Dollar Advances Ahead Of U.S. Jobs Data

02 Outubro 2015 - 5:22AM

RTTF2

The U.S. dollar strengthened against its most major rivals in

European deals on Friday, ahead of the closely-watched U.S. jobs

report due today, which could help shed more light on the Federal

Reserve's monetary policy.

The U.S. Labor Department report is expected to show an increase

of about 203,000 jobs in September following the addition of

173,000 jobs in August. The rate of unemployment is expected to

remain at 5.1 percent.

Strong report would boost expectations that the US Federal

Reserve will lift interest rates soon.

While speaking at a luncheon of community leaders in Salt Lake

City, Federal Reserve Bank of San Francisco President John Williams

said Thursday that a rate hike is certainly on cards this year,

which may occur as soon as October.

"There's always going to be risks, there's always going to be

uncertainties," he told. Even so, "we're going to have to take

actions that we think are the appropriate ones given our

goals."

The currency moved down on Thursday, as jobless claims

more-than-expected in the week ended September 26th and ISM

manufacturing index fell to a two-year low in September.

The greenback has been higher against the euro, yen and the

franc in the Asian session. Against the pound, the currency trended

lower.

In European trades, the greenback climbed to 1.1150 against the

euro, off its prior low of 1.1204. Continuation of the uptrend's

may take the greenback to a resistance around the 1.10 region. At

Thursday's close, the pair was valued at 1.1193.

Figures from Eurostat showed that Eurozone's producer prices

declined at a faster-than-expected pace in August.

The producer price index fell 2.6 percent year-over-year in

August, which was worse than the 2.1 percent decrease in July.

Economists had expected a 2.4 percent drop for the month.

Bouncing off from an early low of 0.9762 against the Swiss

franc, the greenback climbed to a 4-day high of 0.9795. The next

possible resistance for the greenback is seen around the 0.985

level.

The greenback appreciated to 120.25 against the Japanese yen, up

by 0.39 percent from a low of 119.78 hit at 7:45 pm ET. The

greenback is seen finding resistance around the 121.5 zone.

Data from the Ministry of Internal Affairs and Communications

showed that Japan's unemployment rate in came in at a seasonally

adjusted 3.4 percent in August.

That was above forecasts for 3.3 percent, which would have been

unchanged from the July reading.

The greenback reached as high as 1.3251 against the loonie at

6:10 am ET, before holding steady in a short while. The

greenback-loonie pair closed Thursday's trading at 1.3266.

Meanwhile, the greenback fell to 1.5173 against the Sterling at

4:30 am ET, and has been steady thereafter. The pair was valued at

1.5130 when it ended Thursday's trading.

British construction activity growth improved sharply in

September as output grew at the fastest pace in seven months, led

by residential building, prompting firms to add jobs the strongest

pace in three months, survey results from Markit Economics and the

Chartered Institute of Procurement & Supply showed.

The headline seasonally adjusted Marikt/CIPS UK Construction

Purchasing Managers' Index climbed to 59.9 from 57.3 in August.

Economists had expected only a modest improvement with an increase

to 57.5.

Besides U.S. jobs data, factory orders data for August is slated

for release in the New York session.

At 8:45 am ET, Federal Reserve Bank of Philadelphia President

Patrick Harker is scheduled to give opening remarks before the "New

Perspectives on Consumer Behavior in Credit and Payments Markets"

conference hosted by the Federal Reserve Bank of Philadelphia.

Half-an-hour later, Federal Reserve Bank of St. Louis President

James Bullard is expected to speak on the economy and monetary

policy before a Shadow Open Market Committee meeting hosted by the

Manhattan Institute for Policy Research, in New York.

At 1:30 pm ET, Federal Reserve Bank of Boston President Eric

Rosengren will give welcome and opening remarks before the "Macro

Prudential Monetary Policy" conference hosted by the Federal

Reserve Bank of Boston. Additionally, Federal Reserve Governor

Stanley Fischer is expected to speak at the conference.

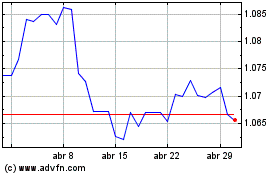

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024