Pound Advances After Upbeat BoE Stress Test Results

01 Dezembro 2015 - 2:31AM

RTTF2

The pound climbed against most major currencies in early

European deals on Tuesday, after the Bank of England said that all

seven largest lenders in the U.K. passed the stress test,

indicating that the banking system has enough capital to support

the real economy in a severe global stress scenario.

In its six-monthly Financial Stability Report, the central bank

noted that the banking system had overcome the post-crisis phase

and it will carefully review the buffer rate at its next quarterly

meeting.

The FPC said it "intends to make active use of the time-varying

countercyclical capital buffer," which was kept at zero percent for

now.

In his press conference, the BoE governor Mark Carney stressed

that the motivation for raising its counter-cyclical buffer is to

make Britain's banks safer, not to curb credit growth.

Traders await U.K. manufacturing PMI data, due at 4:30 am ET.

The manufacturing index is forecast to fall to 53.5 in November

from 55.5 in October.

The pound showed mixed performance in Asian trading. While the

currency held steady against the euro and the franc, it was

slightly higher against the greenback and the yen.

The pound climbed to 186.02 against the yen, its strongest since

November 23. On the upside, 187.00 is possibly seen as its next

resistance level.

The pound advanced to a 5-day high of 1.5125 against the

greenback, while approaching 1.5545 against the franc, its highest

since November 19. The next possible resistance level for the pound

is seen around 1.525 against the greenback and 1.575 versus the

franc.

On the flip side, the pound was trading lower at 0.7020 against

the euro, off its early 6-day high of 0.7007.

Figures from Destatis showed that Germany's unemployment rate

held steady in October.

The jobless rate came in at an adjusted 4.5 percent in October,

the same rate as in the previous month.

Looking ahead, Eurozone unemployment rate for October is due

shortly.

In the New York session, Canada GDP data for September, Canada

RBC manufacturing PMI for November, U.S. construction spending data

for October and ISM U.S. manufacturing PMI for November are slated

for release.

At 12:45 pm ET, Federal Reserve Bank of Chicago President

Charles Evans is expected to speak about the economic outlook and

monetary policy at the Lansing Regional Chamber of Commerce in East

Lansing.

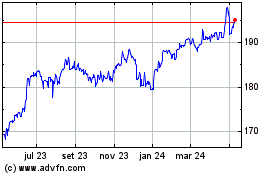

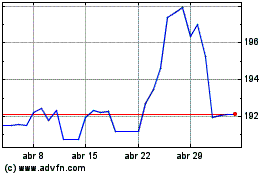

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024