By Sarah Kent in London and Eric Sylvers in Milan

Royal Dutch Shell PLC's top executives last year were worried

that a controversial Nigerian oil deal may have violated a U.S.

Justice Department agreement with the Anglo-Dutch oil giant and

would spark an American probe, according to a recorded phone call

between the firm's chief executive and top finance officer at the

time.

The company is already under investigation in Italy, Nigeria and

the Netherlands for a $1.3 billion deal in 2011 with Italian oil

firm Eni SpA and the Nigerian government for a lucrative Atlantic

Ocean oil license known as OPL 245, according to Italian court

documents, Nigerian public records and a statement from the Dutch

prosecutor. The controversial oil block -- believed to contain

billions of barrels of crude -- is a valuable prize for the two

companies, which already pump huge volumes from oil-rich

Nigeria.

The Justice Department declined to comment.

Italian prosecutors are pursuing criminal charges against Shell

and Eni, saying in court records the companies knew the deal's

proceeds would be used to pay bribes in Nigeria. Shell and Eni said

Friday they paid the Nigerian government for the oil block but

didn't believe the money would ultimately be used for bribes. Court

documents allege the money went to various executives and Nigerian

government officials. An Italian judge has yet to rule on whether a

criminal trial will take place.

The phone call between Shell Chief Executive Ben van Beurden and

then-CFO Simon Henry opens a rare window into the private

conversations of the company's top executives and reveals how the

Nigeria bribery investigation has become a nagging worry. On the

call, they say they are speaking just hours after Dutch police

raided Shell's offices in The Hague in February 2016 as part of an

investigation into the deal.

In response to questions about the call, a Shell spokesman said

the company notified U.S. and U.K. authorities about the raid and

subsequently turned over the results of its own internal

investigation into the Nigerian oil deal to them. Shell said it is

cooperating with authorities but doesn't believe there is a basis

for the Italian prosecution. The company didn't dispute the

authenticity of the recording.

On the call, Mr. van Beurden told Mr. Henry that the company's

legal team conducting their own investigation had turned up

"unhelpful email exchanges" with "loose chatter" from Shell

employees about the Nigeria deal, according to a recording heard by

The Wall Street Journal that was provided by a person in possession

of the recording.

The emails, Mr. van Beurden said on the call, included "things

like 'Well, yeah, you know, I wonder who gets a payoff here' and

whatever."

BuzzFeed reported the call on Sunday.

Mr. van Beurden said on the call that he didn't believe

investigators had found anything incriminating, but he and Mr.

Henry wondered whether the Justice Department was working with the

Dutch police.

"Apparently it was judged to be, you know, just pub talk in

emails, which was stupid, but nevertheless, it's there," he told

Mr. Henry. Later in the call, Mr. van Beurden said Shell concluded

the U.S. wasn't involved in the Dutch raid.

Mr. van Beurden, who took over as CEO in 2014 and wasn't

involved in the OPL 245 deal, expressed concern that his

predecessors hadn't disclosed enough about the deal to the U.S.

Justice Department. The Justice Department had already investigated

Shell for Nigeria bribery allegations in a separate case and

entered a deferred prosecution arrangement with the company in 2010

requiring a $30 million criminal settlement and adherence to what

the Justice Department called "enhanced corporate compliance and

reporting obligations."

"We should have maybe at the time been more open with the DOJ

than we now find we have been," Mr. van Beurden said on the phone

call, referring to the bribery allegations arising from the

subsequent 2011 OPL 245 deal.

The U.S. has been a tough enforcer of anticorruption laws and

has used the Foreign Corrupt Practices Act to levy huge fines

against international companies.

The U.K.'s Serious Fraud Office wouldn't confirm or deny its

interest in the case. The Dutch Public Prosecutor said Sunday it is

working on a joint investigation with Italian authorities into

whether Shell bribed Nigerian officials, but wouldn't comment on

the Shell executives' conversation. Italian prosecutors didn't

respond to requests for comment.

Shell pursued the rights to OPL 245 for years before joining

with Eni to strike the complicated 2011 deal now under

investigation. Under the $1.3 billion arrangement, Eni put $1.1

billion into an escrow account for the Nigerian government.

In internal Shell emails obtained by nonprofit Global Witness

and reviewed by the Journal, Shell's executives and managers in

Africa show the deal was being structured so the government would

send the escrow money to a company called Malabu Oil and Gas, which

was linked to former oil minister Dan Etete, according to court

documents. The deal was intended to settle years of wrangling over

the block's ownership.

London-based Global Witness has conducted an investigation into

Shell's oil deal with Finance Uncovered, a group of investigative

reporters and campaigners. Italian prosecutors in court records say

Mr. Etete's company then used the money for bribes, with the

knowledge of the Nigerian government, Shell and Eni. Malabu

couldn't be reached for comment.

Nigeria's then-President Goodluck Jonathan "is motivated to see

245 closed quickly -- driven by expectations about the proceeds

that Malabu will receive and political contributions that will flow

as a consequence, " Shell manager Peter Robinson said in an August

2010 briefing sent to Malcolm Brinded, then head of exploration and

production.

Oil-industry corruption allegations helped lead to Mr.

Jonathan's defeat in 2015. Mr. Jonathan has previously denied the

bribery allegations in a statement. Attempts to reach Messrs.

Etete, Robinson and Brinded were unsuccessful.

"This is one of the worst corruption scandals the oil industry

has ever seen," said Simon Taylor, director of Global Witness.

--Aruna Viswanatha in Washington contributed to this

article.

Write to Sarah Kent at sarah.kent@wsj.com and Eric Sylvers at

eric.sylvers@wsj.com

(END) Dow Jones Newswires

April 10, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

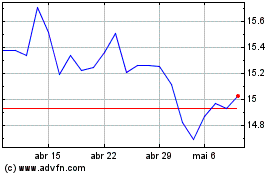

Eni (BIT:ENI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

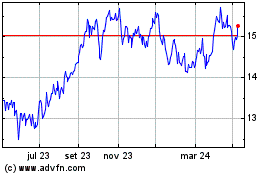

Eni (BIT:ENI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024