Report of Foreign Issuer (6-k)

19 Outubro 2017 - 8:03AM

Edgar (US Regulatory)

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

October 2017

Vale S.A.

Avenida das Américas, No. 700 — Bloco 8, Sala 218

22640-100 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

|

|

(Check One) Form 20-F

x

Form 40-F

o

|

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

Table of Contents

VALE S.A

.

Public Company

CNPJ/MF No. 33.592.510/0001-54

NOTICE TO SHAREHOLDERS

We hereby inform the Shareholders and the market in general, in addition to the information disclosed in the Material Facts of August 18 and 24, 2017, that approval was given, at the Extraordinary Shareholders’ Meeting of Vale SA (“Vale” or “Company”) held on October 18, 2017 and at the Special Shareholders Meeting held on October 18, 2017 (“Meetings”), for the proposed conversion of all Class “A” preferred shares into common shares of the Company, in the proportion of 0.9342 common share for each class “A” preferred share (“Conversion of the Remaining Shares”).

1.

Right of Withdrawal.

Pursuant to Articles 136 and 137 of Law 6,404/76 (“Brazilian Corporate Law”), only those shareholders holding Vale’s Class “A” preferred shares dissenting with regard to the resolution of the Special Meeting that approved the Conversion of the Remaining Shares, will have the right to withdraw from the Company (“Right of Withdrawal”), being entitled to the repayment of their Class “A” preferred shares for the equity value of R$24.26 per share, calculated based on the last balance sheet approved by the Shareholders Annual General Meeting of April 20, 2017, drawn up on December 31, 2016.

Only the dissenting shareholders who have uninterruptedly held title to their Class “A” preferred shares since the closing of the trading session on August 18, 2017, the date of the Relevant Fact that informed the market of the proposal for Conversion of Remaining Shares, until the effective exercise of the Right of Withdrawal, will have said Right. Any shares acquired, as well as those shares related to “renting of shares” (position of borrower and/or lender), as of August 21, 2017, inclusive, will not give the holder withdrawal rights with respect to the Conversion of the Remaining Shares.

A dissenting shareholder wishing to exercise the Right to Withdraw shall expressly express his or her intention to do so in relation to all of his or her shares as from October 20, 2017 until November 19, 2017, inclusive, which is the deadline for the exercise of the Right of Withdrawal.

2. Procedures for Exercise of Right of Withdrawal.

2.1.

Shareholders with shares deposited with Bradesco.

The holders of Vale’s Class “A” preferred shares whose shares are held in custody in Bradesco SA (“Bradesco”), the depositary institution for shares issued by Vale, and wishing to exercise the Right to Withdraw, must, within the above term, appear at one of the Bradesco agencies specializing in dealing with shareholders, during local banking hours, and complete and sign the appropriate form for the exercise of the Right of

3

Table of Contents

Withdrawal, available at the financial institution itself, and to this end produce certified copies of following documents:

(i)

Individual Shareholder

: Identity Card, Personal Identification Number (CPF) and proof of residence;

(ii)

Corporate Shareholder

: certified copy of the last consolidated Bylaws or Articles of Incorporation in force, registration card for the National Registry of Legal Entities (CNPJ), corporate documentation granting powers of representation and certified copies of the CPF (Personal Identification Number), Identity Card and proof of residence of their representatives. Investors residing abroad may be required to submit other proxy documents;

(iii)

Universality of Goods (such as estates)

: certified copy of the documentation granting powers of representation, as well as the CPF (Personal Identification Number), identity card and proof of residence of the respective representatives.

Shareholders who are represented by proxy must produce, in addition to the documents referred to above, the respective power of attorney, which shall contain special powers for the attorney-in-fact to declare on their behalf the exercise of the Right of Withdrawal and request the redemption of shares. The representatives of minors and those legally incompetent must also present their legal authorization.

2.2.

Shareholders with shares deposited in B3.

The holders of Class “A” preferred shares whose shares are deposited in B3 SA - Brasil, Bolsa, Balcão (“B3”) wishing to exercise the Right of Withdrawal, must contact their custody agents (Brokers, Home Brokers) in sufficient time to take the necessary steps to exercise the Right of Withdrawal, subject to the rules and operational procedures of B3.

3. Further Information on Right of Withdrawal.

In accordance with art. 137, §3 of Corporate Law, if the proposal for Conversion of the Remaining Shares is approved, the management bodies may call a general meeting to reconsider the resolution in function of the volume of the withdrawal exercised.

Dissenting shareholders may, at the time of withdrawal, request Vale’s special balance sheet, pursuant to the provisions of paragraph 2 of art. 45 of Brazilian Corporate Law. In this case, after the deadline established for the Conversion of the Remaining Shares to be reconsidered, under the terms described above, the shareholder will receive 80% of the reimbursement amount, the balance, if any, being paid within 120 days from the date of the resolution of the Special Meeting that approved the Conversion of the Remaining Shares.

The date and form of payment of the reimbursement corresponding to the shares subject to the Right of Withdrawal shall be informed after the expiration of the above-mentioned term of said Right.

4

Table of Contents

With the completion of the Conversion of the Remaining Shares and subsequent migration to

Novo Mercado

, a special segment of B3, it is expected that all shareholders will benefit from a company with high standards of corporate governance, a simplified corporate structure and increased share liquidity. The Company will keep its shareholders and the market in general informed of any new material information regarding the matters discussed in this Notice to Shareholders.

Rio de Janeiro, October 18, 2017.

Luciano Siani Pires

Executive Director for Investor Relations

5

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vale S.A.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

By:

|

/s/ André Figueiredo

|

|

Date: October 18, 2017

|

|

Director of Investor Relations

|

6

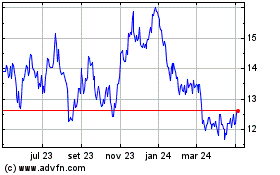

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

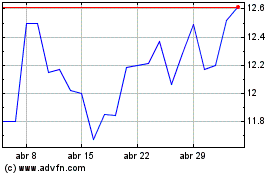

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024