Pound Declines Against Majors

27 Fevereiro 2015 - 9:11AM

RTTF2

The pound declined against its key counterparts on Friday's

European deals, as traders became cautious ahead of economic data

from U.S. and Germany, due shortly.

The U.S. economy is expected to grow at an annual pace of 2

percent in the fourth quarter, down from the initial estimate of

2.6 percent. This follows a 5 percent GDP growth in the third

quarter that was the strongest in 11 years.

Data showed yesterday that U.S. consumer prices turned negative

in January, far away from the Federal Reserve's inflation target of

2.0 percent. The Fed is not likely to hike rates rapidly, unless

inflation ticks back up.

At 8 am ET, Destatis will release its German preliminary

consumer prices report. Inflation is expected to remain in a

deflationary territory in February, with a 0.3 percent fall

annually, after the 0.4 percent drop last month. The harmonized

measure of consumer prices are expected to fall at the stable rate

of 0.5 percent in February.

In an interview with Yorkshire Post newspaper, the Bank of

England policy maker Kristin Forbes told that the sharp decline in

inflation experienced by the U.K. is temporary and it is not long

lasting.

"We shouldn't let the headline inflation figure detract from the

underlying strong fundamentals in the economy," she told, adding

that it "means we will need to start to think about normalising

interest rates."

The pound declined to 1.5383 against the greenback, a 4-day low,

down from an early high of 1.5448. The next likely support for the

pound is seen around the 1.52 zone.

The pound reversed from an early more than 7-year high of 0.7256

versus the euro, edging down to 0.7297. If the pound extends slide,

0.76 is seen as its next possible support level.

Germany's import prices declined at a slower-than-expected pace

in January, yet logged its worst fall in more than five years,

figures from Destatis showed.

The import price index fell 4.4 percent year-on-year at the

start of the year, faster than December's 3.7 percent decline.

Economists had forecast a 4.6 percent fall for the month.

The pound slipped to a 2-day low of 183.53 against the Japanese

yen in early deals and has been steady thereafter. Continuation of

the pound's downtrend may lead it to a support around the 182.00

mark.

Japan housing starts declined more than expected in January,

data from the Ministry of Land, Infrastructure, Transport and

Tourism showed.

Housing starts decreased 13 percent year-on-year in January,

faster than an expected 11.6 percent fall.

The U.K. currency weakened to a 4-day low of 1.4580 against the

Swiss franc at 4:30 am ET and moved sideways since then. Next key

support for the pound may be located around the 1.40 region.

Looking ahead, the second estimate of U.S. fourth quarter GDP

data, pending home sales for January and Reuters/University of

Michigan's final consumer sentiment index for February are due in

the New York session.

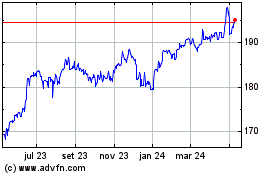

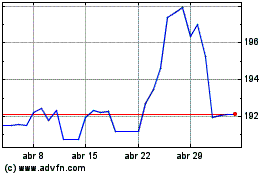

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024