|

Press Release

|

|

|

Highlights

|

|

|

17.

Payroll, plus charges and benefits totaled R$12.700 billion in the first nine months of 2017. Social benefits provided to employees of the Bradesco Organization and their dependents amounted to R$3.480 billion, while investments in education, training and development programs totaled R$127.693 million.

|

|

·

Bradesco Seguros was included in the “

Valor 1000

” yearbook, leading the insurance sector in Brazil. “Bradesco Seguros” and “Bradesco Saúde” placed first in the categories “General Insurance” (includes Auto) and “Health Insurance”, respectively (

Valor Econômico

newspaper).

|

|

18.

Major Awards and Acknowledgments in the period:

|

|

Bradesco Organization is fully committed to the socio-economic development of the country. We set our business guidelines and strategies with a view of incorporating the best sustainability practices, considering the context and the potential of each region, thus contributing to the generation of shared value in the long-term. To reinforce this position, we emphasized adherence to globally recognized business initiatives, such as: Global Compact, Sustainable Development Goals (SDG), Equator Principles, CDP (Carbon Disclosure Program), Principles for Responsible Investment (PRI), GHG Protocol Program (Brazilian Greenhouse Gas Emissions Program) and Companies for Climate Change (EPC). The Board of Directors, through the Sustainability Committee, monitors the sustainability deliberations. Excellence in business management is recognized by the main indexes of Sustainability, such as the Dow Jones Sustainability Index (DJSI) – “World and Emerging Markets”, of the New York Stock Exchange, the Corporate Sustainability Index (ISE), and the Carbon Efficient Index (ICO2), both from B3.

|

|

·

winner of the “Empresas Mais” award, in the “Banks” category (

O Estado de

S. Paulo

newspaper, in partnership with Fundação Instituto de Administração - FIA and Austin Rating);

|

|

|

·

winner in the “As Melhores da Dinheiro 2017” guide, in the category “Corporate Governance”. Bradesco Vida e Previdência won Best Company in the sector and was also featured in the “Financial Sustainability” and “Innovation and Quality” categories (

Isto É Dinheiro

magazine);

|

|

|

·

was featured at the “Tech Projects of the Year Awards 2017”, winning in the “Cyber Security” category, with the case “Using Big Data Technology to Prevent Attacks Against ATM”, which shows the use of Big Data to identify, in real time, possible attacks on ATMs (The Banker magazine);

|

|

|

·

was featured at the 2017 edition of the “Conarec – National Congress of Company-Customer Relations” awards, in the “Banks” category. The Grupo Bradesco Seguros won the award in the categories: “Insurance”, “Health”, “Pension Plans” and “Capitalization Bonds”;

|

|

With a broad social and educational program put in place 60 years ago, Fundação Bradesco operates 40 schools across Brazil. In 2017, a budget of R$625.944 million will benefit an estimated number of 104.2 thousand students enrolled in its schools at the following levels: Basic Education (from Kindergarten to High School and Higher Secondary Technical-Professional Education), youth and adult education; and preliminary and continued vocational training, focused on creating jobs and income. In addition to the guarantee of free, quality education, the students enrolled in the Basic Education system, numbering over 43 thousand, also receive uniforms, school supplies, meals, and medical and dental assistance. Fundação also expects to benefit 630 thousand students via distance learning (EaD), through its e-Learning portal “Escola Virtual” (Virtual School), where students can complete one out of more than 90 courses offered in its schedule. Another 15,040 students are taking part in projects and actions in partnership with the Program Educa+Ação and in Technology courses.

|

|

·

was included on the list of “150 Best Companies to Work in Brazil” (

Época

magazine, with the evaluation of the Great Place To Work consulting firm);

|

|

|

·

B

radesco BBI won the triple crown and became the only Brazilian bank to win three of the sector’s top international awards two years in a row, namely: “The Most Innovative Investment Bank in Latin America”, by The Banker magazine; and “The Best Investment Bank Brazil”, by Global Finance and Euromoney;

|

|

|

·

the Grupo Bradesco Seguros, for the eighth year in a row, was listed in the “

Melhores & Maiores

” yearbook, a major highlight in the insurance sector, with “Bradesco Saúde”, “Bradesco Vida e Previdência”, and “Bradesco Auto/RE” (

Exame

magazine); and

|

|

|

Press Release

|

|

|

Main Information

|

|

6

Economic and Financial Analysis Report - September 2017

|

Press Release

|

|

|

Main Information

|

|

(1)

According to the non-recurring events described on page 8 of this Economic and Financial Analysis Report;

(2)

For more information, please see note 4 – Managerial Statement of Financial Position and Statement of Income by Operating Segment, in chapter 6 of this report;

(3)

Expanded Loan Portfolio: includes sureties, guarantees, credit letters, advances on credit card receivables, debentures, promissory notes, co-obligations in real estate receivable certificates and rural credit;

(4)

Up to December 2016, it included provisions for guarantees provided, encompassing sureties, guarantees, credit letters, and standby letter of credit, which comprises the concept of “excess provision”. In September 2016, the excess provision totaled R$7,491 million, partly offset by the result of the consolidation of HSBC Brasil as from the third quarter of 2016. In March 2017, with Resolution No. 4,512/16, referring to the treatment for financial guarantees provided, the balance of the excess provision declined from R$7,491 million to R$6,907 million;

(5)

In the last 12 months;

(6)

For comparison purposes, shares were adjusted in accordance with bonuses and stock splits occurred in the periods;

(7)

Excluding mark-to-market effect of available-for-sale Securities recorded under Shareholders’ Equity.

(8)

Year-to-Date Adjusted Net Income. As of the first quarter of 2016, the Annualized Returns have been calculated on a linear basis and for the best effect of comparability, the previous periods have been readjusted;

(9)

The Ratio calculation has followed regulatory guidelines set forth in Resolutions No. 4,192/13 (Prudential Conglomerate) and No. 4,193/13 (Basel III);

(10)

Excludes additional provisions;

(11)

Operating efficiency ratio without the effect of impairment of financial assets;

(12)

Number of shares (excluding treasury shares) multiplied by the closing price for common and preferred shares on the period’s last trading day;

(13)

As defined by the Brazilian Central Bank (Bacen);

(14)

Overdue loans;

(15)

The decrease observed from 2015 is related to: (i) the migration of “External ATM Network Points – Bradesco)” to “Banco24Horas Network”; (ii) the deactivation of ATMs from “Banco24Horas Network”; and (iii) the decrease of Bradesco Expresso (Correspondent Banks);

(16)

PA (Service Branch): a result of the consolidation of PAB (Banking Service Branch), PAA (Advanced Service Branch) and Exchange Branches, according to Resolution No. 4,072/12; and PAEs – ATMs located on a company’s premises;

(17)

Including overlapping Onsite Network Bradesco and customer service points within the Bank’s own network and the Banco24Horas Network, reason for which the ATMs and customer service points of Banco24Horas relating to the consolidation of HSBC Brasil were not segregated;

(18)

This decrease is related to the sharing of the off-site ATM network with the Banco24Horas Network;

(19)

It includes the correspondent banks and their branches;

(20)

Number of individual customers (National Registry of Legal Entities (CNPJ) and Individual Taxpayer Registry (CPF);

(21)

Refer to first and second checking account holders; and

(22)

Number of accounts.

|

Press Release

|

|

|

Book Net Income vs. Adjusted Net Income

|

|

The main non-recurring events that affected Book Net Income in the periods below are presented in the following comparative chart:

(1)

In the first nine months of 2017, this refers to: (i) the regulatory change at Cielo, in the amount of R$210 million, in the second quarter of 2017; (ii) special tax regularization program, or “PERT” (

Programa Especial de Regularização Tributária

), in the amount of R$192 million, in the third quarter of 2017; (iii) IPO of IRB, in the amount of R$149 million, in the third quarter of 2017; (iv) impairment of non-financial assets, in the amount of R$ 47 million in the third quarter of 2017; (v) reversal of tax provisions related to social security contributions - Odontoprev, in the amount of R$ 101 million in the third quarter of 2017; and (vi) contingent liabilities. In the same first nine months of 2016, this includes: (i) lump-sum bonus to employees, in the amount of R$191 million; (ii) impairment of shares, in the amount of R$57 million; (iii) costs of migration/merger of HSBC Brasil, in the amount of R$67 million (R$18 million recorded in HSBC Brasil); (iv) gain on the partial sale of investments, in the amount of R$90 million; and (v) contingent liabilities.

Summarized Analysis of Adjusted Net Income

|

To provide a better understanding and for comparison purposes, in chapters 1 and 2 of this report we use the Adjusted Income Statement, which is obtained from adjustments made to the Managerial Income Statement, detailed at the end of this Press Release

.

|

|

It should be noted that, for the accounts of the Adjusted Income Statement, effects of the consolidation of HSBC Brasil are covered, from July 1, 2016, and as additional information, we present, at the end of chapter 2 of this report, a comparison of the Financial Statements, taking into account consolidated "pro forma" financial information, including the consolidation of HSBC Brasil in the periods of 2016, for comparison purposes.

|

(1)

Income from Insurance, Pension Plans and Capitalization Bonds = Retained Premiums from Insurance, Pension Plans and Capitalization Bonds - Variation in Technical Provisions for Insurance, Pension Plans and Capitalization Bonds - Retained Claims - Capitalization Bond Draws and Redemptions - Insurance Plan, Pension Plan and Capitalization Bond Selling Expenses.

8

Economic and Financial Analysis Report - September 2017

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

Adjusted Net Income and Profitability

|

The return on average Adjusted Shareholders’ Equity (ROAE), registered 18.1% in September 2017.

In the comparison between the first nine months of 2017 and same period of previous year, the adjusted net income was up 11.2% or R$1,426 million, totaling R$14,162 million, mainly due to: (i) the reduction of the allowance for loan losses expenses, due to improvement of delinquency indicators; (ii) the increase in (a) fee and commission income and (b) insurance, pension plan and capitalization bond operations; partially impacted by: (iii) higher administrative and personnel expenses, which, combined with the other income statement lines, refer to the effect of the consolidation of HSBC Brasil in the third quarter of 2016, excluding this effect, these expenses decreased 3.1% in the period, even considering the effect of the collective bargaining agreement of 2016/2017 and the contractual adjustments; and (iv) the reduction of net interest income, due to the effect of impairment of financial assets.

|

|

|

|

Adjusted net income totaled R$4,810 million in the third quarter of 2017, up 2.3%, or R$106 million, over the previous quarter, largely due to: (i) reduction in allowance for loan losses expenses; due to improvement of delinquency indicators; (ii) the higher fee and commission income; and (iii) lower personnel expenses; partially offset by: (iv) the reduction of net interest income, impacted by the effect of the impairment of financial assets; (v) the lower income of insurance, pension plan and capitalization bond operations; and (vi) the increase in administrative expenses.

|

|

|

|

The Return on Average Assets (ROAA) recorded 1.5%. Total assets recorded R$1.312 trillion in September 2017, an increase of 3.3% compared to September 2016.

|

|

|

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

Efficiency Ratio (ER)

|

The accumulated ER (Efficiency Ratio) in the twelve months

(1)

, disregarding the effect of the impairment of financial assets, recorded 40.7%, remaining practically stable compared to the previous quarter. We highlight the better performance of: (i) operating expenses; (ii) fee and commission income; and (iii) insurance, pension plan and capitalization bond operations. Such factors were offset for the lower net interest income.

The quarterly Efficiency Ratio (ER)

(1)

excluding the effect of impairment of financial assets reached 41.5% in the third quarter of 2017, registering an increase of 1.1 p.p. compared to the previous quarter, mainly due to: (i) by the lower net interest income; (ii) lower earnings from insurance, pension plan and capitalization bond operations; partially offset by: (iii) higher fee and commission income.

The "risk-adjusted" ER

(2)

, which reflects the impact of risk associated with loan operations, the indicator reached 53.2%, an improvement of 0.5 p.p. in comparison with the previous quarter, reflecting lower expenses with allowance for loan losses.

|

|

|

|

|

ER performance reflects the strategy of sustainable growth, which includes, among others: (i) availability of products and services appropriate to customers, through segmentation of the customer base and digital channels; (ii) optimization of service points; (iii) the strict control of operating expenses arising from the actions of the Efficiency Committee, among which we highlight as a target for this year, the capture of synergies and scale gains from the merger of HSBC Brasil; and (iv) investments in Information Technology (IT), which amounted to R$4.215 billion, in the first nine months of 2017. We also highlight the fact that, for this year, we will obtain the partial effects of the Special Voluntary Severance Program Scheme (PDVE), whose deadline for participation was at the end of August 2017.

|

|

|

(1)

ER = (Personnel Expenses – Employee Profit Sharing + Administrative Expenses)/ (Net Interest Income + Fee and Commission Income + Income from Insurance + Equity in the Earnings (Losses) of Unconsolidated and Jointly Controlled Subsidiaries + Other Operating Income – Other Operating Expenses), and

(2)

Including ALL expenses, adjusted for granted discounts, credit recovery and sale of foreclosed assets, among others.

|

10

Economic and Financial Analysis Report - September 2017

|

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

Net Interest Income

In the comparison of the first nine months of 2017 and same period of previous year, net interest income decreased by 2.3%, or R$ 1,081 million, due to: (i) of the effect of impairment of financial assets, in the amount of R$1,768 million; being offset: (ii) by the higher earnings of the operations that yield “interest,” in the amount of R$798 million, especially the earnings from (a) “Securities/Other” and (b) “Credit Intermediation.”

In the comparison between the third quarter of 2017 and the previous quarter, net interest income decreased 5.7%, or R$880 million, due to: (i) effect of the impairment of financial assets, which increased R$ 520 million; and (ii) the lower non-interest earning portion of the NII in the amount of R$342 million, as a result of lower margins with (a) “Securities/Other” in the amount of R$357 million, (b) “Credit Intermediation”, in the amount of R$296 million, and partially offset by (c) an improvement of R$311 million in the margin of “Insurance”.

Interest-Earning Portion of the NII – 12-Month Average Rates

In the third quarter of 2017, the 12-month net interest margin (NII - interest-earning portion - 12-month average rate) was 6.9%, recording a decrease of 0.6 p.p. in the annual comparison and 0.3 p.p. in the quarterly comparison.

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

Expanded Loan Portfolio

(1)

|

In September 2017, Bradesco’s expanded loan portfolio stood at R$486.9 billion, with a 6.7% decrease in the last 12 months. Companies registered a decrease of 10.3%, and Loans for Individuals had a growth of 0.7%. For Individuals, the products that posted the strongest growth in the last 12 months were: (i) payroll-deductible loans; and (ii) real estate financing. For Companies, the reduction of the portfolio was mainly due to the decrease in: (i) operations abroad; (ii) working capital; and (iii) BNDES/Finame onlendings.

In the quarterly comparison, the portfolio showed a reduction of 1.4%, due to the economic scenario and the low demand for credit. The retraction of assets per business segment was as follows: (i) 2.3% for Large Corporates; and (ii) 1.8% for Micro, Small and Medium-sized Enterprises. Individuals remained stable.

|

|

|

|

|

|

(1)

In addition to Bacen loan portfolio, it includes sureties, guarantees, letters of credit, advances on credit card receivables, debentures, promissory notes, co-obligation in Certificates of real estate receivables, and rural loans.

For more information about the Expanded Loan Portfolio, see Chapter 2 of this Report.

Allowance for loan losses (ALL) expenses

|

In the first nine months of 2017, allowance for loan losses expenses totaled R$13,654 million and R$3,822 million in the third quarter of 2017, down 15.8%, or R$2,560 million from the same prior-year period and 23.1%, or R$ 1,148 million, compared to the second quarter of 2017. These reductions are a reflection of: (i) strengthening of the policy and procedures for credit granting and the quality of the guarantees obtained; (ii) the results of the improvement of credit recovery processes, which contributed to higher income from credit recovery for the period; and (iii) improvement of delinquency indicators.

|

|

|

For more information on the Allowance for Loan Losses Expenses, see Chapter 2 of this Report.

|

12

Economic and Financial Analysis Report - September 2017

|

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

Delinquency Ratio

(1)

|

90-day Delinquency Ratio

Delinquency ratio, comprising operations overdue for more than 90 days in the total portfolio, had a new decrease in this quarter.

In nominal terms, it is worth highlighting the reduction of delinquent loans for three consecutive quarters, mainly influenced by the segments of Individuals and Micro, Small and Medium-Sized Enterprises.

In the third quarter of 2017, R$4.5 billion of loan assignments (previously written-off) without retention of risks and benefits were carried out, not having significantly impacted delinquency ratios. The sales value of these portfolios has not materially impact the result.

|

|

|

|

15-90 Day Delinquency Ratio

Short-term delinquency, comprising operations 15 to 90 days past due, showed changes in the quarter, mainly due to the Large Corporates segment, impacted by the reduction in the volume of lending to this segment. For Micro, Small and Medium-Sized Enterprises, the indicator remained practically stable.

For Individuals, we highlight the permanence of the trend toward reduction the indicator since the third quarter of 2016.

|

|

|

|

Provisioning, Delinquency, ALL and Effective Coverage Ratio

It is important to highlight the robustness of the provisioning criteria adopted, which can be demonstrated by: (i) historical data analysis of recorded allowances for loan losses; and (ii) effective losses in the subsequent 12-month period. When analyzed in terms of credit losses, net of recoveries, for an existing provision of 10.1% of the portfolio

(1)

, in September 2016, the net loss in the subsequent 12 months was 5.1%, representing an effective coverage of 199.6%, and based on the estimated net loss for the next 12 months, this indicates an effective coverage ratio of approximately 250% in September 2017.

|

|

|

(1) As defined by Bacen.

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

NPL Creation 90 days x Write-offs

In the third quarter of 2017, the total NPL creation reached R$4,997 million, a reduction of 3.9%, or R$203 million, in relation to previous quarter, representing 1.4% of the Bacen loan portfolio. It is noteworthy that the NPL Creation on the Loan Portfolio for Micro, Small and Medium-Sized Enterprises and Individuals presented the lowest historical level in the series below, registering 1.8% and 1.6%, respectively.

The breakdown of the NPL Creation by business segment is shown below.

|

14

Economic and Financial Analysis Report - September 2017

|

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

Income from insurance, pension plans and capitalization bonds

|

In the first nine months of 2017, Net Income totaled R$4.127 billion, 2.0% higher than the Net Income recorded in the same period of previous year (R$4.046 billion), with an annualized return on Adjusted Shareholders’ Equity of 19.4%

(1)

.

|

|

Net Income for the third quarter of 2017 totaled R$1.483 billion (R$1.270 billion in the second quarter of 2017), with a 16.8% growth compared to the previous quarter, and the annualized return on Adjusted Shareholders’ Equity was 20.9%

(1)

.

|

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

Income from insurance, pension plans and capitalization bonds

|

In the first nine months of 2017, the production recorded an increase of 9.8% in comparison with the same period of previous year, influenced by the growth in “Life and Pension Plans” (13.8%), “Health” (7.5%), “Capitalization Bonds” (5.6%), and “Auto/P&C” (2.1%) products.

|

|

Net income of the first nine months of 2017 recorded a growth of 2.0% compared with the same period of previous year, primarily due to: (i) the increase of 9.8% in revenue; (ii) the improvement of 0.3 p.p. in claims ratio; (iii) the improvement of 0.6 p.p. in expense ratio, (iv) the improvement in the administrative efficiency ratio, partially offset by: (v) decrease in the financial income, due to the behavior of the economic-financial indices in the period; and (vi) decrease in equity results.

|

|

In the third quarter of 2017, the billing recorded an increase of 0.7% in comparison with the previous quarter, influenced by the growth in “Health” (1.5%), “Capitalization Bonds” (1.2%) and “Life and Pension Plans” (1.1%) products.

|

|

Net income for the third quarter of 2017 recorded a growth of 16.8% over the previous quarter due to: (i) the increase of 0.7% in revenue; (ii) decrease of 1.6 p.p. in the claims ratio; influenced by the “Health” segment; (iii) the 0.6 p.p. downslide in the expense ratio; (iv) the maintenance of the administrative efficiency ratio; and (v) improvement of interest income; partially offset by: (vi) the decrease in equity results.

|

|

16

Economic and Financial Analysis Report - September 2017

|

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

Fee and commission income

|

In the first nine months of 2017, fee and commission income totaled R$22,748 million, recording an increase of 11.1% or R$2,269 million compared to the same period of previous year, due to increase in the volume of operations, due to (a) an advance in the customer segmentation process, which generated a greater offer of products and services in several service channels and (b) consolidation of HSBC Brasil in the third quarter of 2016. It must be noted that the largest drivers of this result were: (i) the good performance of the card business, as a result of (a) the increase in financial volume traded and (b) the higher volume of transactions; (ii) the increase in income from the asset management; (iii) an increase in checking account fees; and increased revenue from: (iv) consortium management; (v) collections; and (vi) custody and brokerage services.

Personnel Expenses

In the comparison between the first nine months of 2017 and same period of previous year, a 16.4% increase or R$2,056 million, in personnel expenses, is explained by changes in: (i) the “structural” portion, due to the increase in expenses with payroll, social security charges and benefits, impacted by (a) the consolidation of HSBC Brasil as of the third quarter of 2016 and (b) higher salaries, in accordance with the 2016/2017 collective bargaining agreement; and (ii) the “non-structural” portion, due to higher expenses with (a) provision for labor claims and (b) employment termination costs.

In the third quarter of 2017, personnel expenses totaled R$4,833 million, a reduction of 2.7%, or R$134 million, compared to the previous quarter, reflecting the partial effects of the Special Voluntary Severance Program Scheme (PDVE), participation in which ended at the end of August 2017, being partially compensated by the increase in salary levels, according to the 2017 collective bargaining agreement.

|

|

Total fee and commission income amounted to R$7,822 million in the third quarter of 2017, up 4.3%, or R$326 million, in comparison with the previous quarter, mainly due to higher volume of operations, in part a reflection of: (i) the greater offering of products and services to customers; (ii) better performance of underwriting/financial advisory services; and (iii) the higher number of business days.

|

|

|

|

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

Administrative Expenses

|

In the comparison between the first nine months of 2017 and the same period of previous year, administrative expenses increased 7.7%, or R$1,059 million, reflecting: (i) a growth in the volume of business and services for the period; (ii) the consolidation of HSBC Brasil, as of the third quarter of 2016; and (iii) contract price adjustments.

|

|

Total Administrative Expenses amounted to R$5,030 million in the third quarter of 2017, up 2.7%, or R$132 million, in comparison with the previous quarter, due to: (i) the increase in the volume of business and services concentrated in the period, which resulted in higher expenses on (a) outsourced services, (b) communication, and (c) data processing; and (ii) higher expenses on advertising and marketing, mainly related to the “Pra frente” campaign.

|

|

It should be noted that the expenses recorded during nine months of 2017 already show the partial effects of the synergies and gains of scale resulting from the merger of HSBC Brasil activities in October 2016, especially when comparing third quarter of 2017 with the third quarter of 2016 and there is a reduction of 5.8%.

|

|

|

|

(1)

The decrease observed as of 2015 is related to: (i) the migration of “External ATM Network Points – Bradesco” to “Banco24Horas Network”; (ii) the deactivation of ATMs from “Banco24Horas Network”; and (iii) the decrease of Bradesco Expresso (Correspondent Banks).

|

|

Other Operating Expenses, Net of Income

In the first nine months of 2017, other operating expenses, net of income totaled R$5,470 million, registering an increase of 1.7% or R$89 million, compared to the same period the previous year, mainly reflecting the effect of the consolidation of HSBC Brasil, which took place starting in the third quarter of 2016.

|

|

|

|

In the comparison between the third quarter of 2017 and the previous quarter, other operating expenses, net of income, increased by 3.0%, or R$54 million, due to higher operating provisions.

|

|

|

18

Economic and Financial Analysis Report - September 2017

|

|

Press Release

|

|

|

Summarized Analysis of Adjusted Net Income

|

|

|

Income Tax and Social Contribution

In the comparison of the first nine months of 2017 and same period of the previous year, income tax and social contribution expenses decreased by 14.1%, or R$871 million, mainly impacted by the deductibility of goodwill amortization in the acquisition of HSBC Brasil as of the fourth quarter of 2016.

|

|

|

|

In the third quarter of 2017, expenses on income tax and social contribution increased 4.2%, or R$72 million compared to the previous quarter, due to: (i) the increase in equity results; and partially offset by: (ii) the greater effect of the provisioning of interest on shareholders’ equity in the third quarter of 2017.

|

|

|

|

Unrealized Gains

In the third quarter of 2017, unrealized gains reached R$31,206 million, an increase of 33.4%, or R$7,811 million, compared to the second quarter of 2017, a reflection of the increase in market value of: (i) fixed-income securities; and (ii) loan operations; partially offset by: (iii) the devaluation of shares of Cielo, which decreased 10.7% in the period.

|

|

|

|

Press Release

|

|

|

Capital Ratios - Basel III

|

|

|

Basel Ratio

In September 2017, the Reference Equity of the Prudential Conglomerate reached R$106,682 million, as compared to risk-weighted assets of R$604,581 million. The Basel Ratio increased 1.0 p.p., from 16.7% in June 2017 to 17.7% in September 2017, Tier I Capital ratio reached 13.4% in September 2017, an increase of 0.9 p.p. in relation to June 2017, basically impacted: (i) by the increase in Shareholders' Equity, due to (a) the increase in income in the quarter and (b) the mark-to-market positive effect of available-for-sale securities; and (ii) by the reduction of weighted assets.

|

|

|

|

|

|

The table below shows the main events that impacted the Tier I Capital ratio in the third quarter of 2017:

|

|

Full Impact – Basel III

We calculated a Basel III simulation, considering some of the main future adjustments, which include: (i) deductions of 100% according to the schedule of phase-in arrangements; (ii) the allocation of resources, obtained via payment of dividends, by our Insurance Group; (iii) consumption of tax credits; (iv) the decrease in the market and operational risk multiplier (early adoption), from 9.250% to 8%; and (v) the impact of the acquisition of HSBC Brasil (amortization of goodwill/ intangible assets and synergies in the process of integration), reaching a Tier I Capital ratio of 13.3%, which, added to potential funding obtained via subordinated debt, may reach a Tier I Capital ratio of approximately 13.9% at the end of 2018.

|

|

|

(1)

Published (Schedule 80%);

(2)

Effect of the full impact. Also includes, the Goodwill / Intangible assets stock paid for the acquisition of HSBC Brasil, net of amortizations and the allocation of resources, obtained via payment of dividends, by the Insurance Group;

(3)

Considers the decrease in the market and operational risks multiplier (early adoption), from 9.250% to 8% in 2019;

(4)

If the bank exercises the possibility of issuance of additional capital by 2018 (if there were market conditions), the Tier I capital ratio would reach 13.9%; and

(5)

They refer to the minimum required ratio, in accordance with Resolution No. 4,193/13, added to the additional capital installments established by Circular Letters No. 3,768/15 and No. 3,769/15.

|

20

Economic and Financial Analysis Report - September 2017

|

|

Press Release

|

|

|

Economic

Environment

|

|

|

During the third quarter of 2017, the positive news about the performance of Brazilian economic activity persisted. The data indicated a more pronounced and disseminated growth, which motivated us to revise the Gross Domestic Product (GDP) projection to 0.9% this year and 2.8% in 2018. Doubts regarding the weight of the effect of the release of FGTS funds on the recovery have been dissipating in recent months, with positive surprises in several indicators, such as sales of construction materials, vehicle sales, retail sales, industrial production, and others.

|

|

By the end of this year, we estimate a foreign exchange of R$3.10, and by 2018, we believe that the gradual normalization of monetary policy in the US should not destabilize financial markets decisively. Thus, we project an exchange rate of R$3.20 for the coming year.

|

|

Qualitatively, in the short term, consumption will continue to drive economic activity, but gradually investments will support expansion of the cycle. In fact, recent indicators showed a slight recovery in the production of capital goods, as well as imports of these items. Thus, as predictability on the sustainability of this resumption and the reduction of idleness begins to increase, investments are expected to show acceleration.

|

|

Despite the increasingly clear realization that economic growth and real interest rates are at an expanding level, we estimate that the economic scenario at the beginning of next year (low inflation, moderate growth and well-anchored expectations) will continue to favor a “fine tuning” of the monetary policy. We estimate the Selic rate at 7.0% this year and 6.75% in 2018. The longer-lasting drop in the structural interest rate remains dependent on the continuity of the planned reforms. It is worth noting that relevant measures have already been approved, such as the LTR (long-term rate), the spending ceiling, and labor reform, which contribute to reducing the long-term interest rate.

|

|

Despite the positive information on the activity, surprise decreases in inflation rates persisted between July and September. The positive developments of this year’s agricultural crop have been confirmed in a favorable supply shock and involved persistently below-expected household grocery prices. Prospectively, the anchoring of expectations, reduced inertia, idle industry, slack in the labor market, and absence of pressure on the balance of payments, are expected to ensure a favorable scenario for inflation. Thus, we estimate an increase of 3.0% in the Extended Consumer Price Index (IPCA) in 2017, and of 3.9% in 2018.

|

|

However,

structural actions remain fundamental. Despite the current positive surprises with fiscal data, stemming from extraordinary revenues and improved prospects for growth, further advances toward meeting the spending ceiling in the medium term are essential.

|

|

A relevant aspect for the reduced concern about inflation comes from our evaluation of the behavior of the foreign exchange rate. We believe that country risk premiums will remain relatively stable and that the external scenario will remain at least reasonable for assets of emerging countries. Data on the global economy indicate solid and diffused growth, with annual Gross Domestic Product (GDP) growth around 4.0% for the second consecutive quarter, the highest rate since 2009. In this context, discussions on the normalization of the monetary policy are intensifying. However, despite favorable data from worldwide activity, inflation has remained in check, a fact that imposes gradualism in the process of monetary adjustment, thereby reducing the risk of major ruptures in asset prices and global liquidity.

|

|

Finally, the Brazilian macroeconomic scenario has proven to be more favorable to the credit market. In this regard, data from the national financial system showed a slight recovery in corporate lending as well as consolidated signs of expansion of household lending. At the same time, the delinquency rate has proven to be more benign.

Accordingly, Bradesco maintains a positive outlook for the nation, foreseeing favorable prospects in the segments in which it operates, both in the short and long term.

|

|

Press Release

|

|

|

Main Economic Indicators

|

|

Projections up to 2019

Bradesco's Perspectives for 2017

This guidance contains forward-looking statements that are subject to risks and uncertainties, as they are based on Management’s expectations and assumptions and information available to the market as of the date hereof.

(1)

Includes the merger of HSBC Brasil during the entire period of analysis to favor the comparability.

|

22

Economic and Financial Analysis Report - September 2017

|

|

Press Release

|

|

|

Managerial Income Statement

vs.

Adjusted Income Statement

|

|

Analytical Breakdown of Managerial Income Statement

(1)

vs.

Adjusted Income Statement

(3)

Third Quarter of 2017 and Second Quarter of 2017

(1)

For more information, please see note 4 – Managerial Statement of Financial Position and Statement of Income by Operating Segment, in chapter 6 of this report;

(2)

Includes reclassifications between the lines of the income statement, which do not affect Net Income, but allow a better analysis of the lines of business, highlighting: (i) tax hedge adjustment, which represents the partial result of the derivatives used for the purpose of hedging investments abroad, which in terms of Net Income simply annuls the tax effect (IR/CS and PIS/COFINS) of this hedge strategy, the amount of R$1,822 million in the third quarter of 2017 and R$1,809 million in the second quarter of 2017; and

(3)

It refers to Managerial Income Statement

(1)

with the reclassifications between lines, which do not affect the Net Income, and without the non-recurring events of the period.

|

Press Release

|

|

|

Managerial Income Statement

vs.

Adjusted Income Statement

|

|

Analytical Breakdown of Managerial Income Statement

(1)

vs.

Adjusted Income Statement

(3)

First nine months of 2017 and First nine months of 2016

(1)

For more information, please see note 4 – Managerial Statement of Financial Position and Statement of Income by Operating Segment, in chapter 6 of this report;

(2)

Includes reclassifications between the lines of the income statement, which do not affect Net Income, but allow a better analysis of the lines of business, highlighting: (i) the adjustment of the tax hedge, which represents the partial result of the derivatives used for hedging investments abroad, which – in terms of net income – simply cancels the tax effect (IR/CS and PIS/COFINS) of this hedge strategy, in the amount of R$1,188 million in the first nine months of 2017 and R$8,512 million in the first nine months of 2016; and (ii) that, in the first nine months of 2017, it includes reclassification (a) of the reversal of provision for guarantees provided, encompassing sureties, guarantees, credit letters, and standby letter of credit, in the amount of R$2,456 million, which was recorded under “Other Operating Income”, as described in Note 27 and (b) in this same amount; “excess provision” was formed, being recorded in “ALL Expenses” and not impacting income for the period. It is important to note that, as of December 31, 2016, the “excess provision” concept included the provision for guarantees provided, encompassing sureties, guarantees, credit letters, and standby letter of credit, in the amount of R$3,061 million. In accordance with Resolution No. 4,512/16, in the first quarter of 2017, part of this balance, in the amount of (a) R$605 million, was allocated to a specific account of provision for guarantees provided encompassing sureties, guarantees and credit letters under “Other Liabilities - Sundry”, and the remaining balance, in the amount of (b) R$2,456 million, as already mentioned, was allocated to “excess provision”, and

(3)

It refers to Managerial Income Statement

(1)

with the reclassifications between lines, which do not affect the Net Income, and without the non-recurring events of the period.

|

24

Economic and Financial Analysis Report - September 2017

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 01, 2017

|

BANCO BRADESCO S.A.

|

|

|

|

By:

|

|

/S/

Alexandre da Silva Glüher

|

|

|

|

Alexandre da Silva Glüher

Executive Vice President

,

Chief Risk Officer (CRO)

and

Investor Relations Officer.

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

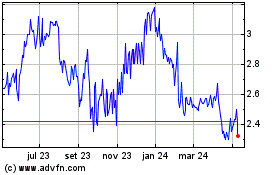

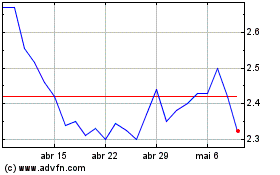

Banco Bradesco (NYSE:BBDO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Banco Bradesco (NYSE:BBDO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024