Euro Strengthens Against Majors

29 Maio 2015 - 9:23AM

RTTF2

The euro spiked up against most major currencies in European

deals on Friday, as investors monitored ongoing Greek negotiations,

with the Mediterranean nation aiming to clinch a deal with its

creditors by Sunday.

Speaking on the sidelines of G7 meeting, EU Commissioner on

Economic Affairs Pierre Moscovici told that Greece's negotiations

has been progressing in recent days and a Greek exit is not on

cards.

Moscovici's comments contradicted to those made by International

Monetary Fund Christine Lagarde, who said Greece's exit from the

Eurozone is a possibility, but it would probably not be an end to

the euro.

Greek government is of the view that a deal could be struck by

Sunday, as time is too short to meet its payment to the IMF next

week.

Meanwhile, uncertainty over Greece's ability to reach a deal

with its creditors undermined European stocks.

Preliminary figures from the statistical office Destatis showed

that Germany's retail sales increased at a faster-than-expected

pace in April, after declining in the previous two months.

Retail sales climbed a seasonally and calender-adjusted 1.7

percent month-over-month in April, in contrast to a 1.4 percent

decline in March.

The euro has been lower against its major rivals, except the

yen, in Asian trading.

In European trading, the euro rose to a 4-day high of 1.0989

against the greenback, 10-day high of 0.7198 against the pound and

an 11-day high of 136.00 against the yen, off early lows of 1.0925,

0.7139 and 135.42, respectively. The next possible resistance for

the euro may be located around 1.12 against the greenback, 0.725

against the pound and 136.5 against the yen.

The 19-nation currency strengthened to more than a 3-week high

of 1.4350 against the aussie and a 3-1/2-month high of 1.5415

against the NZ dollar, bouncing off from its previous lows of

1.4275 and 1.5243, respectively. If the euro extends rise, it may

challenge resistance around 1.45 against the aussie and 1.57

against the kiwi.

Reversing an early low of 1.3592 against the loonie, the euro

edged up to 1.3659. Next key resistance for the euro may be located

around the 1.376 mark.

Looking ahead, the first quarter Canada GDP data, second

estimate of U.S. GDP data for first quarter and University of

Michigan's final consumer sentiment index for May are due in the

New York session.

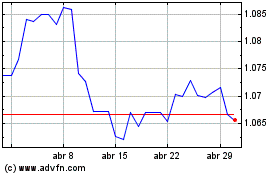

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024