Euro Rises Against Majors

16 Abril 2015 - 1:23AM

RTTF2

The euro strengthened against the other major currencies in the

Asian session on Thursday, after the European Central Bank

Wednesday decided to leave interest rates unchanged for a sixth

straight session. The refinancing rate was left unchanged at a

record low 0.05 percent. The ECB issued an optimistic outlook for

the Quantitative Easing program.

Speaking at a post-decision press conference in Frankfurt, ECB

chief Mario Draghi said the the massive asset purchase program is

proceeding smoothly and is having an impact on economic activity,

which is expected to gradually strengthen in the months ahead.

"The implementation of our asset purchase programmes is

proceeding smoothly, with volumes in line with the announced figure

of EUR 60 billion of securities per month," Draghi said.

"In addition, there is clear evidence that the monetary policy

measures we have put in place are effective," he said.

Further, the ECB President said the euro area economic activity

has gained momentum since last year and the bank expects recovery

to broaden and strengthen gradually.

Meanwhile, most Asian stock markets were trading higher, with

investors indulging in some bargain hunting following the overnight

gains on Wall Street. In addition, higher commodity prices lifted

resource stocks.

Wednesday, the euro showed mixed trading against its major

rivals. While the euro fell against the pound and the Swiss franc,

it held steady against the U.S. dollar and the yen.

In the Asian trading today, the euro rose to a 1-week high of

1.0746 against the U.S. dollar, from yesterday's closing value of

1.0682. On the upside, 1.11 is seen as the next resistance level

for the euro.

Against the yen and the pound, the euro advanced to a 6-day high

of 127.85 and a 2-day high of 0.7230 from yesterday's closing

quotes of 127.28 and 0.7196, respectively. If the euro extends its

uptrend, it is likely to find resistance around 132.00 against the

yen and 0.74 against the pound.

The euro edged up to 1.0337 against the Swiss franc. At

yesterday's close, the euro was trading at 1.0299 against the euro.

The euro may test resistance near the 1.07 region.

Looking ahead, Swiss producer and import prices for March is due

to be released at 3:15 am ET.

In the New York session, U.S. building permits and housing

starts - both for March, U.S. weekly jobless claims for the week

ended April 11 and Reserve Bank of Philadelphia's manufacturing

index for April are slated for release.

At 1:00 am ET, Federal Reserve Bank of Atlanta President Dennis

Lockhart will deliver a speech about the US economic outlook and

monetary policy at the Palm Beach County Convention Center.

After 10 minutes, Federal Reserve Bank of Cleveland President

Loretta Mester will speak on the economy before the Forecasters

Club of New York. Subsequently, Federal Reserve Bank of Boston

President Eric Rosengren participates in "The U.S. Economic Outlook

and Implications for Monetary Policy" event hosted by Chatham House

in London at 1:30 pm ET.

At 3:00 pm ET, Federal Reserve Governor Stanley Fischer will

participate in a panel discussion titled "The Elusive Pursuit of

Inflation" at the International Monetary Fund Spring Meetings in

Washington DC at 3:00 pm ET.

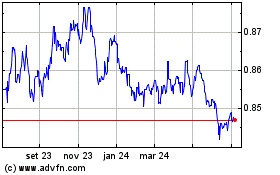

Euro vs Sterling (FX:EURGBP)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

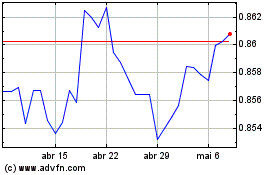

Euro vs Sterling (FX:EURGBP)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024