BHP Billiton Again Holds CEO's Base Pay Steady

19 Setembro 2017 - 8:32PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--BHP Billiton Ltd. (BHP.AU) will hold the

base salary and targeted bonus packages of its chief executive and

top management unchanged this fiscal year, despite a sharp

turnaround in the resources giant's fortunes.

The annual base salary for CEO Andrew Mackenzie has again been

set at US$1.7 million, BHP said in its annual report, released

Wednesday. Mr. Mackzenzie's base pay hasn't changed since he

succeeded Marius Kloppers in 2013 and BHP set a sharply lower base

for its incoming boss than the almost US$2.22 million Mr. Kloppers

left on.

For the last year through June, Mr. Mackenzie's took home

slightly more than US$4.55 million in all, after the remuneration

committee opted to pay a short-term incentive of 86% of the

possible payout he could have received, in part to reflect a mining

fatality. That still marked a sharp jump on the US$2.24 million

paid the year before, when the CEO didn't receive a short-term

incentive following the fatal collapse of a dam at the Samarco

iron-ore venture in Brazil.

And while the company's overall financial performance improved

over the past year, it was below target mainly due to the impact on

production of a strike at the Escondida copper operation in Chile.

The company said it also considered Mr. Mackenzie's performance

against personal objectives, including productivity and capital

spending improvements and an acceleration of diversity targets.

BHP, the world's largest listed miner, said that in line with

the approach for Mr. Mackenzie, the base salaries and total target

remuneration packages for all senior managers will be held steady

this fiscal year.

Carolyn Hewson, chairman of BHP's remuneration committee, said

there had been various proposals put forward by some shareholders

and other groups to consider alternative remuneration arrangements,

particularly in the U.K., but there was no consensus. A recent

review by the company confirmed the current approach was

appropriate but Ms. Hewson said the committee would consider ways

to simplify remuneration while ensuring it remains able to offer

competitive pay packages.

With a strong improvement in commodity prices and after a

continued focus on cutting costs, BHP recorded a net profit of

US$5.89 billion in the 12 months through June against a

year-earlier loss of US$6.39 billion, when BHP absorbed an

impairment hit on its onshore U.S. oil-and-gas business and a

charge for the 2015 dam failure at Samarco.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

September 19, 2017 19:17 ET (23:17 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

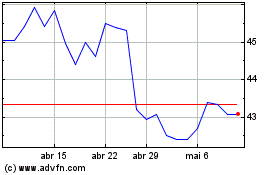

BHP (ASX:BHP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

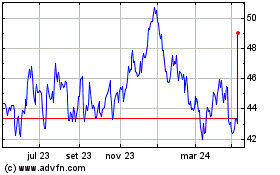

BHP (ASX:BHP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024