Euro Advances After ECB Coeure's Speech

03 Maio 2016 - 3:51AM

RTTF2

The euro climbed against its major rivals in European trading on

Tuesday, on the back of a weaker dollar, and as the European

Central Bank Executive Board member Benoit Coeure said that the

central bank is unlikely to cut the deposit rate into "absurdly low

levels."

The policymaker said that thus far negative rates have not had a

major impact on market makers themselves. On the other hand, banks'

profitability has improved due to a mix of lower funding costs,

increased lending volumes and lower loan-loss provisions, Coeure

said.

"To be sure, this would not necessarily remain true if the

deposit facility rate were to be set at significantly lower

levels."

"But this is why I have said elsewhere that we would not take it

to absurdly low levels," he added.

Figures from Eurostat showed that producer prices advanced 0.3

percent on month, confounding expectations for a 0.1 percent fall.

In February, producer prices had dropped 0.7 percent.

Producer prices fell 4.2 percent year-on-year in March, the same

pace of decline as seen in February. Prices were expected drop 4.6

percent.

The currency was also underpinned by yesterday's data showing

improvement in manufacturing activity in Germany and Eurozone.

The final PMI for the eurozone's manufacturing sector was

revised up to 51.7 from flash score of 51.5, while Germany's

manufacturing PMI climbed to a three-month month of 51.8 in April

from 50.8 in the prior month.

In other economic news, Eurozone growth is likely to be less

than the expansion expected earlier during this year and next, and

inflation is set to be less than what was seen earlier, latest

projections from the European Commission showed Tuesday.

The executive arm of the EU cut the euro area growth forecast

for this year to 1.6 percent from 1.7 percent in its Spring 2016

Economic Forecast report. The projection for next year was lowered

to 1.8 percent from 1.9 percent.

The euro showed mixed performance in Asian deals. While the euro

held steady against the franc and the pound, it rose against the

greenback. Against the yen, it declined.

Reversing from an early low of 0.7842 against the pound, the

euro advanced to near a 2-week high of 0.7893. If the euro-pound

pair extends rise, 0.80 is likely seen as its next resistance

level.

Data from Markit showed that the U.K. factory activity

contracted for the first time in three years in April.

The Chartered Institute of Procurement & Supply Purchasing

Managers' Index fell unexpectedly to 49.2 in April from revised

50.7 in March. It was forecast to rise to 51.2 from March's

originally estimated value of 51.

The single currency, having fallen to 1.1521 against the

greenback at 7:45 pm ET, spiked up to more than an 8-month high of

1.1616. Continuation of the euro's uptrend may lead it to a

resistance surrounding the 1.17 zone.

The 19-nation currency reversed from an early low of 122.12

against the Japanese yen, climbing back to 122.76. Further uptrend

may see the euro challenging resistance around the 124.00 area.

The common currency climbed to more than a 2-week high of 1.4526

against the loonie, 3-week high of 1.6593 against the kiwi and more

than a 2-month high of 1.5319 against the aussie, from its early

lows of 1.4421 and 1.6348, and a 4-day low of 1.4936, respectively.

The euro is seen finding resistance around 1.47 against the loonie,

1.68 against the kiwi and 1.55 against the aussie.

On the flip side, the euro declined to a 4-day low of 1.0960

against the Swiss franc, from an early near 2-month high of 1.1017.

On the downside, the euro may find support around the 1.08

mark.

Looking ahead, at 10:30 am ET, Federal Reserve Bank of Cleveland

President Loretta Mester speaks in a panel discussion titled

"Unconventional wisdom: How will unusual monetary policy affect

market liquidity" at the Atlanta Federal Reserve's Annual Financial

Markets Conference, in Amelia Island.

The Bank of Canada Governor Stephen Poloz speaks in a panel

discussion at the Milken Institute's Global Conference in Los

Angeles at 12:30 pm ET.

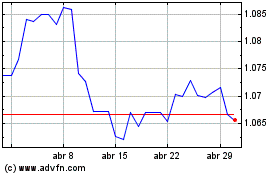

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024