Aussie Falls On Weak Retail Sales, Trade Data

04 Junho 2015 - 12:49AM

RTTF2

The Australian dollar weakened against the other major

currencies in the Asian session on Thursday following the release

of disappointing trade and retail sales data for April.

Data from the Australian Bureau of Statistics showed that

Australia had a merchandise trade deficit of A$3.888 billion in

April. That was wider than forecasts for a shortfall of A$2.10

billion following the upwardly revised A$1.231 billion shortfall in

March.

Exports were down 6.0 percent on month to A$25.659 billion,

while imports advanced 4.0 percent to A$29.547 billion.

Another data from the same agency showed that the total value of

retail sales in Australia was flat on a seasonally adjusted monthly

basis in April, coming in at A$24.097 billion. That missed

forecasts for an increase of 0.3 percent, which would have been

unchanged from the March reading.

Meanwhile, the Australian stock market pared initial gains and

slipped into negative territory, extending its losses to a fourth

straight day. Australia's benchmark S&P/ASX200 Index is

currently down 23.80 points or 0.43 percent at 5,559. The broader

All Ordinaries Index is also currently down 24.00 points or 0.43

percent at 5,564.

Wednesday, the Australian dollar rose against its major rivals,

after data showed that the nation's gross domestic product expanded

more than expected in the first quarter of 2015. The aussie rose

0.37 percent against the U.S. dollar, 0.42 percent against the yen,

0.60 percent against the Canadian dollar and 0.71 percent against

the NZ dollar.

In the Asian trading today, the Australian dollar fell to nearly

a 3-1/2-month low of 1.4598 against the euro, from yesterday's

closing value of 1.4476. The aussie may now seek support near the

1.48 region.

The aussie dropped to a 2-day low of 95.97 against the yen, from

yesterday's closing value of 96.71. On the downside, 93.00 is seen

as the next support level for the aussie.

Against the U.S., the New Zealand and the Canadian dollars, the

aussie slipped to 2-day lows of 0.7708, 1.0805 and 0.9610 from

yesterday's closing quotes of 0.7785, 1.0879 and 0.9679,

respectively. If the aussie extends its downtrend, it is likely to

find support around 0.75 against the greenback, 1.04 against the

kiwi and 0.94 against the loonie.

Looking ahead, ECB council members Yves Mersch and Erkki

Liikanen will deliver speeches at a ECB/Bank of Finland conference

entitled "Getting the balance right: innovation, trust and

regulation in retail payments" in Helsinki, Finland at 2:00 am

ET.

In the European session, Eurozone retail PMI for May is due to

be released.

In the New York session, U.S. weekly jobless claims for the week

ended May 30 and Canada Ivey PMI for May are slated for

release.

The Bank of England will announce its interest rate decision at

7:00 am ET. Economists expect the bank to retain interest rates

unchanged at 0.50 percent and asset purchase target at GBP 375

billion.

At 12:00 pm ET, Federal Reserve Governor Daniel Tarullo is

expected to participate in a panel discussion titled "Conversation

on the Economy and Financial Regulation" at the 2015 Institute for

International Finance North America Summit in New York.

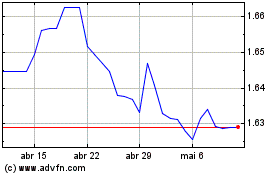

Euro vs AUD (FX:EURAUD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Euro vs AUD (FX:EURAUD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024