Aussie Falls As Australia Jobless Rate Rises

07 Maio 2015 - 1:13AM

RTTF2

The Australian dollar weakened against the other major

currencies in the Asian session on Thursday, after data showed that

the nation's unemployment rose in line with economists' expectation

in April, fueling speculation about further interest rate cut by

the central bank.

Data from the Australian Bureau of Statistics showed that the

unemployment rate in Australia came in at a seasonally adjusted 6.2

percent in April. That was in line with expectations, and up from

6.1 percent in March.

The Australian economy lost 2,900 jobs last month - missing

expectations for an increase of 4,000 jobs following the increase

of 37,700 jobs in the previous month.

At the May 5th monetary policy meeting, the Reserve Bank of

Australia lowered its overnight cash-rate by 25 basis points to a

new record low of 2.00 percent, from 2.25 percent.

Meanwhile, Asian stock markets were trading lower, following the

negative cues from Wall Street overnight after Federal Reserve

Chair Janet Yellen warned about high stock valuations. The

continued increase in bond yields also weighed on investor

sentiment.

In other economic news, data from the Australian Industry Group

revealed that the construction sector in Australia swung back to

contraction in April, with a PMI score of 47.0. That's down sharply

from 50.1 in March, and it moves back beneath the boom-or-bust line

of 50 that separates expansion from contraction.

Wednesday, the Australian dollar rose against its major rivals,

after data showed that the services sector in China expanded at an

accelerated pace in April.

The Australian dollar rose 0.93 percent against the U.S. dollar,

0.56 percent against the yen, 1.05 percent against the euro, 0.37

percent against the Canadian dollar and 1.44 percent against the NZ

dollar on Wednesday.

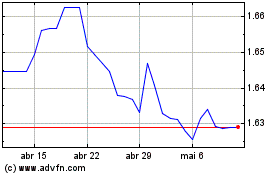

In the Asian session today, the Australian dollar fell to a

3-day low of 1.4288 against the euro, from yesterday's closing

value of 1.4231. The aussie may test support near the 1.44

region.

The aussie dropped to 2-day lows of 94.69 against the yen and

0.9554 against the Canadian dollar, from yesterday's closing quotes

of 95.18 and 0.9587, respectively. If the aussie extends its

downtrend, it is likely to find support around 91.60 against the

yen and 0.93 against the loonie.

Against the U.S. and the New Zealand dollars, the aussie edged

down to 0.7924 and 1.0576 from yesterday's closing quotes of 0.7967

and 1.0625, respectively. On the downside, 0.76 against the

greenback and 1.02 against the kiwi are seen as the next support

level for the aussie.

Looking ahead, Swiss SECO consumer confidence for April is due

to be released at 1:45 am ET. After 15 minutes, German factory

orders for April is also due.

In the European session, the German construction PMI and

Eurozone retail PMI- both for April, are set to be published.

In the New York session, Canada building permits for March, U.S.

weekly jobless claims for the week ended May 2 and U.S. consumer

credit for March are set to be announced.

At 8:30 am ET, Federal Reserve Bank of Chicago President Charles

Evans is expected to speak on current economic conditions and

monetary policy, in New York.

Subsequently, European Central Bank board member Yves Mersch

will deliver a lecture at the Barcelona Graduate School of

Economics in Spain at 12:45 pm ET.

Euro vs AUD (FX:EURAUD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Euro vs AUD (FX:EURAUD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024