizing on last year's sharp

rally in commodity prices, sold a major piece of its coal business

to a Chinese company for $2.45 billion, the biggest move yet in the

British-Australian mining giant's move to shed its coal assets.

ADRs set a 52-week-high on Tuesday before closing at $45.70, up 4%

for the day.

Dutch health-technology company Royal Philips NV (PHG, PHIA.AE)

is in talks with the Justice Department over its defibrillator

business and said negotiations could result in a fine and have a

"meaningful impact on the operations of this business." While the

defibrillator business is relatively small, the issue adds to wider

concerns of Philips' operations in the U.S., its most important

market by sales. ADRs fell 2% to $29.35.

WPP PLC's (WPPGY, WPP.LN) global media investment arm GroupM

said Tuesday it agreed to increase its holding in MediaCom India to

become a majority stakeholder. ADRs rose 0.68% to $116.15.

(END) Dow Jones Newswires

January 24, 2017 17:37 ET (22:37 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

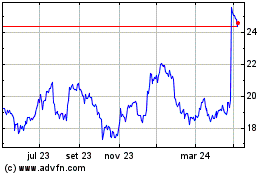

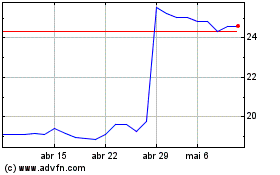

Koninklijke Philips NV (EU:PHIA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Koninklijke Philips NV (EU:PHIA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024