Pound Rises Amid Risk Appetite

12 Fevereiro 2016 - 3:16AM

RTTF2

The British pound strengthened against the other major

currencies in the early European session on Friday amid risk

appetite, as the European shares rose with underlying sentiment

supported by rebounding oil prices and news of an agreement between

world powers to implement a nationwide "cessation of hostilities"

in Syria.

The U.K.'s FTSE 100 index is currently up 1.60 percent or 88.62

points at 5,625, France's CAC 40 index is up 1.37 percent or 53.51

points at 3,950 and Germany's DAX is up 1.35 percent or 118.37

points at 8,871.

Data from the Office for National Statistics showed that the

U.K. construction output rose 1.5 percent month-over-month in

December, reversing a 1.1 percent drop in November. The expected

rate of increase was 2.0 percent. On an annual basis, construction

output climbed 0.5 percent at the end of the year, below

economists' expectations for a 0.8 percent rise. In November,

output had fallen 0.9 percent.

In the whole year 2015, total output in the construction

industry advanced 3.4 percent compared with 2014.

Meanwhile, the house building sector rose at its fastest rate

since the middle of 2014. The output grew 4.1 percent in the

quarter, after a 5.7 percent decline in the previous quarter.

In the Asian session today, the pound held steady against its

major rivals.

In the early European trading, the pound rose to a 2-day high of

1.4199 against the Swiss franc, from an early low of 1.4062. The

pound is likely to find resistance around the 1.45 area.

Against the U.S. dollar, the yen and the euro, the pound

advanced to 1.4549, 163.87 and 0.7758 from early lows of 1.4459,

161.66 and 0.7828, respectively. If the pound extends its uptrend,

it is likely to find resistance around 1.47 against the greenback,

172.00 against the yen and 0.75 against the euro.

Looking ahead, U.S. import price index and retail sales data for

January, U.S. business inventories for December and U.S. University

of Michigan's final consumer sentiment index for February are due

to be released in the New York session.

At 10:00 am ET, Federal Reserve Bank of New York President

William Dudley will participate in a panel discussion about the

Household Debt and Credit Report at the Federal Reserve of New

York.

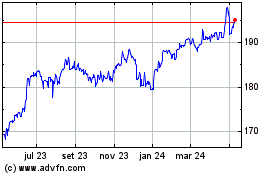

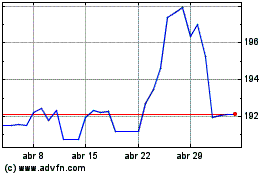

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024