Euro Rises After ECB Draghi's Comments

04 Fevereiro 2016 - 2:39AM

RTTF2

The euro strengthened against the other major currencies in the

early European session on Thursday, after the European Central Bank

President Mario Draghi said that the bank will not "surrender" to

low inflation, even though it is held by global forces.

In a lecture delivered at the Bundesbank, Draghi said, "Adopting

a wait-and-see attitude and extending the policy horizon brings

with it risks: namely a lasting de-anchoring of expectations

leading to persistently weaker inflation."

Draghi also said that global forces are holding inflation down

at present and this might cause inflation to return more slowly to

the ECB target of 'below, but close to 2 percent'. However, the ECB

Chief said there was no reason why they should lead to a

permanently lower inflation rate.

In other economic news, data from Markit Economics showed that

Germany's construction sector expanded at the fastest pace nearly

five years in January, driven by the sharp growth in residential

building activity. The seasonally adjusted Purchasing Managers'

Index, or PMI, climbed to 57.9 in January from 55.5 in

December.

Meanwhile, European shares advanced as commodity prices rallied

amid a weaker dollar. The oil prices jump and mixed private-sector

employment and service sector data raised expectations that the Fed

would put interest rate increases on hold.

In the Asian trading today, the euro held steady against its

major rivals.

In the early European trading, the euro rose to nearly a

13-month high of 1.1197 against the Swiss franc and a 6-day high of

0.7629 against the pound, from early lows of 1.1139 and 0.7590,

respectively. If the euro extends its uptrend, it is likely to find

resistance around 1.12 against the franc and 0.77 against the

pound.

Against the yen, the euro advanced to 131.08 from an early low

of 130.64. This may be compared to an early 2-day high of 131.09.

The euro may test resistance around the 133.00 area.

The euro edged up to 1.5516 against the Australian dollar, from

an early 2-day low of 1.5418. On the upside, 1.59 is seen as the

next resistance level for the euro.

Against the U.S., the New Zealand and the Canadian dollars, the

euro climbed to 1.1137, 1.6686 and 1.5337 from early lows of

1.1069, 1.6588 and 1.5222, respectively. The euro is likely to find

resistance around 1.14 against the greenback, 1.70 against the kiwi

and 1.57 against the loonie.

Looking ahead, the Bank of England is due to announce its

interest rate decision, inflation report and the minutes of the

meeting at 7:00 am ET. Economists expect the bank to retain

interest rates unchanged at 0.50 percent and asset purchase target

at GBP 375 billion.

At 7:45 am ET, the Bank of England Governor Mark Carney, along

with the other MPC members, will hold a press conference on the

Inflation Report in London.

In the New York session, U.S. weekly jobless claims for the week

ended January 30 and U.S. factory orders data for December are

slated for release.

Federal Reserve Bank of Dallas President Robert Kaplan is due to

participate in a discussion of Global Economic Conditions at an

event hosted by the Real Estate Council in Dallas at 8:30 am

ET.

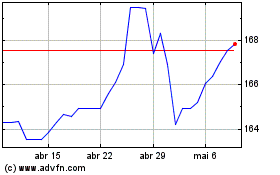

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

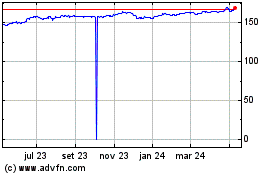

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024