Germany's GDP Growth Rises On Exports, Investment

23 Novembro 2017 - 5:15AM

RTTF2

Germany expanded at a faster pace in the third quarter on robust

foreign demand and investment amid weak private consumption,

official data showed Thursday.

Despite political uncertainty, private sector activity growth in

the largest euro area economy accelerated in November driven by a

pick-up in manufacturing, a closely watched survey revealed

today.

Gross domestic product grew 0.8 percent sequentially, faster

than the 0.6 percent expansion logged in the second quarter and in

line with the preliminary estimate, according to detailed report

from Destatis.

Year-on-year, GDP climbed calendar-adjusted 2.8 percent,

following the 2.3 percent growth seen a quarter ago.

The expenditure-side breakdown of GDP showed that private

spending slid 0.1 percent, reversing a 0.9 percent rise a quarter

ago. At the same time, government expenditure remained flat.

Gross fixed capital formation growth eased to 0.4 percent from

1.5 percent in the preceding period. Capital formation was up

especially in machinery and equipment, by 1.5 percent but it fell

slightly by 0.4 percent in construction.

Export growth climbed to 1.7 percent from 1 percent, while

growth in imports eased to 0.9 percent from 2.4 percent. As a

result, the balance of exports and imports had a positive effect on

GDP growth.

Data from IHS Markit showed that Germany's flash composite PMI

climbed more-than-expected to 57.6 in November from 56.6 in

October. The expected reading was 56.7.

The manufacturing sector continued to lead growth with the

strongest increase in production volumes since April 2011.

The factory PMI rose to an 81-month high of 62.5 from 60.6 in

October. Similarly, the services PMI came in at 54.9, up from 54.7

a month ago.

"The German economy is going great guns, with manufacturing

enjoying one of the best growth spurts seen over the past two

decades," Phil Smith, principal economist at IHS Markit, said.

Inflows of new orders showed the strongest rise in over

six-and-a-half years, leading businesses to take on staff at one of

the fastest rates in the 20-year history of the composite

series.

November's survey showed a further intensification of cost

pressures facing businesses in Germany, with the rate of input

price inflation surpassing the highs seen at the start of the year

to reach the strongest since early-2011.

Consequently, increased costs were passed by businesses in the

form of higher prices charges for goods and services.

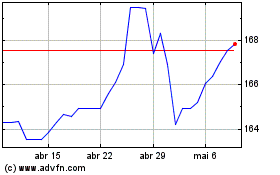

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

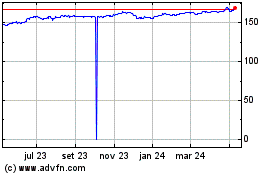

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024