Euro Climbs As Sentiment Improves On Receding Fed Rate Hike Hopes

06 Outubro 2015 - 5:08AM

RTTF2

The euro advanced against the other major currencies in European

deals on Tuesday, as risk sentiment improved in the wake of

disappointing U.S. non-manufacturing data for September, which

dampened expectations for the Federal Reserve rate hike this

year.

The Institute for Supply Management's non-manufacturing index

came in lower than expected to 56.9 in September from 59.0 in

August. Economists had expected the index to dip to 58.0.

Coupled with Friday's dismal jobs data, traders have pushed back

expectations for a Fed rate hike to next year.

Traders await the speech by European Central President Mario

Draghi in Frankfurt at 1:00 pm ET for more clues about bank's

stimulus measures.

In other economic news, data from Destatis showed that Germany's

factory orders declined in August as both domestic and foreign

demand deteriorated from July. Factory orders dropped 1.8 percent

month-on-month in August, confounding expectations for a 0.5

percent rise.

The euro trended lower against the greenback, yen and the pound

in the Asian session. Against the franc, the currency was

steady.

In European trades, the euro climbed to 1.1220 against the

greenback, off its early 4-day low of 1.1172. If the euro extends

rise, 1.13 is possibly seen as its next resistance level.

The 19-nation currency, having declined to a 4-day low of 134.40

against the Japanese yen at 2:00 am ET, bounced off to 135.03. The

next possible resistance for the euro-yen pair may be found around

the 136.00 region.

The single currency was trading higher at 0.7402 against the

pound, reversing from an early 4-day low of 0.7370. On the upside,

the euro may possibly locate resistance around the 0.75 area.

Data from Lloyds Banking Group's Halifax division showed that

U.K. house prices dropped unexpectedly in September.

House prices slid 0.9 percent month-on-month in September,

reversing August's 2.7 percent increase, which was the biggest

monthly growth in 15 months. Economists had forecast prices to gain

0.1 percent.

Rebounding from an early low of 1.0903 against the Swiss franc,

the euro edged up to 1.0940. The euro is seen finding resistance

surrounding the 1.10 level.

Switzerland's consumer prices dropped for the eleventh

consecutive month in September, logging the biggest annual decline

since 1959, according to a report from the Federal Statistical

Office.

Consumer prices fell 1.4 percent year-on-year in September, the

same rate of decline as seen in August. Economists had forecast

prices to drop 1.5 percent.

The euro recovered to 1.7320 against the kiwi, 1.4717 against

the loonie and 1.5802 against the aussie, from its early low of

1.7161, near 5-week low of 1.4607 and 2-week low of 1.5667,

respectively. Continuation of the euro's uptrend may take it to

resistance levels of around 1.75 against the kiwi, 1.48 against the

loonie and 1.60 against the aussie.

Looking ahead, U.S. and Canada trade balance data, both for

August and Canada Ivey PMI for September are set to be published in

the New York session.

At 5:30 pm ET, Federal Reserve Bank of San Francisco President

John Williams is expected to speak about the US economic outlook at

the Urban Land Institute's Fall Meeting in San Francisco.

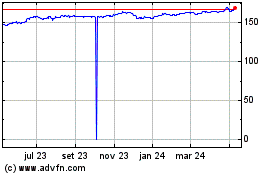

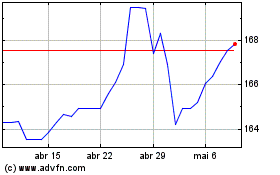

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024