PPG Again Raises Bid for Akzo Nobel -- 2nd Update

24 Abril 2017 - 9:51AM

Dow Jones News

By Christopher Alessi and Austen Hufford

Paints giant PPG Industries Inc. on Monday again raised its

offer for Dutch rival Akzo Nobel NV, the U.S. firm's third takeover

attempt in a two-month long, unsolicited courtship.

PPG increased its offer price for Akzo to EUR96.75 ($105.07) a

share, up from its bid last month of EUR88.72 a share, valuing the

proposed transaction at roughly EUR24.6 billion. PPG's initial

approach at the start of March was at EUR83 a share.

Akzo confirmed in a statement Monday it had received PPG's

updated offer and would "carefully review and consider" the

proposal.

Pittsburgh-based PPG said the new bid values Akzo at a premium

of 24% over its closing price of EUR78.20 a share on April 21, the

last full day of trading before the revised offer.

That was just days after Akzo unveiled the details of a new

strategy to separate its specialty chemicals unit, which is part of

Chief Executive Ton Büchner's ongoing effort to ward off PPG.

Mr. Büchner has repeatedly refused to engage with PPG, calling

the first two takeover offers inadequate.

The company told investors on April 19 that it plans to pursue a

dual-track process to have the option to either spin off the

specialty chemicals business as a separate listed entity or sell it

outright, to be completed within the next 12 months.

Akzo's stock was up almost 5% on Monday.

The Dutch firm first announced last month that it planned to

separate the chemicals business, when it disclosed PPG's

interest.

Mr. Büchner said the "vast majority" of net proceeds from the

separation of the chemicals business would be returned to

shareholders. Pretax proceeds from the move could be roughly EUR8

billion, according to analysts.

Akzo said it is targeting increased shareholder returns and

plans to issue a EUR1 billion special dividend to shareholders in

November, with a 50% increase on the regular dividend to EUR2.5 a

share.

PPG's latest offer comes as Akzo is warding of an effort by some

of its largest investors, including activist investor Elliott

Management Corp., to push the Amsterdam-based company to engage in

negotiations with PPG.

Elliott earlier this month called for a special meeting of

Akzo's shareholders to try to oust the chairman of the supervisory

board. Akzo responded by saying it strongly supported Chairman

Antony Burgmans and would reject an agenda item seeking to dismiss

him.

The company hasn't yet said whether it would agree to hold the

extraordinary meeting.

Speaking with The Wall Street Journal last week, Mr. Büchner

said that unlike PPG's takeover proposal, his plan to separate the

specialty chemicals division and create value for shareholders

offers a "certainty of execution."

PPG said Monday that its most recent proposal "is vastly

superior to Akzo Nobel's new stand-alone plan."

The latest offer appeared to address some of Akzo's concerns

over how a takeover could impact its stakeholders, including

commitments to maintain Dutch jobs and a promise not to relocate

any of the Dutch firm's European Union production facilities to the

U.S.

"We think the revised offer will be very difficult for Akzo to

reject," analysts at Bernstein Bank wrote Monday. "We think the

most likely outcome is that Akzo grants PPG due diligence to enable

a slightly improved offer," they said.

Write to Christopher Alessi at christopher.alessi@wsj.com and

Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 24, 2017 08:36 ET (12:36 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

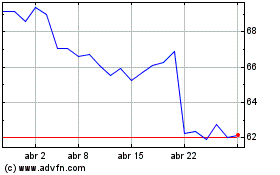

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024