Akzo CEO Exits Due to Health -- WSJ

20 Julho 2017 - 4:02AM

Dow Jones News

By Ben Dummett

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 20, 2017).

Dutch paint giant Akzo Nobel NV said Wednesday its chief

executive has resigned for health reasons, but that the company

remains on course to spin off its chemicals business to appease

shareholders after rejecting a $28 billion takeover bid from U.S.

rival PPG Industries Inc.

Ton Büchner's decision comes after a monthslong battle to fend

off both PPG's takeover attempt and an aggressive legal and public

relations campaign led by Elliott Management Corp., a U.S. activist

investor and one of Akzo's largest shareholders, to try to push the

company into sale talks.

Akzo didn't disclose the details of Mr. Büchner's health issues,

but said the executive believed that he would "endanger" his health

if he continued in the role.

"This is a very recent development -- this is not about weeks

ago, but is about days ago," Akzo Chairman Antony Burgmans told

reporters on a conference call Wednesday. In 2012, Mr. Büchner, 52

years old, took a leave of absence as chief executive for about two

months, citing fatigue.

Elliott -- which launched a legal challenge earlier this month

to remove Mr. Burgmans -- declined to comment on Mr. Büchner's

resignation.

Akzo is in the process of spinning off its specialty-chemicals

business from its paints-and-coatings operations, either through an

initial public offering or a sale. The Amsterdam-based company is

under pressure from shareholders to complete the deal, after

promising such a move would generate more value than selling itself

to PPG.

Thierry Vanlancker, the head of Akzo's chemicals business, has

been appointed as the company's new chief executive, and said he

has no plans to divert from the current strategy.

Mr. Vanlancker joined Akzo in 2016. He was previously a senior

executive for Chemours Co., a Wilmington, Del.-based chemicals

company spun off from DuPont Co. in 2015.

Pittsburgh-based PPG dropped its takeover bid for Akzo in June

after failing to initiate takeover talks despite proposing two

sweetened offers following an initial bid in March. Akzo, led by

Messrs. Büchner and Burgmans, rejected the offers as too low and

argued that completion of the tie-up was far from certain given the

complex and lengthy antitrust review a deal would likely face. The

company is betting that a spinoff of the chemicals business and a

plan to boost dividend payouts would generate more value.

Elliott had argued Akzo couldn't make that decision until first

determining if the company could negotiate a better deal through

negotiations with PPG.

In May, Elliott, which currently owns 9.5% of Akzo, lost an

initial legal battle in the Netherlands to try to remove Mr.

Burgmans. Elliott was betting then that Mr. Burgmans's removal

would pressure Akzo into sale talks with PPG. Even though PPG has

since dropped its bid, Elliott still wants the chairman removed

because of the board's handling of PPG's overture.

Earlier this month, it filed a joint petition to convene a

general meeting of shareholders to vote on Mr. Burgmans's

dismissal.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

July 20, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

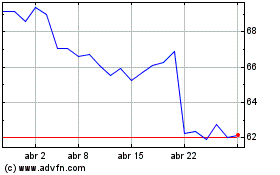

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024