Canadian Dollar Slides As Oil Prices Fall

23 Março 2016 - 12:43AM

RTTF2

The Canadian dollar slipped against its most major counterparts

in pre-European deals on Wednesday, as oil prices declined after

data from the American Petroleum Institute showed a huge build in

oil inventories last week, reinforcing worries over supply

glut.

Data from the industry group API showed that U.S. stockpiles

increased by 8.8 million barrels last week to reach a record high

of 531.8 million.

The Energy Information Administration will release official data

later in the day.

Asian stock markets are mostly lower, following the lackluster

cues overnight from Wall Street. Geopolitical concerns following

the deadly terror attacks in Brussels weighed on sentiment.

The loonie was moderately higher against most major rivals

yesterday. The loonie added 0.7 percent against the euro, 0.4

percent against the greenback and 0.8 percent against the yen.

The loonie weakened by 0.4 percent to 1.3095 against the

greenback from Tuesday's closing value of 1.3048. The loonie is

seen finding support around the 1.32 mark.

The loonie that ended yesterday's trading at 1.4622 against the

euro edged down to 1.4674. The loonie may locate support around the

1.48 region.

The loonie dropped to 85.71 against the Japanese yen, after

having advanced to 86.18 at 5:45 pm ET. On the downside, 84.00 is

likely seen as the next support level for the loonie.

On the flip side, the loonie edged up to 0.9948 against the

aussie, off early weekly low of 0.9980. The pair was worth 0.9934

when it ended yesterday's trading.

Looking ahead, U.S. new home sales for February are due in the

New York session.

At 11:00 am ET, Eurozone flash consumer sentiment index for

March is set for release.

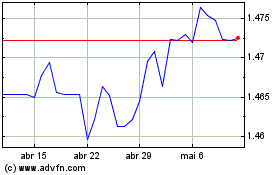

Euro vs CAD (FX:EURCAD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Euro vs CAD (FX:EURCAD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024