Canadian Dollar Declines Amid Risk Aversion, Falling Oil Prices

08 Fevereiro 2016 - 5:04AM

RTTF2

The Canadian dollar lost ground against the other major

currencies in European trading on Monday, as European shares fell

on global growth worries, while oil prices slipped after meeting

between OPEC producers Saudi Arabia and Venezuela failed to address

stability in crude.

European shares are trading in red, as investors fretted over

oil price volatility, slowing global growth and uncertainty over

the Federal Reserve's monetary policy.

Risk-off mood prevailed after results of a survey by Sentix

revealed that Eurozone investor sentiment weakened for the second

straight month to the lowest since early 2015.

The investor sentiment index dropped more than expected to 6 in

February from 9.6 in January. Economists forecast the index to ease

to 8.8.

Over the weekend, oil ministers from Saudi Arabia and Venezuela

discussed cooperation among OPEC and non-OPEC nations to bring

stability in oil production, although no plans to cut output were

agreed upon.

The loonie was modestly higher against the greenback, yen and

the euro in Asian trades, as Asian stocks pared initial losses in

thin holiday trading.

The loonie declined to 1.5549 against the euro, its lowest since

January 26. If the loonie slides further, 1.58 is possibly seen as

its next support level. At last week's close, the pair was valued

at 1.5522.

Reversing from an early high of 1.3841 against the greenback,

the loonie slipped to a session's low of 1.3918. On the downside,

the loonie may find support around the 1.41 zone.

The loonie slid to nearly a 2-week low of 83.76 against the

Japanese yen, compared to 83.92 hit late New York Friday. The

loonie is seen finding support around the 82.00 mark.

Data from the Ministry of Finance showed that Japan registered a

current account surplus of 960.7 billion yen in December, up 325.2

percent on year.

The headline figure was shy of expectations for 1,051.7 billion

yen and down from 1,143.5 billion in November.

The loonie remained lower against the aussie, trading at 0.9863,

off its early high of 0.9819. The pair was valued at 0.9828 when it

ended Friday's trading. The next possible downside target for the

loonie may be located around the 0.99 area.

Looking ahead, Canada housing starts for January and building

permits for December and U.S. labor market conditions index for

January are set to be published in the New York session.

At 12:05 pm ET, Bank of Canada Deputy Governor Timothy Lane will

deliver a speech titled "Monetary Policy and Financial

Stability—Using the Right Tools" at the HEC Montreal.

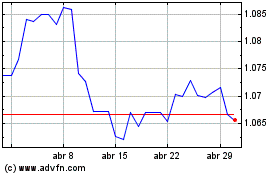

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024