By Covey E. Son

Walt Disney Co.'s decision this month to stream its own movies

and shows marks Hollywood's latest -- and biggest -- attempt to

wean itself from Netflix Inc.

In the shadow of Netflix's boom, smaller services have been

finding niche audiences who appreciate such genres as horror and

anime -- or themes such as British shows or automobiles -- but are

unsatisfied by mainstream general entertainment sources like

Netflix and Hulu.

None of these boutique sites, such as Shudder and Crunchyroll,

matches Netflix's sprawling library with thousands of popular

titles nor its subscriber base of 104 million, which

media-measurement firm comScore says represents 75% of U.S.

streaming-service viewers. Rather, they are seeking to stand out by

offering a hand-picked platter of content.

"Fans feel they can go deeper in contrast to a big service,

whether that's a broadcast network or a mass-market subscription

video service that's trying to have something for everyone," said

Christopher Vollmer, a partner at PricewaterhouseCoopers's

entertainment and media practice.

Some avoid the mainstream entirely. MUBI Inc. offers "arthouse

cinema" -- foreign films, independent films and classics. The

company shows just 30 films at any given time, with a new one added

and another removed each day. The closely held company has 100,000

subscribers who pay $4.99 a month, said MUBI director of content

Daniel Kasman.

Netflix isn't a direct competitor, Mr. Kasman said, and even

some of the most devout cinephiles often find themselves stumped by

MUBI's selection of obscure and unknown films. He and two other

curators frequently visit film festivals including Cannes and

Sundance to scout for new material, working directly with

filmmakers and small distributors to buy streaming rights.

Mr. Kasman said he seeks movies that are important to MUBI's

audience. "It can be something that touches you, expand your mind

or show you new places or new stories you've never thought of

before," he said. "It might be something that makes you laugh. It

might be a classic and a favorite of yours."

Then there's Brown Sugar, which bills itself as "just like

Netflix, only blacker," featuring a collection of 1970s films

starring black actors in lead roles, like "Shaft" and "Uptown

Saturday Night." Bounce TV, a broadcast network catering to a black

audience, launched Brown Sugar in November to celebrate the era in

which Hollywood started offering lead roles to black actors.

Bounce's parent company, Katz Broadcasting, which was acquired by

E.W. Scripps Co., didn't disclose subscriber figures for its

$3.99-a-month service.

Video streaming as a whole -- getting shows and movies on demand

via the web -- is soaring. Revenues tripled for subscription

video-on-demand since 2012 to over $8.2 billion last year,

according to a PricewaterhouseCoopers report. Netflix reported $5

billion in U.S. streaming revenue last year. PwC projects the

market will reach $14 billion in 2021.

Although Nextlix is expanding in genres such as children's fare,

reality TV and stand-up comedy specials, PwC's Vollmer said Netflix

wasn't likely to emphasize niche fare, but rather a "something for

everyone" approach.

That leaves room for others.

AMC Networks Inc., for example, dove into the horror market in

2105 with Shudder, a spooky-flicks-only streaming service. Its

selection ranges from the iconic "Friday the 13th" to lesser known

titles and foreign productions.

Matt Faure, a 44-year-old logistics professional in Redmond,

Wash., said he typically watches a movie a day on Shudder.

Mr. Faure said it's a different experience than browsing Netflix

for horror, where its selection is largely filled with newer, more

popular flicks. He likes those too, but he's more interested in

discovering the arcane and unknown, like a German film called

"Necromantic."

"I'm more impressed by somebody who reaches back and takes some

of the older and more obscure films," Mr. Faure said.

Services like Shudder offer value to fans who are less

interested in a broad selection of videos or something to

supplement their Netflix fare, PwC's Mr. Vollmer said. Shudder,

which declined to disclose its number of subscribers, costs about

$4.99 a month, compared to about $8 a month for Netflix.

Netflix declined to comment.

Crunchyroll, owned by a joint venture between AT&T Inc. and

Hollywood veteran Peter Chernin's Chernin Group, has become the

go-to anime streaming hub for a million paid subscribers who pay

$6.95 a month. In January, the company launched VRV, a service that

bundles Crunchyroll and other related subscription video services

together for "super fans" looking to save on their favorite

channels.

The Enthusiast Network, a trade-magazine publisher owned by

hedge fund GoldenTree Asset Management LP, sought to imitate

Crunchyroll with an "eight-figure bet" on Motor Trend On Demand in

2015, Chief Executive Scott Dickey said. Today, 100,000 gearheads

are subscribed for $4.99 a month or $49.99 a year. They come to the

channel for a dozen originally produced automobile shows and live

streams of racing events.

Earlier this month, the Enthusiast Network, known as TEN,

announced a joint venture with Discovery Communications Inc.

"We knew video was coming and it was coming fast and furious,"

Mr. Dickey said. "We had a really unique environment at TEN where

our core business was declining ... We had to place bets and we had

to place bets quickly."

(END) Dow Jones Newswires

August 18, 2017 05:44 ET (09:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

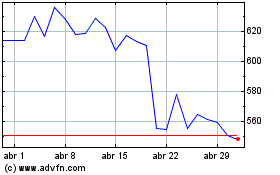

Netflix (NASDAQ:NFLX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

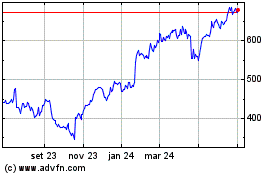

Netflix (NASDAQ:NFLX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024