TIDMKEFI

RNS Number : 1862L

KEFI Minerals plc

17 July 2017

17 July 2017

KEFI Minerals plc

("KEFI" or the "Company")

PROJECT FUNDING OF US$135M FOR TULU KAPI GOLD PROJECT

"KEFI signs terms for funding all on-site infrastructure,

already having signed terms to fund all off-site

infrastructure"

KEFI Minerals (AIM: KEFI), the gold exploration and development

company with projects in the Kingdom of Saudi Arabia and the

Federal Democratic Republic of Ethiopia, is pleased to announce the

signing of a mandate letter and heads of terms for US$135 million

of project funding with Oryx Management Limited ("Oryx") to finance

and operate all the on-site infrastructure at the Company's Tulu

Kapi Gold Project in Ethiopia (the "Project"). The planned

financing package also includes funding finance charges during a

30-month construction and production ramp-up period.

Highlights

-- Mandate signed with infrastructure specialist Oryx to operate and lease-finance all on-site infrastructure at the Project.

-- Oryx to establish a special purpose vehicle (the "Finance

SPV") to issue bonds, the proceeds of which would be used to build

and own all the on-site infrastructure for the Project which it

would lease to the Project company, Tulu Kapi Gold Mines Limited

("TKM"). The receipt of lease payments from TKM would be used by

Finance SPV to pay the principal and interest on its bonds.

-- Oryx to also operate the on-site ore processing infrastructure on an open-book, cost plus performance-bonus based operating contract.

-- Ethiopian Government to fund the building of all off-site

infrastructure for the Project, in accordance with previously

announced and executed Shareholders Agreement. The relevant

Government agencies will operate and maintain the off-site

infrastructure.

-- Ausdrill Limited (through its subsidiary African Mining

Services Pty Limited) to supply and operate all the mining

equipment under a mine services agreement structured as a

conventional schedule of rates contract, whereby the contractor is

paid per tonne of material delivered.

-- All contractors to be accountable to and supervised by KEFI subsidiary TKM.

-- Ignoring historic investment of c.US$60 million, the

Project's remaining funding requirement has now been successfully

reduced from c.US$289 million when KEFI took control in 2014 to an

amount of c. US$160 million (before overlaying the Oryx proposal)

to a residual balance of US$32 million. The residual balance of

US$32 million, which includes c.US$13 million of contingency

provisions, will now be refined, structured and sourced. This

residual amount will also be further evaluated over the coming

months and may be reduced.

-- A variety of sources to finance the estimated residual

requirement of US$20-30 million are being considered, including

working capital facilities with Development Bank of Ethiopia,

Project-level equity with a mining and engineering group and

further equity from KEFI in the Project company.

-- It is currently estimated that KEFI's holding in TKM, will be

c.75%, without the issue of further Project-level equity to any

third party, and under any scenario, it is KEFI's preference to

retain majority ownership and control of the Project.

-- Tulu Kapi's cash flow projections (supported by the 2017

Update to the Definitive Feasibility Study, "DFS") at a gold price

of US$1,250/oz support the Company's plan to rapidly pay down the

project finance indebtedness at the same time as pursuing a focused

and exciting exploration program, and also to consider commencing

dividends to shareholders early in the Project's life. An indicator

of the projected cash flow strength is that under these

assumptions, Oryx could be repaid around half-way through the

9-year term.

-- Timetable agreed with the Ethiopian Government and Oryx for

financing to be provided and development to start before the end of

2017.

A new investor presentation has been uploaded to the Company's

website: www.kefi-minerals.com

Commenting KEFI's Executive Chairman, Harry Anagnostaras-Adams,

said:

"KEFI has selected a development funding approach considered

more appropriate for start-up purposes than bank debt due to its

longer 9-year tenor and its repayments commencing 30 months after

drawdown.

This Project has been designed in close collaboration with the

selected project contractors, Ausdrill for mining and Lycopodium

for processing, and in partnership with the Ethiopian

Government.

At a gold price of US$1,250/oz, Tulu Kapi's robust project cash

flow projections, combined with the innovative financing proposal

from Oryx, looks to well serve KEFI's objective to rapidly repay

debts whilst implementing our targeted exploration programs and

commencing dividends during the early production years.

We welcome Oryx to the Tulu Kapi syndicate and look forward to

putting the funding in place to commence development of Tulu Kapi

this year."

Further Details

On-site Infrastructure

The Company has signed a mandate letter and heads of terms for

US$135 million of project funding with Oryx to finance (via the

issuance of bonds by its Finance SPV) and to operate (under an

open-book operating contract) all the on-site infrastructure at the

Project. The overall arrangement with Oryx is analogous to a Build,

Own, Operate and Transfer ("BOOT") arrangement.

The on-site infrastructure will be contract-built by Lycopodium

Minerals Pty Limited ("Lycopodium") and includes the processing

plant, provided under a lump sum (Engineering, Procurement,

Construction or "EPC") contract, and accommodation village,

earthworks, water dams and tailing storage facility provided under

a cost plus margin (Engineering, Procurement, Construction,

Management, or "EPCM") arrangement.

The key financing terms agreed with Oryx are summarised

below:

Summary of Bonds

------------------------------ ------------------------------------

Source of Funds: Luxembourg listed bonds arranged

by Oryx and issued by its

Luxembourg incorporated special

purpose vehicle ("Finance

SPV")

------------------------------ ------------------------------------

Amount: US$135 million

------------------------------ ------------------------------------

Tenor: 9 years from drawdown

------------------------------ ------------------------------------

Security: Bonds securitised against

the underlying physical assets,

with the collateral benefit

of all security granted in

respect of the lease from

Finance SPV to TKM (see below)

------------------------------ ------------------------------------

Interest Rate: Fixed coupon of 8% p.a.,

paid semi-annually from the

issue date

------------------------------ ------------------------------------

Non-Redemption Period 3 years from drawdown

("NRP")

------------------------------ ------------------------------------

Repayment schedule: As from end of NRP, sinking

fund redemptions based on

lease payments received by

Finance SPV from TKM

------------------------------ ------------------------------------

Early Repayment: No early repayment prior

to NRP. Thereafter diminishing

call premium based on US

Government yields

------------------------------ ------------------------------------

Summary of Lease terms

and TKM arrangements

for operating infrastructure

------------------------------ ------------------------------------

Term of lease 9 years

------------------------------ ------------------------------------

Early termination: TKM may terminate the lease

at any time on 3 months'

written notice and payment

of an early pay-out amount

which includes a penalty

if done before end of NRP

and thereafter is merely

the present value based on

US Government yields

------------------------------ ------------------------------------

Lease payments: Quarterly in US$, commencing

month 30

------------------------------ ------------------------------------

Potential yield enhancement Zero at gold price US$1,100/oz

supplement: and rising in a linear manner

to a cap which raises total

aggregate interest rate embedded

within the lease rental from

8% to 16% p.a. at gold price

of US$1,700/oz

------------------------------ ------------------------------------

Security: Guarantee from KEFI

Tulu Kapi Gold Project

Shares in TKM

Direct agreements

------------------------------ ------------------------------------

Financial Covenants: None

------------------------------ ------------------------------------

Other Covenants: Positive and negative covenants

to include:

Revise mine plan if material

underperformance

Cash sweep

Right to cash flows from

satellite deposits if required

to recover amounts owing

by TKM

------------------------------ ------------------------------------

Operating contract for Open-book, cost plus performance

on-site infrastructure: / key performance indicator

based operating contract

------------------------------ ------------------------------------

Structure: Plant and infrastructure

fixed-asset lease-to-buy,

coupled with Operating &

Maintenance services. Analogous

to the Build-Own-Operate-Transfer

("BOOT") schemes widely used

for infrastructure funding

------------------------------ ------------------------------------

Ownership: Ownership of on-site infrastructure

reverts to Project company

TKM following full repayment

and termination of the lease

------------------------------ ------------------------------------

Hedging: Agreement to allow modest

level of gold hedging

------------------------------ ------------------------------------

Conditions precedent to closing the Oryx proposal include:

-- Completion of due diligence by independent technical experts, accountants and lawyers;

-- Approval of draft formal documentation by National Bank of Ethiopia; and

-- Oryx completing the fund-raising of listed debentures.

Prior to closing the Oryx proposal, KEFI is permitted to advance

competing financing proposals. However, the Directors of KEFI

believe that the Oryx proposal has significant advantages for

KEFI:

-- Appropriate and low risk start-up finance for a company's first mine

-- Equity dilution minimised

-- Structure provides development funding on a safer basis than bank debt due to, inter alia:

o Lease payments commencing 30 months after drawdown

o Longer term of 9 years

-- Debt can be repaid quickly if all goes according to plan:

Cash flow projections at a gold price of US$1,250/oz indicate

capacity to repay in about full half-way through 9-year term

-- Further reinforces the Company's key contracting

relationships at both financial and operational level

-- No stipulated hedging required but it has been agreed to

jointly consider a modest hedging policy as part of risk

management

-- Provides on-site infrastructure for processing additional ore

from potential underground mine below Tulu Kapi open pit and

targeted satellite deposits

As announced on 24 May 2017, the strong Project cash flows as

detailed in the 2017 Definitive Feasibility Study Update are

expected to support rapid repayment of the Project financing.

Off-site Infrastructure

As announced on 5 May 2017, the Ethiopian Government has agreed

to finance the budgeted US$20 million of capital expenditure for

off-site infrastructure in exchange for Project equity of c. 20% in

addition to its 5% free-carry. The Government's electricity and

roads authorities will operate the relevant power lines and roads

following completion of construction.

Proposed Sources and Applications of Project Development

Funding

US$

million

---------------------------------------------- ---------

Funding requirement:

---------------------------------------------- ---------

Total funding needs before project financing

structure, as previously reported 160

---------------------------------------------- ---------

Extra funds required for project funding

structure, particularly during grace period 33

---------------------------------------------- ---------

Total funding requirement 193

---------------------------------------------- ---------

Proposed sources:

---------------------------------------------- ---------

Bonds via Finance SPV 135

---------------------------------------------- ---------

Ethiopian Government 20

---------------------------------------------- ---------

Equity Funds already committed to KEFI

for Project, from Lanstead and Lycopodium 6

---------------------------------------------- ---------

Residual working capital funding required

(including US$13 million contingency) 32

---------------------------------------------- ---------

Total sources 193

---------------------------------------------- ---------

It should be noted that Lycopodium has confirmed its current

intention to subscribe for US$2.5 million of new ordinary shares in

KEFI upon execution of the EPC contract and the Company continues

to receive monthly settlements from Lanstead under the Settlement

Agreement entered into with Lanstead in February 2017. The estimate

of US$6 million in the above table is based on the Company's

current share price.

The Company intends to refine the requirement for the residual

working capital funding of up to US$32 million before the closing

of Oryx funding, expected during the second half of 2017. Further

detailed engineering and procurement work may lead to some savings

in the US$13 million contingency within the residual funding

requirement.

There are a number of options open to the Company to secure the

remaining funding including working capital facilities covering

gold-in-ore-stockpiles with Development Bank of Ethiopia,

Project-level equity with mining and engineering groups and further

equity from KEFI in the Project company. It is currently

anticipated that a combination of financing sources will ultimately

be used, with KEFI's preference to retain majority ownership and

control of the Project.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

ENQUIRIES

KEFI Minerals plc

Harry Anagnostaras-Adams (Executive

Chairman) +357 99457843

John Leach (Finance Director) +357 99208130

SP Angel Corporate Finance

LLP (Nominated Adviser)

Ewan Leggat, Jeff Keating +44 20 3470 0470

Brandon Hill Capital Ltd (Joint

Broker)

Oliver Stansfield, Alex Walker,

Jonathan Evans +44 20 7936 5200

RFC Ambrian Ltd (Joint Broker)

Jonathan Williams

Beaufort Securities Ltd (Joint

Broker) +44 20 3440 6817

Elliot Hance +44 20 7382 8300

IFC Advisory Ltd (Financial

PR and IR)

Tim Metcalfe, Heather Armstrong +44 20 3053 8671

NOTES TO EDITORS

Oryx Management Limited

Oryx Management Limited ("Oryx") is privately held Jersey

incorporated company created for the purpose of identifying,

evaluating, effecting and managing investment-ready opportunities

for fixed asset leasing in the resources sector.

Oryx's alternative financing solution for the sector is to

provide process plant and infrastructure assets to projects on a

fixed-asset lease-to-buy basis, coupled with providing operating

& maintenance services in relation to such Assets.

The founders and board of directors of Oryx comprise experienced

mining professionals, chemical engineers and financiers with

significant experience in the natural resources and construction

sector. Its Australian, UK and African executive team has a close

relationship with Lycopodium Limited, an Australian headquartered

international engineering and project management consultancy which

provides a complete range of services for the evaluation,

development and implementation of projects worldwide.

KEFI Minerals plc

KEFI is the operator of two advanced gold development projects

within the highly prospective Arabian-Nubian Shield, with an

attributable 1.93Moz (100% of Tulu Kapi's 1.72Moz and 40% of Jibal

Qutman's 0.73Moz) gold Mineral Resources (JORC 2012) plus

significant resource growth potential. KEFI targets that production

at these projects generates cash flows for further exploration and

expansion as warranted, recoupment of development costs and, when

appropriate, dividends to shareholders.

KEFI Minerals in Ethiopia

The Tulu Kapi gold project in western Ethiopia is being

progressed towards development, following a grant of a Mining

Licence in April 2015.

Following completion of KEFI's Definitive Feasibility Study for

Tulu Kapi, the Company is now progressing contractual terms for

project construction and operation. Latest estimates for annual

gold production are c. 120,000oz pa and All-in Sustaining Costs

(including operating, sustaining capital and closure but not

including financing charges) of <US$800/oz. Tulu Kapi's Ore

Reserve estimate totals 15.4Mt at 2.12g/t gold, containing

1.05Moz.

All aspects of the Tulu Kapi (open pit) gold project have been

reported in compliance with the JORC Code (2012) and subjected to

reviews by appropriate independent experts. These plans now also

reflect the agreed construction and operating terms with project

contractors, and have been independently reviewed by experts

appointed for the project finance syndicate.

A Preliminary Economic Assessment has been published that

indicates the economic attractiveness of mining the underground

deposit adjacent to the Tulu Kapi open pit, after the start-up of

the open pit and after positive cash flows have begun to repay

project debts.

The projected cash flows indicate that the net cash build-up

(after servicing financing) in the first three production years is

US$61 million to US$251 million for the gold price range of

US$1,100/oz to US$1,900/oz which prevailed during the past seven

years.

KEFI Minerals in the Kingdom of Saudi Arabia

In 2009, KEFI formed G&M in Saudi Arabia with local Saudi

partner, Abdul Rahman Saad Al-Rashid & Sons Company Limited

("ARTAR"), to explore for gold and associated metals in the

Arabian-Nubian Shield. KEFI has a 40% interest in G&M and is

the operating partner. To date, G&M has conducted preliminary

regional reconnaissance and has had five exploration licences

("ELs") granted, including Jibal Qutman and the more recently

granted Hawiah EL that contains over 6km strike length of

outcropping gossans developed on altered and mineralised rocks with

all the hallmarks of a copper-gold-zinc VHMS deposit.

At Jibal Qutman, G&M's flagship project, Mineral Resources

are estimated to total 28.4Mt at 0.80g/t gold for 733,045 contained

ounces. The shallow oxide portion of this resource is being

evaluated as a low capital expenditure heap-leach mine

development.

ARTAR, on behalf of G&M, holds a large portfolio of EL

applications. ELs are renewable for up to three years and bestow

the exclusive right to explore and to obtain a 30-year exploitation

(mining) lease within the area. The Kingdom of Saudi Arabia has

instituted, and is further overhauling, policies to encourage

minerals exploration and development, and KEFI Minerals supports

this priority by serving as the technical partner within G&M.

ARTAR also serves this government policy as the major partner in

G&M, which is one of the early movers in the modern resurgence

of the Kingdom's minerals sector.

Further information on KEFI can be found at

www.kefi-minerals.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

UPDDDGDRRBBBGRL

(END) Dow Jones Newswires

July 17, 2017 02:00 ET (06:00 GMT)

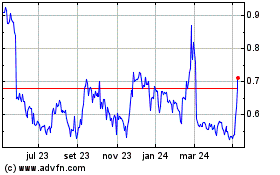

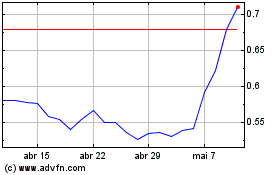

Kefi Gold And Copper (LSE:KEFI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Kefi Gold And Copper (LSE:KEFI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024