Preview -- Barron's

07 Abril 2023 - 11:00PM

Dow Jones News

Tuesday 4/11

Albertsons and CarMax report quarterly results

Moderna hosts a virtual investor conference to discuss its

vaccine development.

The National Federation of Independent Business releases its

Small Business Optimism Index for March. The consensus estimate is

for a 89.9 reading, about one point lower than in February. The

index remains well below historical averages as small-business

owners struggle with labor shortages. In February, 47% of owners

reported job openings that were hard to fill, a very high

level.

Wednesday 4/12

ConocoPhillips holds its 2023 analyst and investor meeting.

The Federal Open Market Committee releases the minutes from its

late-March monetary-policy meeting.

The Bank of Canada announces its monetary-policy decision. The

central bank is expected to keep short-term interest rates

unchanged at 4.5%. The BOC has raised rates by 4.25 percentage

points since last March, and traders are now betting that the

terminal, or peak, rate for this hiking cycle is already in.

The Bureau of Labor Statistics releases the consumer price index

for March. Expectations are for the CPI to be up 5.2%, year over

year, after increasing 6% in February. The core CPI, which excludes

volatile food and energy prices, is seen edging up to 5.6%, from

5.5%. The FOMC has stressed that it is particularly important to

see moderation in core services inflation, excluding housing, which

rose 6.1% in February.

Thursday 4/13

Delta Air Lines and Fastenal hold conference calls to discuss

their earnings.

The BLS releases the producer price index for March. Economists

forecast that the PPI will increase 3.1% from its level a year

earlier, while the core PPI will be up by 4.3%. This compares with

gains of 4.6% and 4.4%, respectively, in February. A 3.1% rise

would be the lowest since February 2021.

Friday 4/14

BlackRock, PNC Financial Services Group, and UnitedHealth Group

announce quarterly results.

The Census Bureau reports retail sales data for March. The

consensus call is for consumer spending to decline 0.3%, month over

month, to $696 billion. Excluding autos, retail sales are expected

to fall 0.2%, compared with a 0.1% decrease in February.

The University of Michigan releases its consumer sentiment index

for April. Economists forecast a 64 reading, two points more than

in March, but a historically low figure. In March, consumers'

expectations of the year-ahead inflation was 3.6%, the lowest level

since April 2021.

To subscribe to Barron's, visit

http://www.barrons.com/subscribe

(END) Dow Jones Newswires

April 07, 2023 21:45 ET (01:45 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

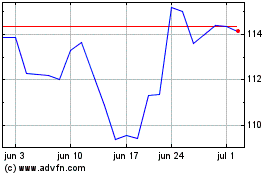

ConocoPhillips (NYSE:COP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

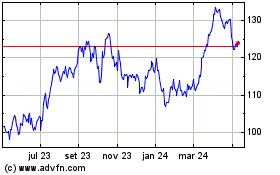

ConocoPhillips (NYSE:COP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024