Dollar Climbs After Upward Revision To U.S. GDP Data; Yellen's Speech Due

27 Maio 2016 - 6:33AM

RTTF2

The U.S. dollar strengthened against its most major rivals in

mid-European trading on Friday, after data showed that the U.S.

economy expanded faster than the initial estimate in the first

quarter, supporting expectations of a Federal Reserve interest rate

increase in June.

Data from the Commerce Department showed that the U.S. economic

growth was stronger than previously estimated in the first quarter,

although the pace of growth still reflects a significant

slowdown.

The report said the pace of growth in gross domestic product was

upwardly revised to 0.8 percent from the initial estimate of 0.5

percent.

Nonetheless, the revised GDP growth in the first quarter

compares to the 1.4 percent jump seen in the fourth quarter and the

0.9 percent increase expected by economists.

Traders now await the University of Michigan's revised report on

consumer sentiment in May, due shortly. The consumer sentiment

index is expected to be downwardly revised to 95.5 from the

mid-month reading of 95.8, which represented an eleven-month

high.

At 1:15 pm ET, Yellen is scheduled to speak with Harvard

Professor Gregory Mankiw and receive an award from the Radcliffe

Institute for Advanced Study.

Traders are likely to closely scrutinize Yellen's remarks for

any hints regarding whether the Fed intends to raise interest rates

at its meeting next month.

The greenback showed mixed performance in Asian deals. While the

currency held steady against the franc, euro and the pound, it

declined against the yen.

The greenback climbed to 1.1153 against the euro, after having

fallen to 1.1201 at 2:00 am ET. On the upside, the greenback is

likely to find resistance around the 1.10 area.

Data from the Bank of Italy and the Centre for Economic Policy

Research showed that a measure of the current economic situation in

the euro area declined for a fourth straight month in May, amid an

industrial slowdown and low inflation.

The euro-coin indicator dropped to 0.26 from 0.28 in April.

The greenback rose back to 1.4623 against the pound, heading

closer to pierce its early 2-day high of 1.4620. Further uptrend

may see the greenback challenging resistance around the 1.45

mark.

The latest survey from GfK showed that the U.K. consumer

confidence showed a bit of improvement in May but remained

pessimistic, with an index score of -1.

That beat forecasts for -4 and was an improvement over April's

-3, although it still was negative.

Reversing from an early low of 0.9885 against the Swiss franc,

the greenback edged up to 0.9915. The greenback is seen finding

resistance around the 1.01 mark.

The greenback was trading in a positive territory against the

kiwi, with the pair trading at 0.6720. Against the aussie, it

advanced to 0.7198. Continuation of the greenback's uptrend may see

it finding resistance around 0.665 against the kiwi and 0.71

against the aussie.

Extending early rally, the greenback strengthened to a 2-day

high of 1.3068 against the Canadian dollar. This marks a 0.7

percent gain from Thursday's closing value of 1.2977. The greenback

is likely to test resistance around the 1.32 region.

On the flip side, the greenback declined to 109.48 against the

Japanese yen, compared to 109.76 hit late New York Thursday. On the

downside, 108.00 is likely seen as the next support level for the

greenback-yen pair.

Data from the Ministry of Internal Affairs and Communications

showed that Japan's consumer prices fell 0.3 percent on year in

April.

That beat forecasts for -0.4 percent, although it weakened from

-0.1 percent in March.

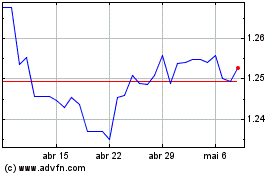

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

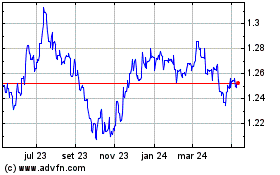

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024