Dollar Extends Slide As Economy Contracts

29 Maio 2015 - 10:37AM

RTTF2

The U.S. dollar continued to be weaker on Friday, after data

showed that U.S. economic activity contracted for the first time in

a year in the first quarter of 2015.

Revised data released by the Commerce Department showed that the

gross domestic product fell by 0.7 percent in the first quarter

compared to the previously reported 0.2 percent uptick. The drop

came on the heels of a 2.2 percent increase in the fourth

quarter.

The revised decrease in GDP in the first quarter was still

slightly smaller than the 0.8 percent drop expected by

economists.

The U.S. consumer sentiment and Chicago-area business activity

are due out shortly, which may offer further clues about the state

of economy.

The greenback has been rallying this week as positive economic

data supported hopes that Federal Reserve may start raising rates

around September. Nevertheless, the greenback was trading mixed on

Thursday.

In Asian trading, the currency was steady against the euro and

the franc but fell against the yen and the pound.

In European trading, the greenback depreciated by 0.35 percent

to hit a weekly low of 0.9392 against the franc, compared to

yesterday's closing value of 0.9425. The next possible support for

the greenback-franc pair may be located around the 0.92 zone.

Data published by the State Secretariat for Economic Affairs

revealed that the Swiss economy shrank unexpectedly in the first

quarter largely due to weak exports.

Gross domestic product fell 0.2 percent sequentially in the

first quarter, reversing the prior quarter's 0.5 percent

increase.

The greenback declined to a 4-day low of 1.0996 against the

European currency, down by 0.46 percent from Thursday's closing

quote of 1.0946. Next key support for the greenback is likely seen

around the 1.10 region.

Preliminary figures from the statistical office Destatis showed

Germany's retail sales increased at a faster-than-expected pace in

April, after declining in the previous two months.

Retail sales climbed a seasonally and calender-adjusted 1.7

percent month-over-month in April, in contrast to a 1.4 percent

decline in March.

Reversing from an early nearly 3-week high of 1.5235 against the

pound, the greenback dropped to 1.5295. At Thursday's close, the

pair was valued at 1.5310. Continuation of the greenback's

downtrend may take it to a support around the 1.54 region.

On the flip side, the greenback remained firmer against the yen,

trading around yesterday's closing value of 123.94. This may be

compared to an early low of 123.60.

Data from the Ministry of Internal Affairs and Communications

showed that Japan's consumer prices increased at a slower rate in

April compared to the previous month.

The consumer price index were up 0.6 percent on year in April,

slower than the previous month's 2.3 growth.

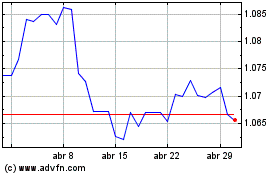

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024