Report of Foreign Issuer (6-k)

15 Junho 2017 - 7:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2017

Commission File Number: 001-34476

BANCO SANTANDER (BRASIL) S.A.

(Exact name of registrant as specified in its charter)

Avenida Presidente Juscelino Kubitschek, 2041 and 2235

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

N/A

BANCO SANTANDER (BRASIL)S.A.

CNPJ No. 90.400.888/0001-42– NIRE 35.300.332.067

Publicly-Held Company with Authorized Capital

NOTICE TO THE MARKET

BANCO SANTANDER (BRASIL) S.A.

hereby announces to its stakeholders and the market that, jointly with Banco do Brasil S.A., Banco Bradesco S.A., Banco Itaú S.A. and Caixa Econômica Federal, through its subsidiary Caixa Participações S.A. (hereinafter jointly referred to as “

Parties

”), executed on this date the definitive documents necessary to the incorporation of the company Gestora de Inteligência de Crédito S.A. (“

Company

”). The Company’s control shall be shared between the Parties, whereas each one on them shall hold 20% of its corporate capital. The Company’s Board of Directors shall solely consist of members indicated by the Parties and the Company’s Officers shall have exclusive dedication to the business, thereby preserving its independent administration. As per informed in the Notice to the Market published on 01.21.2016, the Company shall develop a data base aiming to aggregate, reconcile and handle registration data and credit information of individuals and legal entities in accordance with the applicable law. Such activity shall allow, through deeper knowledge of the profile of such individuals and legal entities, a significant enhancement on the process of granting, pricing and directing of the lines of credit handled by the entities participants of the Brazilian National Financial System (

Sistema Financeiro Nacional

), therefore resulting on a better credit ambient in the country as from a medium and long term perspective. The Parties estimate that the Company shall be fully operation by 2019.

The incorporation of the Company reaffirms our trust in the future of Brasil and its credit market, creating conditions to a more solid and sustainable market.

São Paulo, June 14

th

, 2017

Angel Santodomingo

Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: June 14, 2017

|

Banco Santander (Brasil) S.A.

|

|

|

|

|

|

By:

|

/

S

/

Amancio Acurcio Gouveia

|

|

|

|

Amancio Acurcio Gouveia

Officer Without Specific Designation

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/

S

/

Angel Santodomingo Martell

|

|

|

|

Angel Santodomingo Martell

Vice - President Executive Officer

|

|

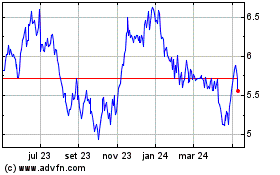

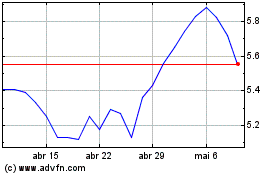

Banco Santander Brasil (NYSE:BSBR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Banco Santander Brasil (NYSE:BSBR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024