UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2017

Commission File Number: 001-34476

BANCO SANTANDER (BRASIL) S.A.

(Exact name of registrant as specified in its charter)

Avenida Presidente Juscelino Kubitschek, 2041 and 2235

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

N/A

1.

Message from the Chairman of the Board of Directors

Dear Shareholders,

I am very pleased to invite you, shareholder of Santander Brasil, to participate of the Extraordinary General Meeting (“EGM”) of Santander Brasil, called for July 20

th

, 2017 at 3 p.m., at the Company’s head office located at Avenida Presidente Juscelino Kubitschek No. 2041 and 2235 – Vila Olímpia, São Paulo – State of São Paulo.

This Manual

for Participation in General Meetings (“

Manual

”), an example of a sustainable relationship practice with you, our shareholder,

aims to assist you on the comprehension of the presented matters, for the taking of decisions, anticipating relevant clarifications and voting orientations.

Pursuant to the Call Notice turned available, we shall take resolutions on the following matters:

(I)

To FIX the number of members that will compose the Board of Directors in the mandate from 2017 to 2019;

(II)

To ELECT new member to compose the Company´s Board of Directors; and

(III)

Due to deliberate in the previous items, to CONFIRM the composition of the Company’s Board of Directors.

The description and respective justifications of the matters included in the Agenda of this Meeting are set forth in the Manual for Participation in General Meeting.

In order to facilitate your analysis and appreciation of the matters to be resolved in the EGM, we attached as exhibits to this Manual all documents related to the matter of the Call Notice into the form of exhibits to this Manual, in attention to the CVM requirements.

Please read this carefully. We are at your disposal to clarify any doubts through our emails

acionistas@santander.com.br

for individual investors and non-financial entities and

ri@santander.com.br

for institutional investors

.

We hope that this Manual will fulfill its purpose of assisting you with clarification on the matters to be resolved. Your participation in this important event is essential for the Company.

Very truly yours,

Álvaro Antônio Cardoso de Souza

Chairman of the Board of Directors

2.

Call Notice

to be published in the Diário Oficial do Estado de São Paulo (São Paulo State Gazette) and in Valor Econômico on June 20, 21 and 22, 2017.

BANCO SANTANDER (BRASIL) S.A.

Public-Held Company with Authorized Capital

Corporate Taxpayer ID (CNPJ/MF) 90.400.888/0001-42

Company Registration (NIRE) 35.300.332.067

CALL NOTICE

-

EXTRAORDINARY GENERAL MEETING -

The shareholders are hereby called to attend the Extraordinary General Meeting to be held on July 20

th

, 2017, at 3 p.m. at the Company’s head office, located in the City of São Paulo, State of São Paulo, at Avenida Presidente Juscelino Kubitschek nº. 2.041 and 2.235, Vila Olímpia, to resolve on the following Agenda:

(I)

To FIX the number of members that will compose the Board of Directors in the mandate from 2017 to 2019;

(II)

To ELECT new member to compose the Company´s Board of Directors; and

(III)

Due to deliberate in the previous items, to CONFIRM the composition of the Company’s Board of Directors.

General Instructions

:

1. As provided for in CVM Instruction nº. 165/91, as amended by CVM Instruction nº. 282/98, the minimum percentage of stake in the voting capital required to request the multiple voting process for the election of members of the Board of Directors is equal to five percent (5%);

2. Pursuant to paragraph 2 of article 161 of Law 6404/76 and CVM Instruction No.324/00, the installation of the Fiscal Council by the General Meeting shall occur at the request of shareholders representing at least 2% (two percent ) of the voting shares, or 1% (one percent) of the non-voting shares;

3. The shareholders or their legal representatives should attend the General Meeting bringing the relevant identity documents. In the event of representation of a shareholder by means of a proxy, the shareholders shall deliver at the Company’s head office, no less than seventy-two (72) hours before the General Meeting, a power of attorney granted according to the law;

4. The documents related to the matters to be analyzed at the Extraordinary General Meeting are available to shareholders (i) at the Company’s head office, at Avenida Presidente Juscelino Kubitschek, No. 2041 and 2235 - Bloco A, Vila

Olímpia, São Paulo/SP, 9th floor - Corporate Law Department, where they can be consulted, on business days, from 10:00 am to 4:00 pm, and also at its website (www.ri.santander.com.brwww.ri.santander.com.br – in Corporate Governance > Minutes and Management Meetings); (ii) at the Brazilian Securities and Exchange Commission (

Comissão de Valores Mobiliários

), at Rua Sete de Setembro No. 111, 5th Floor, Consultation Center, Rio de Janeiro/RJ or at Rua Cincinato Braga No. 340, 2nd to 4th floors, Ed. Delta Plaza, São Paulo/SP and on its website (www.cvm.gov.br) and (iii) at the B3 S.A. Brasil, Bolsa, Balcão, at Rua XV de Novembro No. 275, São Paulo/SP and on its website (www.bmfbovespa.com.br); and

5.

Remote Voting Form

: the Company implemented the remote voting system in accordance with CVM Instruction 481/09, as amended by CVM Instructions 561 and 570/15, enabling Shareholders to send remote voting form directly to the Company, to the bookkeeping or their respective custodian, according to the procedures described in the Manual for Participation in Shareholder´s meeting.

São Paulo, June 19, 2017 –

Álvaro Antônio Cardoso de Souza - Chairman of the Board of Directors.

___________________________________________________

3. Participation of the Shareholders in the EGM

The shareholders of Santander Brasil may attend the EGM

personally

, through a

duly appointed and established attorney-in-fact

or through

Remote Voting

.

The following documents will be required from the shareholders to attend the EGM:

|

Individual

|

• ID document with photo

1

(original or certified copy)

•proof of ownership of shares issued by the Company, issued by the custody agent and / or custodian financial institution (original or certified copy)

|

|

Legal entity

|

• corporate documents that evidence the legal representation of the shareholder (original or certified copy)

2

• ID document of the legal representative with photo (original or certified copy)

|

3.1. Attendance

The shareholders of Santander Brasil may attend the General Meetings by attending the place of their performance and declaring their vote, according to the kind of shares they hold (common and/or preferred) and the matters to be voted on. Pursuant to the provisions of Article 126 of Law 6.404/76, shareholders must attend the General Meetings, in addition to the identity document, proof of ownership of shares issued by the Company, issued by the depositary financial institution and/or custody agent. The Company recommends that such proof be issued within two (2) business days prior to the date scheduled for the Meeting.

Corporate shareholders, such as Commercial Companies and Investment Funds, must be represented in accordance with their Bylaws, Articles of Incorporation or Regulation, providing documents proving the regularity of the representation, accompanied by a Minutes of the election of the entity’s management members, as the case may be, in place and term indicated in the item below. Before the General Meetings are installed, the shareholders will sign the Attendance Book. Non-voting shareholders may attend General Meetings and discuss all matters submitted for deliberation.

1

The following documents may be presented: (i) General Registration ID Card (RG); (ii) Foreigner Identity Card (RNE); (iii) Valid passport; (iv) Professional Class ID Card valid as a civil identity for legal purpose (e.g.: OAB, CRM, CRC, CREA); or (v) National Driver’s License (CNH) with photo.

2

By-Laws/Articles of Association and Minutes/Instruments of election of the legal representatives registered with the pertinent body.

3.2. Representation by attorney-in-fact

The shareholder may be represented at the EGM by a proxy, duly constituted by a public or private instrument, and pursuant to article 126, paragraph 1 of the Brazilian Corporation Law, the attorneys-in-fact must have been constituted less than one (1) year, and should be (i) the Company's shareholders, (ii) the Company's management members, (iii) lawyers, or (iv) financial institutions, being the administrator of funds the person authorized to represent the fund’s quota holders.

The originals or certified copies of the documents referred to above may be delivered at the Company's headquarters until the time of the EGM.

However, in order to turn available the access of shareholders at the EGM, we recommend that the delivery of these documents be made at least seventy-two (72) hours prior to the EGM.

In the case of sending the documents by e-mail, the originals or certified copies must be delivered to the Company's headquarters on the day of the EGM.

The documents must be delivered to the Company's registered office at Avenida Presidente Juscelino Kubitschek, 2235 - Vila Olímpia - São Paulo, State of São Paulo, Brazil, 9th floor - Corporate Legal Department, at +55 11 3553-5438 and + 55 11 3553-5641, e-mail:

juridsocietario@santander.com.br

.

__________________________________________________

3.3. Remote Voting Participation

Pursuant to articles 21-A and following of CVM Instruction 481/2009, the Company's shareholders may also exercise their vote at general meetings by means of remote voting, to be formalized in an electronic document called Remote Voting Form, whose model is available in the Corporate Governance area of the Investor Relations website of Santander Brasil (www.ri.santander.com.br) or on the website of the Brazilian Securities and Exchange Commission (CVM) (http://sistemas.cvm.gov.br/?CiaDoc).

A shareholder that elects to exercise his right to vote at a Remote must do so by one of the options described below:

(i)

Delivery of Remote Voting Form directly to the Custody Agent

The shareholder that chooses to exercise the remote voting through its custody agent (“Custody Agent”) shall transmit the voting instructions observing the rules determined by the Custody Agent, which shall send such voting manifestations to

the Depositary Central of B3. The Shareholders must contact their respective Custody Agents to verify the procedures established by them for issuance of the voting instructions through the Form, as well as the documents and information required.

The Shareholder shall transmit the instruction for fulfillment of the Form to the Custody Agent until July 14

th

, 2017, except if a different term is determined by the Custody Agents.

(ii)

Delivery of Remote Voting Form directly to the bookkeeper

The shareholder that chooses to exercise the remote voting through the Company’s bookkeeper must observe the following instructions in order for the Remote Voting Form to be considered valid and the votes counted:

(i)

all the blank spaces must be duly fulfilled;

(ii)

all the pages must be initialed;

(iii)

the last page must be signed by the shareholder or its legal representative(s), as the case may be and pursuant to the applicable legislation in force; and

(iv)

the Form must be certified by a notary.

The following documents have to be sent to the Company’s bookkeeper

:

(i)

original Form, duly fulfilled, initialed and signed; and

(ii)

certified copies of the documents that follows:

·

Individual (shareholder or legal representative): Identification document with picture (Identity Card - RG and CPF/MF; Driver License – CNH or Professional Card issued with public faith and containing the CPF number). For documents issued abroad it is necessary the respective sworn translation duly certified by the competent consulate (“consularization”).

·

Legal Entities/Corporations: (i) Articles of Association or Bylaws duly updated, with the document that prove the representation powers (minutes of election); (ii) Identity Card with picture of the representatives (RG and CPF; CNH or Professional Card issued with public faith and containing the CPF number). For documents issued abroad it is necessary the respective sworn translation duly certified by the competent consulate (“consularization”).

The documents must be sent to the Company’s bookkeeper within seven (7) days before the Extraordinary General Meeting, in fact,

until July 14

th

2017,

through

(i)

mail to Banco Santander (Brasil) S.A. –

Acionistas

–

Escrituração de Ações

– Rua Amador Bueno, 474 – 2nd floor – Block D – Santo Amaro – São Paulo/SP,

Brazil – 04752-005; or

(ii)

via e-mail: custodiaacionistavotoadistancia@santander.com.br.

After the receipt of such documents, the bookkeeper, within three (3) days, shall inform the shareholder about the receipt of such documents and its acceptance. If the sent documents are not considered proper, the Form shall be deemed invalid, being the shareholder able to regularize it until July 14

th

, 2017.

The Forms received by the bookkeeper after July 14

th

, 2017 shall not be considered for voting purposes.

(iii)

Delivery of the Remote Voting Form directly to the Company

The shareholder that chooses to exercise the remote voting directly through the Company shall observe the following instructions in order for the Remote Voting Form to be considered valid and the votes counted:

(i)

all the blank spaces must be duly fulfilled;

(ii)

all the pages must be initialed;

(iii)

the last page must be signed by the shareholder or its legal representative(s), as the case may be and pursuant to the applicable legislation in force; and

(iv)

the Form must be certified by a notary.

The following documents have to be sent to the Company

:

(i)

original Form, duly fulfilled, initialed and signed; and

(ii)

certified copies of the documents that follows:

·

Individual (shareholder or legal representative): Identification document with picture (Identity Card - RG and CPF/MF; Driver License – CNH or Professional Card issued with public faith and containing the CPF number). For documents issued abroad it is necessary the respective sworn translation duly certified by the competent consulate (“consularization”).

·

Legal Entities/Corporations: (i) Articles of Association or Bylaws duly updated, with the document that prove the representation powers (minutes of election); (ii) Identity Card with picture of the representatives (RG and CPF; CNH or Professional Card issued with public faith and containing the CPF number). For documents issued abroad it is necessary the respective sworn translation duly certified by the competent consulate (“consularization”).

The documents must be sent to the Company within seven (7) days before the Extraordinary General Meeting, in fact,

until July 14

th

, 2017,

through

(i)

mail to Banco Santander (Brasil) S.A. – Investors Relations – Avenida Presidente Juscelino

Kubitschek, 2235 – 26

th

floor – Vila Olímpia – São Paulo/SP, Brazil –04543-011; or

(ii)

via e-mail: ri@santander.com.br.

After the receipt of such documents, the Company, within three (3) days, shall inform the shareholder about the receipt of such documents and its acceptance. If the sent documents are not considered proper, the Form shall be deemed invalid, being the shareholder able to regularize it until July 14

th

, 2017.

The Forms received by the Company after July 14

th

, 2017 shall not be considered for voting purposes.

General Information:

ü

in accordance with Article 21-S of CVM Instruction 481, the Central Depositary of B3, upon receiving shareholder voting instructions through its respective custody agent, shall not consider any instructions that differ from the same resolution that have been issued by the same CPF or CNPJ registration number; and

ü

after the deadline for remote voting, that is, until July

14

th

, 2017 (including), the shareholder may not change the voting instructions already sent, unless presented at the Extraordinary General Meeting or represented by proxy, upon explicit request to not consider the instructions in the Remote Voting Form submitted before the respective Forms were placed.

__________________________________________________

3.4. ADRs Holders

Holders of American Depositary Receipts (ADRs) will be entitled to vote on matters listed on the Agenda, according to the same criteria applied to national investors, according to the type of shares (common or preferred) in which their ADRs are backed. The holders of ADRs will be duly instructed by The Bank of New York Mellon, the depositary financial institution of the ADRs backed by the shares of Santander Brasil.

__________________________________________________

4.

Matters to be resolved in the EGM

Below you shall find clarifications made by the Company’s management regarding each of the items to be resolved in the EGM.

According to the Call Notice available to shareholders, our EGM will deliberate about the following matters on the agenda:

(I)

To FIX the number of members that will compose the Board of Directors in the mandate from 2017 to 2019;

(II)

To ELECT new member to compose the Company´s Board of Directors; and

(III)

Due to deliberate in the previous items, to CONFIRM the composition of the Company’s Board of Directors.

___________________________________________________

4.1.

To FIX the number of members that will compose the Board of Directors in the mandate from 2017 to 2019

Pursuant to paragraph 1 of article 14 of the Company's Bylaws, at the General Meeting with the purpose of deliberating the election of members of the Board of Directors, the shareholders shall initially determine the effective number of members of the Board of Directors to be elected.

In this sense, the controlling shareholders propose the number of members part of of the Board of Directors for the 2017 to 2019 term to be set at ten (10) members.

___________________________________________________

4.2.

To ELECT new member to compose the Company´s Board of Directors

The board of directors is the supervisory board and, as set out in the Brazilian Corporate Law, the Company’s By-Laws and its Internal Regulation, it is responsible for the business general guidelines of Santander Brasil and its subsidiary and companies belonging to the Santander Brasil Group, analyzing the relevant matters of the Company and effectively overseeing its management. It has the main scope of promoting the long term success of the business, by means of an active posture and always considering the interest of Santander Brasil as well as of its shareholders.

The board of directors will be comprised of a minimum of five (5) members and a maximum of twelve (12) members, elected by the shareholders meeting for terms of two (2) years. A minimum of twenty per cent (20.0%) of the members of the board of directors must be independent directors, according to Second and Third paragraphs of Article 14 of the Company’s Bylaws.

Currently, the Board of Directors is composed by nine (9) directors, of which four (4) are independent.

The Board of Directors members meet regularly four times a year and extraordinarily as often as required, by its Chairman.

The structure, operation and competencies of the Board of Directors are on articles 14 to 18 of our By-Laws and on its Internal Regulation, both on the following website:

www.ri.santander.com.br

– section “Corporate Governance”.

The Company, with the favorable recommendation of the Nomination and Remuneration Committee, proposes to the EGM the election of Mrs.

Deborah Stern Vieitas

, as independent member of the Company’s Board of Directors, for a complementary mandate valid until the Ordinary General Meeting of 2019.

Mrs. Vieitas has an extensive career in financial markets, with solid experience in management and structuring of corporate banking, trade finance, debt capital markets, structured finance as well to conducting negotiations of complex operations for different markets.

Mrs. Vieitas is considered to hold the necessary experience to join the Santander Brasil Board of Directors and will bring a breadth of experience to the Board.

The information related to the election of the member of the Board of Directors of the Company, pursuant to article 10 of Instruction CVM No. 481, may be found on

Exhibit I

of this Manual.

___________________________________________________

4.3. To CONFIRM the composition of the Company’s Board of Directors

Once approved the previous items, the Company’s Board of Directors composition, with a mandate valid until the Ordinary General Meeting of 2019, will be as follows:

|

Nome

|

Cargo

|

|

Álvaro Antônio Cardoso de Souza

|

Chairman (Independent)

|

|

Sergio Agapito Lires Rial

|

Vice-President

|

|

Conrado Engel

|

Director

|

|

José Antonio Alvarez Alvarez

|

Director

|

|

José de Paiva Ferreira

|

Director

|

|

José Maria Nus Badía

|

Director

|

|

Celso Clemente Giacometti

|

Independent Director

|

|

Deborah Patricia Wright

|

Independent Director

|

|

Deborah Stern Vieitas

|

Independent Director

|

|

José Luciano Duarte Penido

|

Independent Director

|

___________________________________________________

11

EXHIBIT I

PROPOSAL FOR ELECTION OFTHE COMPANY’S BOARD OF DIRECTORS

(Information in compliance with items 12.5 to 12.10 of Appendix 24 of CVM Instruction 480, pursuant to the terms of exhibit A of CVM Instruction 552)

12.5. In relation to each of the managers and members of the Fiscal Board of the Company, indicate, in table form

|

Name

|

Álvaro Antonio Cardoso de Souza

|

|

Date of Birth

|

09/05/1948

|

|

Profession

|

Economist and Bussiness Manager

|

|

CPF or passport number

|

249.630.118-91

|

|

Position occupied

|

Chairman of the Board of Directors

|

|

Election date

|

28/04/2017

|

|

Take Office date

|

After approval of the election by the Brazilian Central Bank

|

|

Term of office

|

OGM of 2019

|

|

Other position or occupation on the company

|

Coordinator of Risk and Compliance Committee and member of Remuneration and Nomination and Governance Committees.

|

|

Elected by the controller

|

Yes

|

|

If is an independent member and, if so, what was the criterion used by the issuer to determine the independence

|

Yes, according to 3

rd

paragraph of article 14 of the Bylaws

|

|

Number of consecutive terms

|

03

|

|

Information about:

Main professional experiences during the last 5 years, indicating:

Name and activity sector of the company

Position

If the company is (i) part of the economic group of the issuer or (ii) controlled by a shareholder of the issuer that holds an interest, direct or indirect, equal or higher than 5% of the same class or type of a security of the issuer

Indication of all management positions held by other companies or organizations in the third sector

|

Senior Advisor for Latin America at Citibank (financial sector) until his retirement in September 2003. He was CEO of Banco ABC-Roma, an affiliate to Grupo Globo and was member of the Board of Directors of several Brazilian companies, such as Celbrás, Ultraquímica, SPCI Computadores, Signature Lazard, Banco Triângulo, CSU Cardsystems and Gol Linhas Aéreas. He was also member of the Board of Directors of MasterCard International (credit cards sector) and President of the American Chamber of Commerce in São Paulo.

|

|

Description of any of the following events that have occurred during the last 5 years

|

Mr. Álvaro Antonio Cardoso de Souza declares that he has not suffered any criminal conviction, conviction in an administrative proceeding of the CVM, or a final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disqualified him for practicing any professional or commercial activity.

|

|

Name

|

Sérgio Agapito Lires Rial

|

|

Date of Birth

|

07/28/1960

|

|

Profession

|

Economist

|

|

CPF or passport number

|

595.644.157-72

|

|

Position occupied

|

Vice-Chairman of the Board of Directors

|

|

Election date

|

28/04/2017

|

|

Take Office date

|

After approval of the election by the Brazilian Central Bank

|

|

Term of office

|

OGM of 2019

|

|

Other position or occupation on the company

|

Chief Executive Officer

|

|

Elected by the controller

|

Yes

|

|

If is an independent member and, if so, what was the criterion used by the issuer to determine the independence

|

No

|

|

Number of consecutive terms

|

02

|

|

Information about:

Main professional experiences during the last 5 years, indicating:

Name and activity sector of the company

Position

If the company is (i) part of the economic group of the issuer or (ii) controlled by a shareholder of the issuer that holds an interest, direct or indirect, equal or higher than 5% of the same class or type of a security of the issuer

Indication of all management positions held by other companies or organizations in the third sector

|

He was Chief Executive Officer of Marfrig Global Foods S.A. (food sector) and is a member of the Board of Directors of Cyrela Brazil Reality S.A. His professional career includes the positions of Vice-President Executive Officer and World Chief Financial Officer of Cargill, being also part of the Board of Directors of such company, where he developed his functions for 9 years. He was Managing Director of Banco de Investimentos Bear Stearns & Co. (financial sector), in New York, officer of ABN AMRO Bank and member of the Board of Directors of ABN AMRO Bank in Netherlands (financial sector), as well as member of the Board of Directors of Mosaic Fertlizers. He has a degree in Law for the Universidade Federal do Rio de Janeiro (UFRJ) and in Economics for Universidade Gama Filho, and also has MBA for the Instituto Brasileiro de Mercado de Capitais (IBMEC – São Paulo), specialization for the Harvard Business School, Wharton School of Business of Pennsyvania University and INSEAD, in France. Currently he occupies the positions of member of the Board of Directors and Chief Executive Officer of Santander Brasil, Chairman of the Board of Directors of Getnet Adquirência e Serviços para Meios de Pagamento S.A. and Universia Brasil, S.A. (company controlled by the issuer).

|

|

Description of any of the following events that have occurred during the last 5 years

|

Mr. Sérgio Agapito Lires Rial declares that he has not suffered any criminal conviction, conviction in an administrative proceeding of the CVM, or a final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disqualified him for practicing any professional or commercial activity.

|

|

Name

|

Conrado Engel

|

|

Date of Birth

|

05/30/1957

|

|

Profession

|

Engineer

|

|

CPF or passport number

|

025.984.758-52

|

|

Position occupied

|

Director

|

|

Election date

|

28/04/2017

|

|

Take Office date

|

After approval of the election by the Brazilian Central Bank

|

|

Term of office

|

OGM of 2019

|

|

Other position or occupation on the company

|

Senior Vice-President Executive Officer and member of the Risk and Compliance Committee.

|

|

Elected by the controller

|

Yes

|

|

If is an independent member and, if so, what was the criterion used by the issuer to determine the independence

|

No

|

|

Number of consecutive terms

|

04

|

|

Information about:

Main professional experiences during the last 5 years, indicating:

Name and activity sector of the company

Position

If the company is (i) part of the economic group of the issuer or (ii) controlled by a shareholder of the issuer that holds an interest, direct or indirect, equal or higher than 5% of the same class or type of a security of the issuer

Indication of all management positions held by other companies or organizations in the third sector

|

In May 2008 he was appointed as group general manager and took office as CEO of HSBC Brasil (financial sector) in June 2009, where he remained until March 2012. At Santander Brasil he is a senior vice-president executive officer, responsible for the vice-presidency of

Wealth Management

& Specialized Businesses, including Auto Joint Ventures and also is member of our Board of Directors. He is also a member of the Risk and Compliance Committee of Santander Brasil, Chief Executive Officer and member of the Board of Directors of Santander Leasing S.A. Arrendamento Mercantil,, Vice-President of Banco Bandepe S.A. and member of the Board of Directors of Banco RCI Brasil S.A, Chief Executive Officer of Aymoré Crédito, Financiamento e Investimento S.A. and Santander Finance Arrendamento Mercantil S.A, member of the Board of Directors of Getnet Adquirência e Serviços para Meios de Pagamento S.A., member of the Advisory Board of Santander Brasil Gestão de Recursos Ltda. and Chairman of the Board of Directors of Webmotors S.A. and Banco Bonsucesso Consignado S.A. (which are part of the financial conglomerate of the issuer).

|

|

Description of any of the following events that have occurred during the last 5 years

|

Mr. Conrado Engel declares that he has not suffered any criminal conviction, conviction in an administrative proceeding of the CVM, or a final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disqualified him for practicing any professional or commercial activity.

|

|

Name

|

José Antonio Alvarez Alvarez

|

|

Date of Birth

|

01/06/1960

|

|

Profession

|

Executive

|

|

CPF or passport number

|

233.771.448-97

|

|

Position occupied

|

Director

|

|

Election date

|

28/04/2017

|

|

Take Office date

|

After approval of the election by the Brazilian Central Bank

|

|

Term of office

|

OGM of 2019

|

|

Other position or occupation on the company

|

No

|

|

Elected by the controller

|

Yes

|

|

If is an independent member and, if so, what was the criterion used by the issuer to determine the independence

|

No

|

|

Number of consecutive terms

|

05

|

|

Information about:

Main professional experiences during the last 5 years, indicating:

Name and activity sector of the company

Position

If the company is (i) part of the economic group of the issuer or (ii) controlled by a shareholder of the issuer that holds an interest, direct or indirect, equal or higher than 5% of the same class or type of a security of the issuer

Indication of all management positions held by other companies or organizations in the third sector

|

He was a member of the Board of Directors of Banco de Crédito Local S.A. from 2000 to 2002 and Chairman of the Banking Supervision Committee of the European Banking Federation from 2009 until 2012. Currently, he is the CEO of Santander Group, member of the Board of Directors of Santander Consumer Finance, S.A., member of the Fiscal Board of Bank Zackodni WBK, S.A., member of the Fiscal Board of Santander Consumer Bank AG and Santander Consumer Holding GmbH and member of the Fiscal Board of Santander Holdings USA, INC. (financial sector) until January 2015 (which are companies controlled by shareholder of the issuer). As of 2009, he is member of the Board of Directors of Santander Brasil.

|

|

Description of any of the following events that have occurred during the last 5 years

|

Mr. José Antonio Alvarez Alvarez declares that he has not suffered any criminal conviction, conviction in an administrative proceeding of the CVM, or a final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disqualified him for practicing any professional or commercial activity.

|

|

Name

|

José de Paiva Ferreira

|

|

Date of Birth

|

03/01/1959

|

|

Profession

|

Manager

|

|

CPF or passport number

|

007.805.468-06

|

|

Position occupied

|

Director

|

|

Election date

|

28/04/2017

|

|

Take Office date

|

After approval of the election by the Brazilian Central Bank

|

|

Term of office

|

OGM of 2019

|

|

Other position or occupation on the company

|

Senior Vice-President Executive Officer and member of the Risk and Compliance Committee.

|

|

Elected by the controller

|

Yes

|

|

If is an independent member and, if so, what was the criterion used by the issuer to determine the independence

|

No

|

|

Number of consecutive terms

|

05

|

|

Information about:

Main professional experiences during the last 5 years, indicating:

Name and activity sector of the company

Position

If the company is (i) part of the economic group of the issuer or (ii) controlled by a shareholder of the issuer that holds an interest, direct or indirect, equal or higher than 5% of the same class or type of a security of the issuer

Indication of all management positions held by other companies or organizations in the third sector

|

In 2008 he became the CEO of Santander Brasil, a position that he occupied until the merger with Banco Real, when he became Senior Vice-President Executive Officer, responsible for the Retail Business. In March 2011 he became Director of the Santander’s Board of Directors, and joined the Board of Directors of the business group based in Los Angeles, California, USA, which main activities are technological innovations. Currently, he is a member of our Board of Directors and since July 2013 he also occupies the position of Senior Vice-President Executive Officer, being responsible for Organization, Property, Proceedings, Operations, Technology and Costs. He is also Chairman of the Board of Directors of Santander Leasing S.A. Arrendamento Mercantil and TECBAN – Tecnologia Bancária and member of the Board of Directors of Getnet Adquirência e Serviços para Meios de Pagamento S.A. (which companies are part of the financial conglomerate of the issuer).

|

|

Description of any of the following events that have occurred during the last 5 years

|

Mr. José de Paiva Ferreira declares that he has not suffered any criminal conviction, conviction in an administrative proceeding of the CVM, or a final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disqualified him for practicing any professional or commercial activity.

|

|

Name

|

José Maria Nus Badía

|

|

Date of Birth

|

02/09/1950

|

|

Profession

|

Executive

|

|

CPF or passport number

|

AAJ040239

|

|

Position occupied

|

Director

|

|

Election date

|

28/04/2017

|

|

Take Office date

|

After approval of the election by the Brazilian Central Bank

|

|

Term of office

|

OGM of 2019

|

|

Other position or occupation on the company

|

No

|

|

Elected by the controller

|

Yes

|

|

If is an independent member and, if so, what was the criterion used by the issuer to determine the independence

|

No

|

|

Number of consecutive terms

|

3

|

|

Information about:

Main professional experiences during the last 5 years, indicating:

Name and activity sector of the company

Position

If the company is (i) part of the economic group of the issuer or (ii) controlled by a shareholder of the issuer that holds an interest, direct or indirect, equal or higher than 5% of the same class or type of a security of the issuer

Indication of all management positions held by other companies or organizations in the third sector

|

Mr. Badía served as Risk Vice-President Executive Officer and Chief of the Strategic Planning Department of the Risk Division from March 2014 until January 2015 at Banco Santander, S.A. He served as Vice-President Executive Officer of Santander UK Operations at Banco Santander, S.A., Risk Officer and Executive Director at Santander UK plc (financial sector) (controlled by shareholder of the issuer) from March 17, 2011 to March 1, 2014. He has also been Risk Vice-President Executive Officer in Argentaria and Bankinter, and member of the Board of Directors in Banco de Vitoria, Banco de Negocios Argentaria, Banco de Credito Local and Banco de Alicante (financial sector). He served as Executive Director and Risk Officer at Banco Banesto (financial sector) (controlled by shareholder of the issuer). Previously, he was Risk Officer at Banco Español de Credito, S.A. (financial sector), where he was member of the Board of Directors and member of the Executive Board. He has been an Executive Director at Alliance & Leicester plc since March 17, 2011. He is a member of the board of Societat Catalana d'Economia. Since 2015 he is member of the Board of Directors of Santander Brasil.

|

|

Description of any of the following events that have occurred during the last 5 years

|

Mr. José Maria Nus Badía declares that he has not suffered any criminal conviction, conviction in an administrative proceeding of the CVM, or a final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disqualified him for practicing any professional or commercial activity.

|

|

Name

|

Celso Clemente Giacometti

|

|

Date of Birth

|

10/13/1943

|

|

Profession

|

Bussiness Manager

|

|

CPF or passport number

|

029.303.408-78

|

|

Position occupied

|

Director (independent)

|

|

Election date

|

28/04/2017

|

|

Take Office date

|

After approval of the election by the Brazilian Central Bank

|

|

Term of office

|

OGM de 2019

|

|

Other position or occupation on the company

|

Member of the Remuneration and Nomination and Governance Committees

|

|

Elected by the controller

|

Yes

|

|

If is an independent member and, if so, what was the criterion used by the issuer to determine the independence

|

Yes, according to 3

rd

paragraph of article 14 of the Bylaws

|

|

Number of consecutive terms

|

05

|

|

Information about:

Main professional experiences during the last 5 years, indicating:

Name and activity sector of the company

Position

If the company is (i) part of the economic group of the issuer or (ii) controlled by a shareholder of the issuer that holds an interest, direct or indirect, equal or higher than 5% of the same class or type of a security of the issuer

Indication of all management positions held by other companies or organizations in the third sector

|

Since February 2010 he acts as independent member of the Board of Directors of Santander Brasil, which he presides between October 2011 and June 2013 and between August 2013 and March 2015. He is President of the Fiscal Board and Audit Committee of Ambev S.A. (beverages sector). He is the managing partner of Giacometti Serviços Profissionais Ltda. (accounting sector) and one of the co-founders and former board member of Brazilian Institute Corporate Governance - IBGC.

|

|

Description of any of the following events that have occurred during the last 5 years

|

Mr. Celso Clemente Giacometti declares that he has not suffered any criminal conviction, conviction in an administrative proceeding of the CVM, or a final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disqualified him for practicing any professional or commercial activity.

|

|

Name

|

Deborah Patricia Wright

|

|

Date of Birth

|

09/04/1957

|

|

Profession

|

Business manager

|

|

CPF or passport number

|

031.544.298-08

|

|

Position occupied

|

Independent Member of the Board of Directors

|

|

Election date

|

28/04/2017

|

|

Take Office date

|

After approval of the election by the Brazilian Central Bank

|

|

Term of office

|

OGM of 2019

|

|

Other position or occupation on the company

|

Member of the Remuneration and Nomination and Governance Committees.

|

|

Elected by the controller

|

Yes

|

|

If is an independent member and, if so, what was the criterion used by the issuer to determine the independence

|

Yes, according to 3

rd

paragraph of article 14 of the Bylaws

|

|

Number of consecutive terms

|

01

|

|

Information about:

Main professional experiences during the last 5 years, indicating:

Name and activity sector of the company

Position

If the company is (i) part of the economic group of the issuer or (ii) controlled by a shareholder of the issuer that holds an interest, direct or indirect, equal or higher than 5% of the same class or type of a security of the issuer

Indication of all management positions held by other companies or organizations in the third sector

|

Between 2008 and 2014 she acted as member of the Board of Directors of Lojas Renner (clothing sector) and President of the Sustainability Committee between 2012 and 2014. Currently she is member of the Board of Directors of Eurofarma (pharmaceutical sector). Currently she participates in: WCD Grupo Brasileiro (Women Corporate Directors); IBGC (

Instituto Brasileiro de Governança Corporativa

); and Diversity – Women in Board of Directors.

|

|

Description of any of the following events that have occurred during the last 5 years

|

Mrs. Deborah Patricia Wright declares that he has not suffered any criminal conviction, conviction in an administrative proceeding of the CVM, or a final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disqualified him for practicing any professional or commercial activity.

|

|

Name

|

José Luciano Duarte Penido

|

|

Date of Birth

|

03/08/1948

|

|

Profession

|

Engineer

|

|

CPF or passport number

|

091.760.806-25

|

|

Position occupied

|

Independent Member of the Board of Directors

|

|

Election date

|

28/04/2017

|

|

Take Office date

|

After approval of the election by the Brazilian Central Bank

|

|

Term of office

|

OGM of 2019

|

|

Other position or occupation on the company

|

Member of the Sustainability and Audit Committees.

|

|

Elected by the controller

|

Yes

|

|

If is an independent member and, if so, what was the criterion used by the issuer to determine the independence

|

Yes, according to 3

rd

paragraph of article 14 of the Bylaws

|

|

Number of consecutive terms

|

01

|

|

Information about:

Main professional experiences during the last 5 years, indicating:

Name and activity sector of the company

Position

If the company is (i) part of the economic group of the issuer or (ii) controlled by a shareholder of the issuer that holds an interest, direct or indirect, equal or higher than 5% of the same class or type of a security of the issuer

Indication of all management positions held by other companies or organizations in the third sector

|

He is independent member of the Boards of Directors of COPERSUCAR (exportation sector), Química Amparo YPÊ (industrial sector) and ALGAR Group (IT/Telecom sector). He is also member of the board of Instituto Votorantim (industrial sector). Mr. Penido is Vice-Chair of the Executive Committee of WBCSD – World Business Council for Sustainable Development. In his socioenvironmental activities Mr. Penido acts as Chairman of the Associação Corredor Ecológico do Vale do Paraíba and as member of the board of Rede Cidadã NGO.

|

|

Description of any of the following events that have occurred during the last 5 years

|

Mr. José Luciano Duarte Penido declares that he has not suffered any criminal conviction, conviction in an administrative proceeding of the CVM, or a final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disqualified him for practicing any professional or commercial activity.

|

|

Name

|

Deborah Stern Vieitas

|

|

Date of Birth

|

21/08/1957

|

|

Profession

|

Public Administrator and Journalist

|

|

CPF or passport number

|

013.968.828-55

|

|

Position occupied

|

Independent Member of the Board of Directors

|

|

Election date

|

EGM to be held on 20/07/2017

|

|

Take Office date

|

After approval of the election by the Brazilian Central Bank

|

|

Term of office

|

OGM of 2019

|

|

Other position or occupation on the company

|

None

|

|

Elected by the controller

|

Yes

|

|

If is an independent member and, if so, what was the criterion used by the issuer to determine the independence

|

Yes, according to 3

rd

paragraph of article 14 of the Bylaws

|

|

Number of consecutive terms

|

None

|

|

Information about:

Main professional experiences during the last 5 years, indicating:

Name and activity sector of the company

Position

If the company is (i) part of the economic group of the issuer or (ii) controlled by a shareholder of the issuer that holds an interest, direct or indirect, equal or higher than 5% of the same class or type of a security of the issuer

Indication of all management positions held by other companies or organizations in the third sector

|

Mrs. Vieitas is currently a CEO of American Chamber of Commerce Brazil (Amcham Brazil), and a board member of AXA Seguros S.A. From 2008 to 2014, she was a CEO and a member of the Board of Banco Caixa Geral Brasil. From 2000 to 2008, she was an Executive Vice President of Banco BNP Paribas Brasil, responsible for Corporate Coverage and Loan and Financing portfolios. From 1998 to 2000, she was an Executive Vice President of

Banco CCF Brasil.

|

|

Description of any of the following events that have occurred during the last 5 years

|

Mrs. Deborah Stern Vieitas declares that he has not suffered any criminal conviction, conviction in an administrative proceeding of the CVM, or a final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disqualified him for practicing any professional or commercial activity.

|

12.6. In relation to each of the persons who served as members of the board of directors or of the supervisory board in the last fiscal year, inform, in a table format, the percentage of participation in the meetings

held by the respective organ in the same period that occurred after the office

Not applicable for the member indicated to the election.

12.7 Provide the information mentioned in item 12.5 with respect to members of statutory committees, as well as audit, risk, financial and compensation committees, even if such committees or structures are not statutory

Not applicable for the member indicated to the election.

12.8. In relation to each person who served as a member of the statutory committees, as well as the audit, risk, financial and compensation committees, even if such committees are not statutory, state in a table format the percentage of participation in the meetings Carried out by the respective body in the same period, that occurred after the tenure in office.

Not applicable for the member indicated to the election.

12.9. Inform the existence of a marital relationship, stable union or kinship up to the second degree between:

a. Issuer administrators

It does not apply, since there is no relationship between such persons.

b. (i) managers of the issuer and (ii) managers of the direct or indirect subsidiaries of the issuer

It does not apply, since there is no relationship between such persons.

c. (i) administrators of the issuer or its subsidiaries, direct or indirect and (ii) direct or indirect controllers of the issuer

It does not apply, since there is no relationship between such persons.

d. (i) managers of the issuer and (ii) managers of the issuer's direct and indirect controlling companies

It does not apply, since there is no relationship between such persons.

12.10. Inform relationships of subordination, service rendering or control kept, in the last 3 fiscal years, among managers of the issuer and:

a. company direct or indirectly controlled by the issuer

For information about this item, please consult item 12.9.

b. issuer’s direct or indirect controller company

Regarding the subordination item, Santander Brasil has two (2) members of the Board of Directors that has executive positions in Santander Spain Group, namely: José Antonio Alvarez Alvarez and José Maria Nus Badía.

c. If relevant, supplier, customer, debtor or creditor of the issuer, its subsidiary or controlling companies or subsidiaries of any of these persons

For information on this item, please check item 12.9.

___________________________________________________

* * * *

EXHIBIT II – Related Documents and Links

All documents mentioned herein may be found in the websites mentioned below.

Additionally, each website includes, specifically, the following additional documents of interest to shareholders:

-

www.ri.santander.com.br

or

www.santander.com.br/acionistas

:

Information about the Company, such as corporate governance practices, resumes of the other members of the Board of Directors.

-

www.cvm.gov.br:

Corporate Law, CVM Instructions 480, 481 and 552.

___________________________________________________

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: June 19, 2017

|

Banco Santander (Brasil) S.A.

|

|

|

|

|

|

By:

|

/

S

/

Amancio Acurcio Gouveia

|

|

|

|

Amancio Acurcio Gouveia

Officer Without Specific Designation

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/

S

/

Angel Santodomingo Martell

|

|

|

|

Angel Santodomingo Martell

Vice - President Executive Officer

|

|

Banco Santander Brasil (NYSE:BSBR)

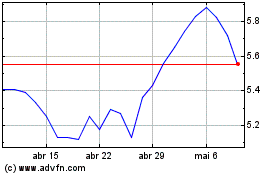

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

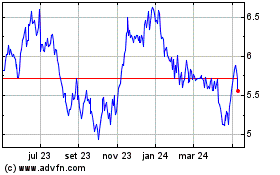

Banco Santander Brasil (NYSE:BSBR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024