U.S. Dollar Slides Ahead Of U.S. GDP Data

29 Maio 2015 - 3:58AM

RTTF2

The U.S. dollar weakened against the other major currencies in

the Asian session on Friday, as investors took a breather after

recent rally and awaited the release of U.S. GDP data later in the

day.

The Commerce Department is slated to release second estimate of

first quarter GDP data at 8:30 am ET. Economists expect the GDP to

be revised down to 0.8 percent, compared to 0.2 percent rise

initially recorded in the first quarter. In the fourth quarter, the

GDP expanded by 2.2 percent.

Traders also mulled over some soft data from the U.S. with

initial claims for unemployment benefits rising more than expected

last week.

The Labor Department report on Thursday showed another uptick in

initial jobless claims in the week ended May 23, after reporting a

modest increase in first-time claims for U.S. unemployment benefits

in the previous week. Initial jobless claims edged up to 282,000,

an increase of 7,000 from the previous week's revised level of

275,000. Economists expected jobless claims to dip to 270,000 from

the 274,000 originally reported for the previous week.

Ongoing uncertainty about the situation in Greece kept investors

cautious following yesterday's mixed comments regarding the

embattled nation's negotiations with its creditors.

While Greek Prime Minister Alexi Tsipras told reporters his

government is close to an agreement to secure funding from its

lenders, European Commission Vice President Valdis Dombrovskis said

the two sides still have a ways to go.

The outcome of a meeting of G7 finance ministers in Dresden

today could shed more light on how Greece's international creditors

seek to end the impasse.

In the Asian trading today, the U.S. dollar fell to a 5-day low

of 0.9408 against the Swiss franc, a 3-day low of 1.0973 against

the euro and a 2-day low of 1.2410 against the Canadian dollar,

from yesterday's closing quotes of 0.9424, 1.0945 and 1.2433,

respectively. If the greenback extends its downtrend, it is likely

to find support around 0.91 against the franc, 1.13 against the

euro and 1.20 against the loonie.

Against the pound and the yen, the greenback dropped to 1.5341

and 123.59 from yesterday's closing quotes of 1.5310 and 123.94,

respectively. On the downside, 1.58 against the pound and 121.00

against the yen are seen as the next support level for the

greenback.

Looking ahead, Swiss KOF leading indicator for May and Eurozone

M3 money supply data for April are slated for release in the

European session.

In the New York session, the first quarter Canada GDP data,

second estimate of U.S. GDP data for first quarter and University

of Michigan's final consumer sentiment index for May are due.

At 7:00 am ET, European Central Bank board member Yves Mersch

speaks at the Bulgarian Authorities 2015 IMF/World Bank

Constituency Meetings, in Sofia, Bulgaria.

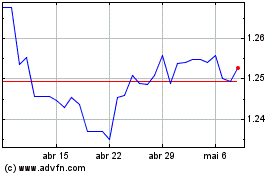

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

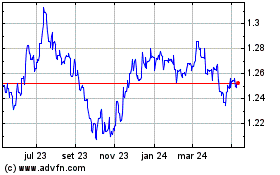

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024