Euro Declines As European Stocks Slip On Growth Concerns

08 Fevereiro 2016 - 6:53AM

RTTF2

The euro slipped against most major rivals in European deals on

Monday, as European stocks fell amid falling oil prices, worries

over weakness of the global economy and uncertainty over the

Federal Reserve's monetary policy.

Survey from Sentix showing deteriorating investor sentiment in

the euro area also dampened the investor mood.

The investor sentiment index dropped more than expected to 6 in

February from 9.6 in January. Economists forecast the index to ease

to 8.8.

The reading was the lowest since early 2015.

German bund yields turned negative, with yields on 2-year note

hitting a new record low of minus 0.51 percent, while the 7-year

yield fell 4 basis points to minus 0.135 percent.

The currency showed mixed performance in Asian deals. While the

euro rose against the yen and the franc, it declined against the

pound. Against the greenback, it held steady.

The single currency weakened to an 11-day low of 129.06 against

the yen, from a high of 130.90 hit at 1:45 am ET. The euro is

likely to challenge support around the 128.00 zone.

Data from the Ministry of Finance showed that Japan registered a

current account surplus of 960.7 billion yen in December, up 325.2

percent on year.

The headline figure was shy of expectations for 1,051.7 billion

yen and down from 1,143.5 billion in November.

The euro, having advanced to 1.1184 versus the greenback,

reversed direction and reached a 4-day low of 1.1087. If the

euro-greenback pair extends slide, 1.10 is possibly seen as its

next support level.

The euro eased to 1.1043 against the franc, 1.5674 against the

aussie, 1.6760 against the kiwi and 1.5455 against the loonie, from

its early highs of 1.1095 and 1.5785, 6-day high of 1.6895 and a

near 2-week high of 1.5549, respectively. The next possible support

for the euro is seen around 1.095 against the franc, 1.56 against

the aussie, 1.66 against the kiwi and 1.56 against the loonie.

Looking ahead, U.S. labor market conditions index for January

are set to be published shortly.

At 12:05 pm ET, Bank of Canada Deputy Governor Timothy Lane will

deliver a speech titled "Monetary Policy and Financial

Stability—Using the Right Tools" at the HEC Montreal.

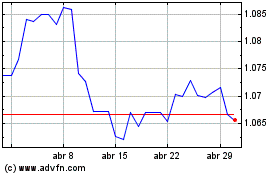

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024