Report of Foreign Issuer (6-k)

11 Outubro 2017 - 9:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2017

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

|

|

Publicly-Held Company

Corporate Taxpayer's ID No.

60.746.948/0001-

|

Material Fact

Change in the Board of Directors of Banco Bradesco S.A.

Banco Bradesco S.A.

(“Bradesco” o

r

“

Company

”)

informs its shareholders, clients, employees and the market in general that Mr. Lázaro de Mello Brandão has presented today his resignation letter from the position of Chairman of the Board of Directors of Bradesco, as well as from the functions he has been performing in all its subsidiaries.

Mr. Brandão started his career in 1942 at Casa Bancária Almeida & Cia., a financial institution that, in 1943, became Banco Brasileiro de Descontos S.A., currently known as Banco Bradesco S.A., moving up through the banking hierarchy. He was Chief Executive Officer from January 1981 to March 1999, taking over the Chairmanship of the Board of Directors in February 1990, being always respected by innumerous segments of the Brazilian and international communities.

Throughout his career, he maintained, with unique mastery, the

“Culture” and the “Values” of the Bradesco Organization, where the development and

improvement of the Institution

’

s actions are a constant duty, enriched by the permanent counseling of his collegiate bodies, demonstrating that the main interest is the

Company’

s life and prosperity, as well as the realization of its goals to the Community in general.

Mr. Brandão will continue holding the position of Chairman of the Board of Directors of

Bradesco’s

parent companies, conveying the knowledge and experience he acquired through over 75 years of professional life exclusively dedicated to the Organization, with magnificent examples of work, honesty and ethics.

To replace him in the chairmanship of the Board of Directors, Mr. Luiz Carlos Trabuco Cappi was nominated, so far holding the position of Vice Chairman of the Body and current Chief Executive Officer of the Bank. His merits are unquestionable. His expertise and efficiency are translated into the daily overcoming of adversities in an increasingly competitive market and in a challenging economic environment.

As the leader of the main Body of the governance system, Mr.

Trabuco was assigned the mission of, together with the other members, establishing

Bradesco’s strategic

guidelines, always valuing the

“Cultur

e

”

and

“Val

ues

”

of the Organization.

Mr.

Luiz Carlos Trabuco Cappi

will accumulate the positions of Chairman of the Board of Directors and of Chief Executive Officer of Bradesco until

the first meeting of the Body to be held after the Annual Shareholders’ Meeting

to be probably held in March 2018, occasion in which a new Chief Executive Officer of the Company will be elected, in order to comply with the provisions set forth in Paragraph One, of Article 7, of the Bylaws, due to the non-cumulative nature of positions.

In view of the ascension of Mr. Luiz Carlos Trabuco Cappi to the Chairmanship of the Board of Directors, Mr. Carlos Alberto Rodrigues Guilherme, member of the Body since March 10, 2009, was nominated to the position of Vice Chairman.

To Messrs. Luiz Carlos Trabuco Cappi and Carlos Alberto Rodrigues Guilherme our wishes of wisdom in the conduction of the

Company’s

Board of Directors, so that, together with the other Managers and Employees of the Organization, they can work to turn Bradesco into an even stronger and more dynamic institution, always satisfying its millions of clients and thousands of shareholders, with active participation in the development of our Country.

Núcleo Cidade de Deus, Osasco, SP, October 10, 2017

|

|

|

|

|

Banco Bradesco S.A.

|

|

|

|

|

|

|

Alexandre da Silva Glüher

Executive Vice President,

Chief Risk Officer (CRO) and

Investor Relations Officer

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 11, 2017

|

BANCO BRADESCO S.A.

|

|

|

|

By:

|

|

/S/

Alexandre da Silva Glüher

|

|

|

|

Alexandre da Silva Glüher

Executive Vice President,

Chief Risk Officer (CRO) and

Investor Relations Officer.

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

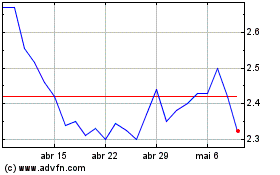

Banco Bradesco (NYSE:BBDO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

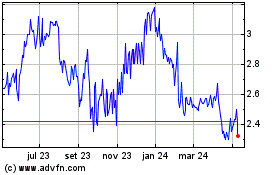

Banco Bradesco (NYSE:BBDO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024