FREE WRITING PROSPECTUS

Filed pursuant to Rule 433

Registration Statement No.

333-202409

Strengthening our balance sheet, repositioning the opportunity

IBDROOTPROJECTSIBD-LNFRACTION2015585460_16. Presentations2016.02.08—Roadshow PresentationProjectRose_investorpresentation_V7 160204 speakernotes.pptx

General disclaimer

For readers in the European Economic Area

This

presentation does not constitute an offer to sell, or the solicitation of an offer to buy or subscribe for, any securities of ArcelorMittal within the meaning of Luxembourg law and/or the laws

of any other member state of the European Economic Area. This document does not constitute a prospectus within the meaning

of EC Directive 2003/71/EC of the European Parliament and of

the Council dated 4 November 2003, as

amended (the _Prospectus Directive_), which expression includes any relevant implementing measure in the member state concerned, and should not

be the basis for any agreement or decision to invest. The Company has not made any final decision whether to proceed with any offering of securities or to admit new securities to trading

on a

regulated market. Any such offering or new admission will be based exclusively on a prospectus prepared

for that purpose. Further, ArcelorMittal has not authorized any offer to the public of

securities in any

member state of the European Economic Area that has implemented the Prospectus Directive, other than Luxembourg, the Netherlands, France and Spain, (each, a

_Relevant Member State_). With respect to each Relevant Member State, no action has been undertaken or will be undertaken to make an offer to the public of securities requiring publication

of a prospectus in any Relevant Member State. Should an offering or new admission of subscription rights and

new shares be conducted, as is currently planned, in Luxembourg, the

Netherlands, France and Spain, a

securities prospectus will be produced, which is to be published following its approval by the Luxembourg supervisory authority for the financial sector

(Commission de Surveillance du Secteur Financier CSSF) and after it has been passported into the Netherlands, France and Spain subsequent to notification having been given to the

competent regulatory authorities in those jurisdictions. Any decision to purchase, subscribe for or otherwise

acquire any subscription rights or new shares of the Company must be made only

on the basis of the information

in a securities prospectus (if published in due course by the Company), which will then be available for download on the internet site of ArcelorMittal

(www.arcelormittal.com). Copies of the prospectus will then also be readily available upon request and free of charge at 24-26, boulevard d’Avranches, L-1160 Luxembourg, Grand-Duchy

of

Luxembourg.

In each Relevant Member State this communication is only addressed to, and directed at, qualified investors in that Relevant Member State within the meaning of the Prospectus Directive.

This presentation contains advertising materials in connection with the Offer as referred to in the Market

Abuse Directive 2003/6/EC and implementing laws and regulations.

For readers in the United Kingdom

This communication is only being distributed to, and is only directed at, (i) persons who are outside the United

Kingdom or (ii) investment professionals falling within Article 19(5) of the

Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005 (the _Order_) or (iii) high net worth companies, and other persons to whom it may lawfully be communicated, falling

within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as _relevant persons_). The subscription rights and new shares are only available to, and any

invitation,

offer or agreement to subscribe for, purchase or otherwise acquire such subscription rights or new

shares will be engaged in only with, relevant persons. Any person who is not a relevant

person should not act

or rely on this document or any of its contents.

For readers in the United States

ArcelorMittal has filed a registration statement (including a prospectus) with the United States Securities and Exchange

Commission (the _SEC_) for the offering to which this communication

relates. Before you invest, you should

read the prospectus in that registration statement, the supplement to that prospectus ArcelorMittal expects to file with the SEC and other documents

ArcelorMittal has filed and will file with the SEC for more complete information about ArcelorMittal and this offering. You may get these documents, once filed, free of charge by visiting

EDGAR

on the SEC Web site at www.sec.gov. Alternatively, ArcelorMittal, any underwriter or any dealer

participating in the offering will arrange to send you the prospectus after filing if you request it

by

writing or telephoning ArcelorMittal at ArcelorMittal USA LLC, 1 South Dearborn Street, 19th Floor, Chicago, IL 60603, Attention: Ms. Lisa M. Fortuna, Manager, Investor Relations,

telephone number: (312) 899-3985.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION DIRECTLY OR INDIRECTLY IN OR INTO CANADA, AUSTRALIA, JAPAN OR ANY OTHER JURISDICTION IN WHICH TO DO SO WOULD BE PROHIBITED BY APPLICABLE LAW

1

IBDROOTPROJECTSIBD-LNFRACTION2015585460_16. Presentations2016.02.08—Roadshow PresentationProjectRose_investorpresentation_V7 160204 speakernotes.pptx

Forward-looking statements

This presentation may contain forward-looking information and statements about ArcelorMittal and its subsidiaries. These statements include

financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and

expectations with respect

to future operations, products and services, and statements regarding future

performance. Forward-looking statements may be identified by

the words

_believe, expect, anticipate,

target_ or similar expressions. Although ArcelorMittals management believes that the

expectations reflected in

such forward-looking statements are reasonable, investors and holders of ArcelorMittals securities are cautioned

that forward-looking information and statements are subject to numerous risks and uncertainties, many of which are

difficult to predict and

generally beyond the control of ArcelorMittal, that could cause actual results and

developments to differ materially and adversely from those

expressed in, or implied or projected by, the

forward-looking information and statements. These risks and uncertainties include those

discussed or

identified in the filings with the Luxembourg supervisory authority for the financial sector (Commission de Surveillance du

Secteur Financier CSSF) and the United States Securities and Exchange Commission (the _SEC_) made or to be made by ArcelorMittal,

including ArcelorMittals latest Annual Report on Form 20-F filed with the SEC. ArcelorMittal undertakes no obligation to

publicly update its

forward-looking statements, whether as a result of new information, future events, or

otherwise.

2

Overview

$4bn net debt reduction through $3bn

capital increase and $1bn

asset sale

All segments of the business FCF positive at current spot steel

spreads

Pro forma net debt at December 31,

2015 reduced to <$12bn / 2.2x

2015 EBITDA

Opportunities to deliver c.$3bn EBITDA improvement and >$2bn free

cash flow at current steel spreads by 2020

Executing strategy to deliver value to shareholders

3

Global presence, industry leading product portfolio and

continuous investment

Worlds leading steel and

mining company

Developed markets are core

Low cost assets…. well positioned on global cost curve

Optimized asset base in Europe

next comes the US footprint optimization

Primary

position in premium grades & global automotive

supported by industry leading R&D capability with

12 major research

centres globally

Capacity to capitalize on demand recovery

Roadmap

to achieve annual FCF of $2bn by 2020 (at current spreads)

ArcelorMittal is the world leading global steel

company positioned to deliver value to shareholders

4

Cost competitive assets capable of generating positive FCF through the cycle

Reduced by $6.1bn since year end 2012¹; reduction is $10.1bn post today’s

Net Debt announcements

Interest expense reduced

by $0.6bn since 2012

$2.5bn² of proceeds from non-core asset disposals and strategic partnerships

Portfolio Closure / idling of non-performing assets (e.g. South Africa, Spain, US)

Optimization

Highgrading assets in core markets including acquisition of Calvert

Successfully implemented capacity rationalization program in Europe,

Cost Cutting delivering savings of >$1bn per annum

$3bn management gains program completed

Capex Cut

by $2.0bn since 2012

Dividends Suspended in 2015

Significant actions to de-lever and optimize the portfolio prior to today’s announcement

¹ Reported net debt at year end 2015 of $15.7 billion.

² Since end 2012; total asset sales proceeds since 4Q11 total $5.2 billion; this excludes $1 billion proceeds from

the sale of Gestamp announced February 5, 2016.

5

Positive industry signals

Supply side reforms in

China

Capacity is finally exiting in 2015

New _Industry Structure Reform Fund_ to provide social

support

Supply side reform will continue given unsustainability

Steel price recovery

Stabilization of price

environment brings an end to

destocking cycle

Steel spreads currently recovering in all key markets

Encouraging demand outlook

Positive real demand growth in core developed markets

continues

US ASC in 2016 will likely be boosted

by end of destocking

cycle

European demand remains positive

Policy actions

in China combined with improving market conditions support medium term outlook

China steel spreads ($/t)1

159

146

132 +34%

125

117

87 93

2013 2014 1Q15 2Q15 3Q15 4Q15 Current*

US steel

demand: Apparent (ASC)2 vs. Real (RSC)

ASC RSC 108 104 100

96

2013 2014 2015 2016F

Policy actions in China

combined with improving market conditions support medium term outlook

Source: Mysteel, CU Steel, Broker

Research, Factiva

1. $/t differential between China HRC domestic price ex VAT and international Raw Material

Basket (Raw Material Basket for HRC = 1.6 X IO (delivered to China)+ 0.6 X HCC (delivered to China)+ 0.15 X Scrap ( HMS 1/2 80:20 / East Asia import); *Current data Jan 29

2. ASC refers to apparent steel consumption; RSC refers to real steel consumption —the difference between ASC and RSC represents the change in inventory

6

2015 performance highlights

EBITDA: FY15 EBITDA

of $5.2bn vs. $7.2bn in FY14

Steel performance: primarily impacted by low steel selling prices

Mining costs performance exceeding targets: FY15 unit cash costs reduced by 20% YoY;

exceeding the 15% target for 2015

Net loss¹driven by impairments, exceptional charges and non-cash forex

Liquidity improved: $10.1bn as of December 31, 2015

Deleveraging targets on track: Year end net debt of $15.7bn lowest level post merger

(USDm) unless otherwise shown 4Q’15 3Q’15 4Q’14 FY15 FY14

Iron ore shipments market price (Mt) 9.9 10.3 9.9 40.3 39.8

Steel shipments (Mt) 19.7 21.1 21.2 84.6 85.1

Sales 13,981 15,589 18,723 63,578 79,282

EBITDA 1,103 1,351 1,815 5,231 7,237

Net (loss) /

income(6,686)(711)(955)(7,946)(1,086)

Adjusted net (loss) / income(375)(75) 142(333) 372

EBITDA impacted by low steel selling prices

1 FY 2015 net loss of $7.9 billion includes $4.8 billion of impairments and $1.4 billion of exceptional charges primarily related to the write-down of inventory following the rapid decline

of international steel prices. 7

Further reduction in cash requirements expected in 2016

$1bn reduction in cash requirements

expected in

2016 vs. 2015:

Capex: $0.3bn saving1

Cash taxes: $0.1bn saving

Dividend suspended:

$0.4 saving

Cash interest: $0.2bn saving2

Capex (US$bn)

-2.3

4.7

3.5 3.7

2.7 2.4

2012 2013 2014 2015 2016F

Net interest expense (US$bn)

-0.8

1.9 1.8

1.5 1.3 1.1

2012 2013 2014 2015

2016F

All segments FCF positive at current spot steel and raw material prices

1 At spot FX rates

2 From net debt reduction and lower cash interest costs following maturity of Mandatory Convertible Notes on January 15, 2016

These statements are forward-looking, are subject to significant business, economic, regulatory and competitive

uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may

be material. For discussion of some of the important factors that could cause these variations, please consult the _Risk Factors_ section of the Companys latest Annual Report on Form 20-F on file with SEC. Nothing in this presentation should be

regarded as a representation by any person that these objectives will be achieved and the Company undertakes no duty to update its objectives.

8

Gestamp sale unlocks c.$1bn of value

Sale of 35%

stake in Gestamp for €875 million to the majority shareholder,

the Riberas family

Gestamp is a privately held entity involved in stamping, assembly and

welded blanks for automotive original equipment manufacturers (OEMs)

The sale of our stake in Gestamp unlocks substantial value for

ArcelorMittals shareholders and is consistent with our stated strategy of

stated strategy of portfolio optimization

Our strategic and preferred supplier relationship with Gonvarri and

Gestamp is unaffected and we will continue to work together to supply

automotive OEMs with world-class automotive steel products

ArcelorMittal will continue to have a board presence in Gestamp,

collaborate in automotive R&D and remain its major steel supplier

This sale has no impact on Group EBITDA; share of JV and associates

income will decline by ~$50m per annum and we will no longer receive a

dividend (~$15m in 2015)

Gestamp sale proceeds of

c.$1bn with zero EBITDA impact and de minimis cashflow impact

9

Actions to right-size the balance sheet

Near-term

actions to reduce net debt¹ to <$12bn Liquidity remains strong

Net debt /

EBITDA 3.0x 2.8x 2.2x

2015A 15.7 14.1

14.7 1.0 Gestamp proceeds

3.0 Capital

(1.0) 11.7 raise

7.6

(3.0) Unutilized

6.0 credit lines

5.0

Cash on

4.1 balance 2015YE sheet

as of

2015A c.$1bn 2015A Net debt $3.0bn Capital 2015A Net debt Liquidity 2016—2018 Debt 2019-2020 Debt

Net debt Gestamp pro-forma raise pro-forma capital Maturities 2 Maturities

proceeds Gestamp raise and

proceeds Gestamp

proceeds

Capital raise right-sizes balance sheet; pro-forma leverage substantially reduced

1 Net long-term debt, plus short term debt, less cash and cash equivalents, restricted cash and short-term investments

(including those held as part of asset/liabilities held for sale)

2 Includes $2.3bn debt maturing in 2016,

$2.7bn maturing in 2017 and $2.6bn of debt maturing in 2018.

10

_Action 2020_ plan to achieve significant improvement1

(EBITDA/T)

Includes $1bn2 transformation plan

which involves _clustering_ sites to 90Mt

gains further optimise, HAV mix and volume >85/t1 shipments

1

Includes US footprint optimisation

($250mn)2 ,

Calvert ramp-up

($250mn)2 and HAV mix 12

Brazil Value plan including

HAV mix, and domestic

volumes recovery

9

Improved competitiveness of CIS

operations 4

AMSA competiveness plan including 8

new iron ore supply agreement

4 4

Action 2020 plan is incremental to

continuing management gains efforts

which seek to

offset inflation and

industry improvement efforts

2016 ACIS BANC NAFTA Europe Mining 2020

Action 2020 plan designed to take annual FCF generation to >$2bn

with further upside potential through spread recovery

1 At current prevailing steel spreads; 2 Indicative amounts constituting management objectives. Subject to forward looking statements note below. Note: HAV refers to higher value added

These statements are forward-looking, are subject to significant business, economic, regulatory and

competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and

are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the

important factors that could cause these

will variations, be achieved please and consult the Company the _Risk

undertakes Factors_ section no duty of to the update Companys its objectives. latest Annual Report on Form 20-F on file with SEC. Nothing in this presentation should be regarded as a representation by any person that these objectives 11

Summary

4bn net debt reduction through $3bn

capital and $1bn asset sale augments

previous actions to reduce cash flow requirements to below $4.5bn per

annum

All segments of the business FCF positive at current spot steel spreads

Pro forma net debt at 31/12/15 reduced to <$12bn / 2.2x 2015 EBITDA. Company

will restart dividend distribution once ND/EBITDA is <2x

New opportunities to deliver c.$85/t EBITDA and >$2bn free cash flow at current

steel spreads by 2020

Executing strategy to deliver value to shareholders

12

Indicative terms of the proposed rights offering

Capital increase with preferential subscription rights (structured as a non-statutory rights offering) to ArcelorMittal

shareholders

Structure of the offering Oversubscription privilege to ArcelorMittal shareholders

Rump placement for remaining unsubscribed new shares

Offer size c.$3.0bn (will correspond to the value in Euros of such amount at time of launch)

Terms Issue price (in Euro) and subscription ratio to be determined upon launch

Public offering in Luxembourg, the Netherlands, France, Spain and in the US

Distribution SEC registered offering in the US

International offering to qualified investors elsewhere

Equity issuance and asset sale. (Gestamp) proceeds would reduce net debt to below $12bn at 31/12/15 representing 2.2x 2015 pro forma

Use of proceeds EBITDA

Investment vehicles held by the Mittal Family will take up their pro-rata entitlement (c.$1.1bn)

Subscription undertaking

and underwriting

ArcelorMittal has entered into a standby underwriting commitment with Goldman Sachs International, BofA Merrill Lynch and Credit Agricole

Corporate and Investment Bank, acting as Joint Global Coordinators, for the remaining c.$1.9bn, subject to customary conditions

Lock-up 180 days for ArcelorMittal and the Mittal Family from closing

Board of Directors held on February 3, 2016

Legal authorizations and

timing The Company will

convene an EGM (30-day notice) to obtain the necessary authorisations.

The rights offering will be launched on

the back of the EGM, subject to market conditions

Preferential subscription rights and new shares expected to

be admitted to trading on the Luxembourg Stock Exchange, Euronext Paris,

Trading Euronext Amsterdam, the

Spanish Stock Exchanges and the NYSE

13

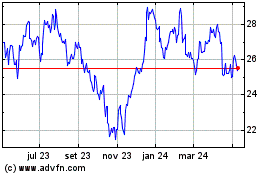

Arcelor Mittal (NYSE:MT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

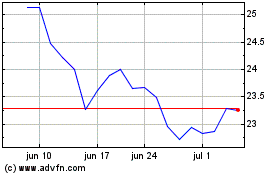

Arcelor Mittal (NYSE:MT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024