NZ Dollar Falls Amid Rising Risk Aversion

23 Agosto 2016 - 9:56PM

RTTF2

The New Zealand dollar weakened against the other major

currencies in the Asian session on Wednesday amid rising risk

aversion. Investors remained cautious ahead of Federal Reserve

Chair Janet Yellen's speech later this week.

Yellen will speak on Friday at the Kansas City Fed's monetary

policy symposium in Jackson Hole, Wyoming, and investors will keep

a close eye on her remarks for clues about the outlook for U.S.

interest rates.

Crude oil for October delivery are currently down $0.71 at

$47.39 a barrel following the release of the a private inventory

report, which showed that U.S. crude stocks rose.

The American Petroleum Institute (API) reported a 4.464 million

barrel increase in U.S. crude oil inventories in the biggest build

in crude supplies in four months. Meanwhile, traders await the

official data of U.S. crude stocks published by the U.S. Energy

Information Administration (EIA), due later in the day.

In other economic news, data from Statistics New Zealand showed

that New Zealand had a merchandise trade deficit of NZ$433 million

in July. That missed forecasts for a shortfall of NZ$325 million

following the downwardly revised surplus of NZ$110 million in

June.

Exports were worth NZ$3.96 billion, shy of expectations for

NZ$4.07 billion and down from NZ$4.26 billion in the previous

month. Imports came in at NZ$4.40 billion versus forecasts for

NZ$4.45 billion and up from NZ$4.13 billion a month earlier.

Tuesday, the NZ dollar rose 0.69 percent against the U.S.

dollar, 0.47 percent against the yen, 0.47 percent against the euro

and 0.31 percent against the Australian dollar.

In the Asian trading, the NZ dollar fell to 0.7269 against the

U.S. dollar and 72.92 against the yen, from yesterday's closing

quotes of 0.7286 and 73.03, respectively. If the kiwi extends its

downtrend, it is likely to find support around 0.71 against the

greenback and 70.00 against the yen.

Against the euro and the Australian dollar, the kiwi dropped to

1.5544 and 1.0469 from yesterday's closing quotes of 1.5495 and

1.0438, respectively. The kiwi may test support near 1.59 against

the euro and 1.06 against the aussie.

Looking ahead, UBS Swiss consumption indicator for July and

final German GDP data for the second quarter are due to be released

in the pre-European session at 2:00 am ET.

U.K. BBA mortgage approvals for July is slated for release at

4:30 am ET.

In the New York session, U.S. FHFA house price index for June,

U.S. existing home sales data for July and crude oil inventories

data are set to be published.

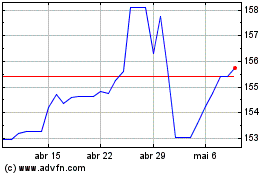

US Dollar vs Yen (FX:USDJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

US Dollar vs Yen (FX:USDJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024