Wal-Mart Nears Web Deal with Lord & Taylor

19 Outubro 2017 - 9:29AM

Dow Jones News

By Suzanne Kapner and Sarah Nassauer

Wal-Mart Stores Inc. has a solution for retailers doing battle

with Amazon.com Inc.: join forces to give shoppers an

alternative.

The world's biggest retailer is near a deal with Lord &

Taylor that would give the department store dedicated space on

walmart.com, according to a person familiar with the matter. Such

an agreement would be the first step in creating an online mall

that shoppers could access from Walmart's website, this person

said.

Additional brands that could eventually be included in the

project are men's clothing company Bonobos and online retailer

Jet.com, both of which are owned by Wal-Mart, as well as other

traditional chains, this person said. Financial terms of the

potential Lord & Taylor partnership couldn't be learned.

Wal-Mart is seeking to build an anti-Amazon coalition as it

begins to ramp up e-commerce sales after several years of sluggish

growth. Last year Wal-Mart bought Jet, placing its founder Marc

Lore at the head of U.S. e-commerce operations. Then Wal-Mart made

a series of smaller e-commerce purchases including Moosejaw,

Bonobos and ShoeBuy, both to expand its online selection and gain

give it access to brands built online, executives have told

investors.

Now Wal-Mart aims to make walmart.com more attractive to premium

brands and high-income shoppers, an area Amazon has also pursued in

recent years.

Over the next year, Wal-Mart wants to "elevate the Walmart.com

brands," Mr. Lore said last week. The changes include using blue

branded boxes to ship walmart.com orders, redesigning the website

and working on partnerships to gain access to more premium

products, Mr. Lore said.

Last month, Wal-Mart said Denise Incandela will become its head

of fashion for U.S. e-commerce. Ms. Incandela was most recently

chief executive of shoe company Aerosoles and is the former

president of digital for Ralph Lauren and chief marketing officer

for Saks Fifth Ave.

Amazon has made an aggressive push in recent years to win over

fashion brands. It scored a coup in June when Nike Inc. agreed to

sell some of its products directly to the e-commerce company, and

over the years it has reached agreements with department store

stalwarts such as Calvin Klein, Kate Spade and Levi Strauss.

Amazon has also extended its reach into physical stores, buying

grocer Whole Foods, and striking a deal with department store

Kohl's Corp. that lets shoppers return goods bought on Amazon at 82

Kohl's locations.

Wal-Mart is framing itself as the only e-commerce operation that

will be able to challenge Amazon directly, despite the fact that

its website draws about half as many monthly U.S. visitors,

according to the research firm comScore.

"Wal-Mart is positioning itself as a clear No. 2 in the space,"

said another person familiar with the discussions.

Like other department store chains, Lord & Taylor, which is

owned by Hudson's Bay Co., is struggling with sluggish sales and

falling foot traffic. Sales at Hudson's Bay's department store

group, which includes Lord & Taylor, fell 1.6% in the three

months to July 29.

Joining with Wal-Mart would help draw shoppers to Lord &

Taylor's website, which attracted an average of 849,000 unique

monthly U.S. visitors from February through July, according to

comScore. That compares with 160 million for Amazon.com and about

79 million for Wal-Mart.com.

Smaller brands and retailers are wrestling with how to balance

exclusivity with the need to grow online as Amazon and Wal-Mart get

bigger, said Roshan Varma, vice president in the retail practice at

AlixPartners. "It's a little bit of a prisoner's dilemma. Are you

going to defect or stay on your own?"

Higher-end brands have shied away from joining with Wal-Mart

because of its discounter roots. But several brand executives said

they need to rethink their distribution models to compete in a

world increasingly dominated by Amazon.

Lord & Taylor will continue to operate its own website. In

the future, shoppers ordering from lordandtaylor.com would be able

to pick up and return items at Wal-Mart's 4,700 U.S. retail stores,

the person said. Wal-Mart executives said in recent weeks the

company is working to allow returns from third-party online sellers

at U.S. stores.

The department-store chain will own the inventory and fulfill

orders from the site. "The only difference," said a person familiar

with the plan, "is that it happens to be on walmart.com."

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Sarah

Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

October 19, 2017 07:14 ET (11:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

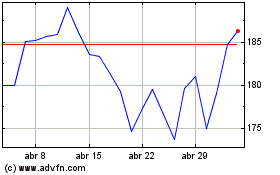

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

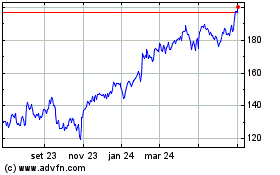

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024