Pound Weakens After U.K. Manufacturing PMI Falls To 8-month Low

01 Abril 2014 - 7:05AM

RTTF2

The pound slipped against other major currencies in European

deals on Tuesday after U.K. manufacturing sector growth slowed

unexpectedly to an eight-month low in March.

The survey data from Markit Economics showed today that the

seasonally adjusted Markit/Chartered Institute of Purchasing &

Supply Purchasing Manager's Index fell to 55.3 in March from 56.2

in February, signaling a further cooling of growth from the peaks

scaled towards the end of last year.

The score was forecast to rise to 56.7 in March. Nonetheless,

the above neutral 50 reading indicates expansion in the sector.

Meanwhile, European stocks rose on better-than-expected China

official manufacturing PMI and comments from Federal Reserve Chair

Janet Yellen that the U.S. economy still needs "extraordinary"

monetary support "for some time" to ensure more sustained

recovery.

The pound reached as low as 1.6645 against the greenback, down

from yesterday's closing quote of 1.6662. Further weakness may take

the pound to a support around the 1.65 mark.

The pound reversed from an early high of 1.4750 against the

franc, falling to 1.4701. If the pound extends decline, it may eye

support around the 1.46 zone.

The pound fell to 0.8292 against the euro, down from high of

0.8261 hit around 2:50 am ET. On the downside, the pound may test

support around the 0.835 mark.

The Eurozone jobless rate remained unchanged in February, data

from Eurostat showed today.

The unemployment rate held steady at 11.9 percent after the

January figure was revised down from 12 percent. Economists had

forecast the rate to remain unchanged at January's originally

estimated 12 percent.

The pound showed a mild pullback against the yen with pair

trading around 172.04, down from an early 3-week high of

172.32.

An index monitoring business sentiment in Japan showed mild

upside in the first quarter of 2014, the Bank of Japan revealed

today in its quarterly Tankan business survey - although the

outlook for the second quarter is somewhat less optimistic.

The large manufacturers index came in with a six-year high score

of 17, missing forecasts for 18 but up from 16 in the fourth

quarter of last year.

Looking ahead, U.S. ISM manufacturing index for March and

construction spending for February are set for release in the New

York session.

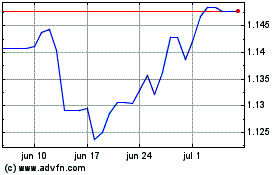

Sterling vs CHF (FX:GBPCHF)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Sterling vs CHF (FX:GBPCHF)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024