BNP Paribas to Stop Financing Shale, Oil Sands Projects

11 Outubro 2017 - 11:30AM

Dow Jones News

By Noemie Bisserbe and Sarah Kent

PARIS -- French lender BNP Paribas SA said Wednesday it will no

longer finance shale and oil sands projects, in one of the clearest

signs yet the banking industry is re-evaluating its relationship

with the oil sector amid mounting pressure from investors and top

financial institutions.

France's largest listed bank said it would stop working with

companies whose main business is the exploration, production,

distribution or marketing of oil and gas from shale or oil sands.

BNP Paribas won't finance oil or gas projects in the Arctic region

either, the bank said.

"These measures will lead us to stop financing a significant

number of players that don't further the transition toward an

economy that emits less greenhouse gas," BNP Paribas chief

executive Jean-Laurent Bonnafé wrote in a post on LinkedIn

published Wednesday.

BNP Paribas is one of the first banks to eschew parts of the oil

sector. Many governments are taking steps to curb emissions and

investors have been increasing pressure on companies over their

environmental footprints.

Earlier this year, a panel of top financial institutions and

companies led by Michael Bloomberg published a series of guidelines

pushing for companies to disclose more about the impact of climate

change on their businesses.

"I think personally the writing is on the wall over the

medium-term for the most carbon-intensive fossil fuels," said Mark

Lewis, a member of the panel. It is backed by the Financial

Stability Board, a body that makes recommendations to the Group of

20 nations about financial regulation and policy.

"The banks will adapt like all other companies to changing

economics and changing investor preference," Mr. Lewis added.

Exxon Mobil Corp. faced a shareholder revolt this spring as

investors ignored management recommendations and voted in favor of

a resolution calling for more information on how climate change and

regulation could affect the company.

Still, there is little sign that the industry is facing

difficulty raising money. The shale oil sector has boomed over the

last three years, despite a steep drop in oil prices. Most shale

developments are in the U.S. where the Trump administration has

rolled back tougher environmental regulation. U.S. companies also

have access to a deep pool of investors and banks.

BNP Paribas has already made moves to reduce its financing of

coal mines and coal-fired power plants and expand its investment in

renewable energy. Earlier this year, BNP Paribas said it won't

finance coal energy sector companies that aren't seeking to

diversify their energy sources.

Weeks before the COP21 climate change conference in Paris in

December 2015, the bank pledged to increase total financing for

renewable energy to 15 billion euros ($17.7 billion) and set aside

EUR100 million for investment in startups working on solutions for

energy transition.

It is now turning its back on some of the more contentious parts

of the oil sector. Oil from tar sands like those in Canada have

long faced criticism because of their high carbon intensity

compared with more conventional oil sources. Many large oil

producers like Royal Dutch Shell PLC have sold oil sands assets in

recent years as falling prices made their economics less

attractive.

Extraction of shale oil and gas has also faced wide-ranging

concerns about its environmental impact and the technique of

extracting oil and gas by fracking has been banned in parts of

Europe, including France.

A BNP Paribas spokeswoman declined to comment on the bank's

exposure to shale and oil sands projects, but analysts estimate

that it is limited.

The bank's credit risk exposure to energy excluding electricity

was of EUR30.4 billion as of December 31, 2016, according to

corporate filings.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com and Sarah

Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

October 11, 2017 10:15 ET (14:15 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

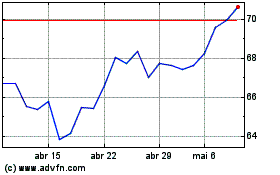

BNP Paribas (EU:BNP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

BNP Paribas (EU:BNP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024